Nassau County is located in the state of New York and has its own specific requirements and regulations when it comes to UCC-1 Financing Statements regarding Fixture Filings for Commercial Loans. A Nassau New York Exhibit to UCC-1 Financing Statement outlines the details of a fixture filing, which is when a creditor asserts its interest in a fixture (an item that is attached to real property and is considered part of it) as collateral for a commercial loan. The exhibit serves to provide additional information and context about the fixture that is being used to secure the loan. Key points to include in the description may include: 1. Definition of a Fixture: Explain what a fixture is within the context of real property. A fixture is generally an item that is attached to the property (such as equipment, machinery, or furnishings) and is intended to remain there permanently as part of the property. 2. UCC-1 Financing Statement: Provide an overview of the UCC-1 Financing Statement, which is a legal form used to document a creditor's security interest in personal property as collateral for a loan. Explain its purpose and mention that it is required for fixture filings in Nassau County, New York. 3. Requirement for Exhibit in Nassau County: Emphasize that in Nassau County, a separate exhibit is required to accompany the UCC-1 Financing Statement when filing a fixture lien. This exhibit provides additional information about the fixture being used to secure the loan. 4. Contents of the Exhibit: Describe the specific details and information that should be included in the exhibit. This may include a description of the fixture, its exact location, the debtor's ownership interest in the real property, and any relevant lease agreements or contracts. 5. Different Types of Nassau New York Exhibits: While there may not be specific different types of Nassau New York exhibits related to UCC-1 Financing Statements for fixture filings, it is important to mention that the content of the exhibit may vary depending on the nature of the fixture and specific requirements outlined by Nassau County. In conclusion, a Nassau New York Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan is an essential document required in Nassau County to accompany the UCC-1 Financing Statement. It provides additional details about the fixture being used as collateral and helps ensure the secured party's interest is properly recorded.

Nassau New York Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan

Description

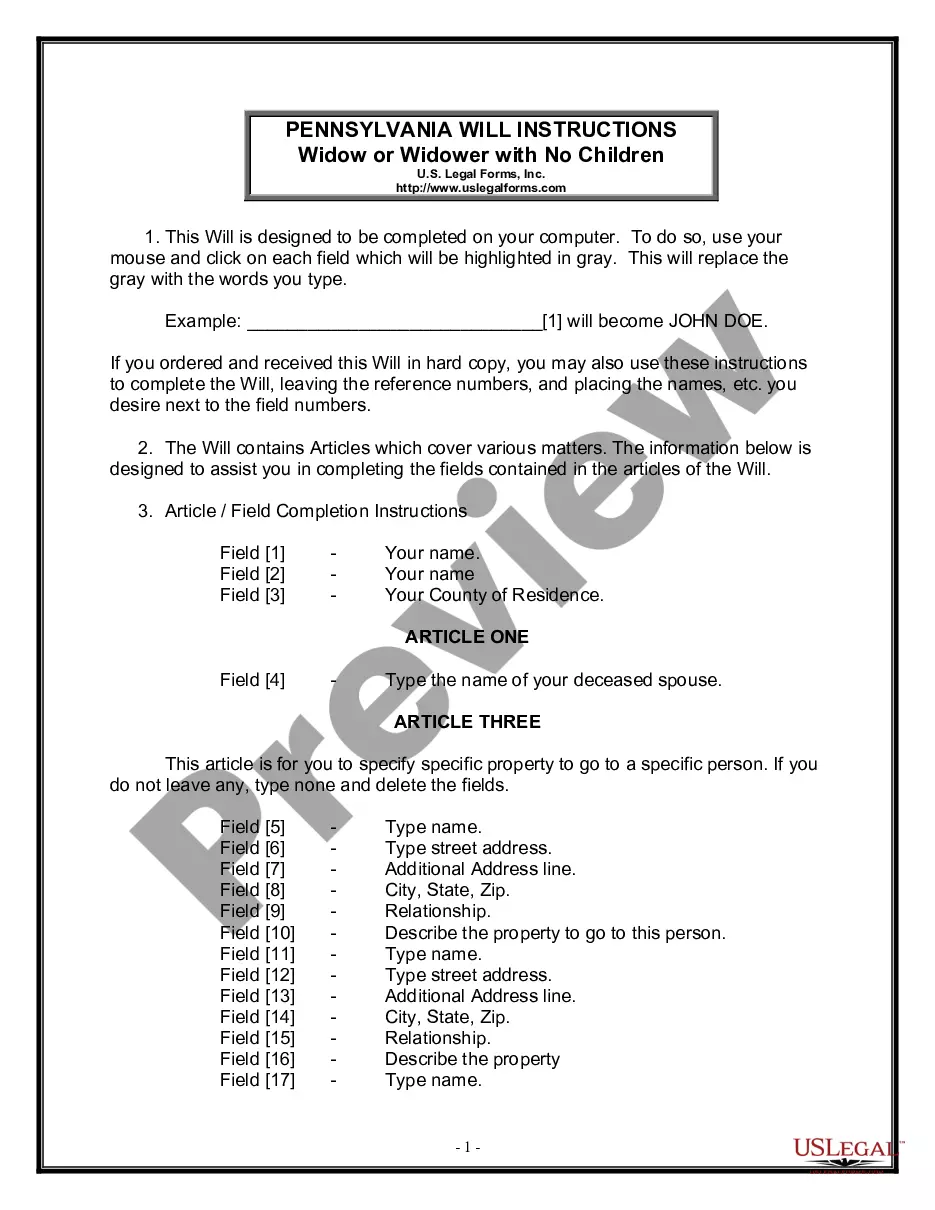

How to fill out Nassau New York Exhibit To UCC-1 Financing Statement Regarding A Fixture Filing For A Commercial Loan?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Nassau Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Nassau Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan. Follow the guide below:

- Make sure the sample fulfills your personal needs and state law regulations.

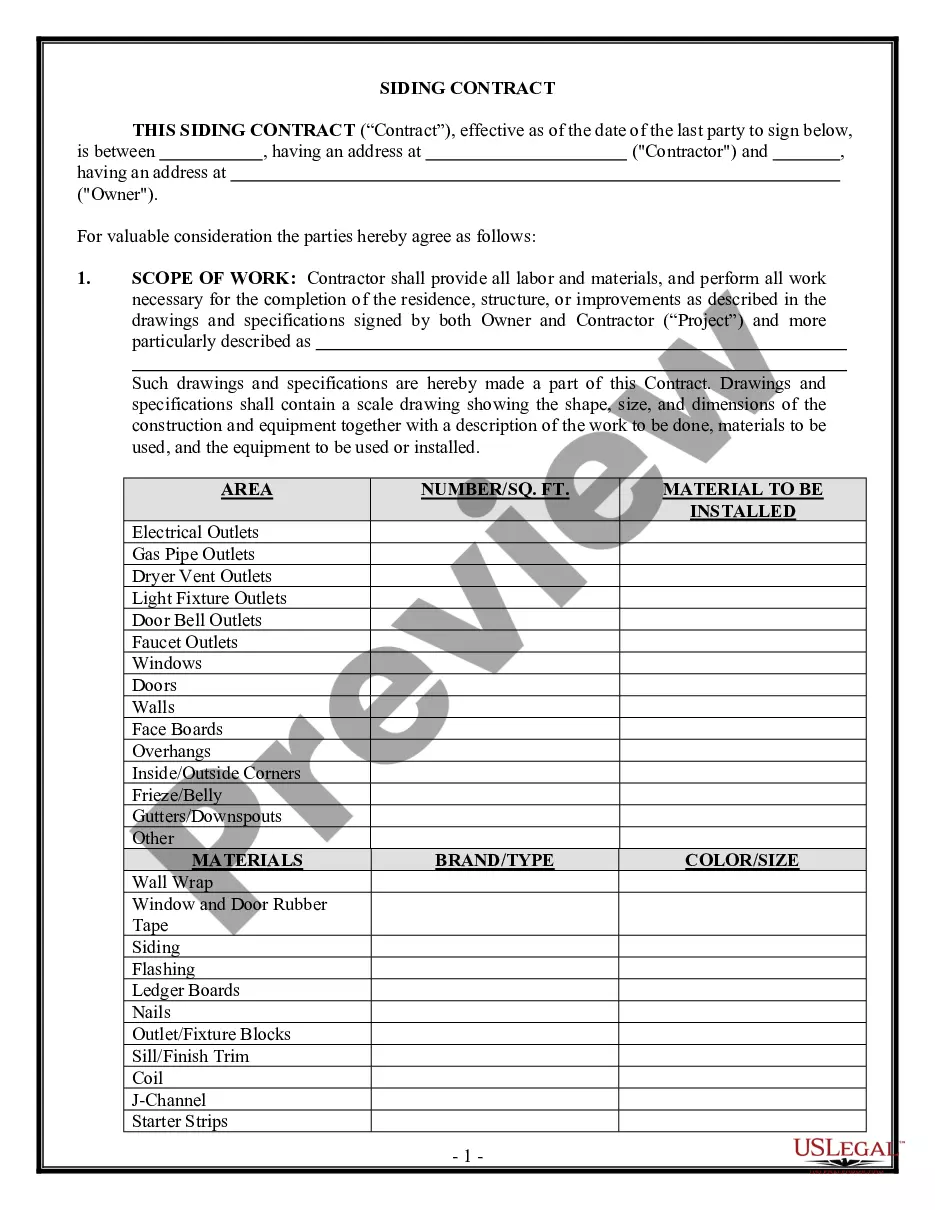

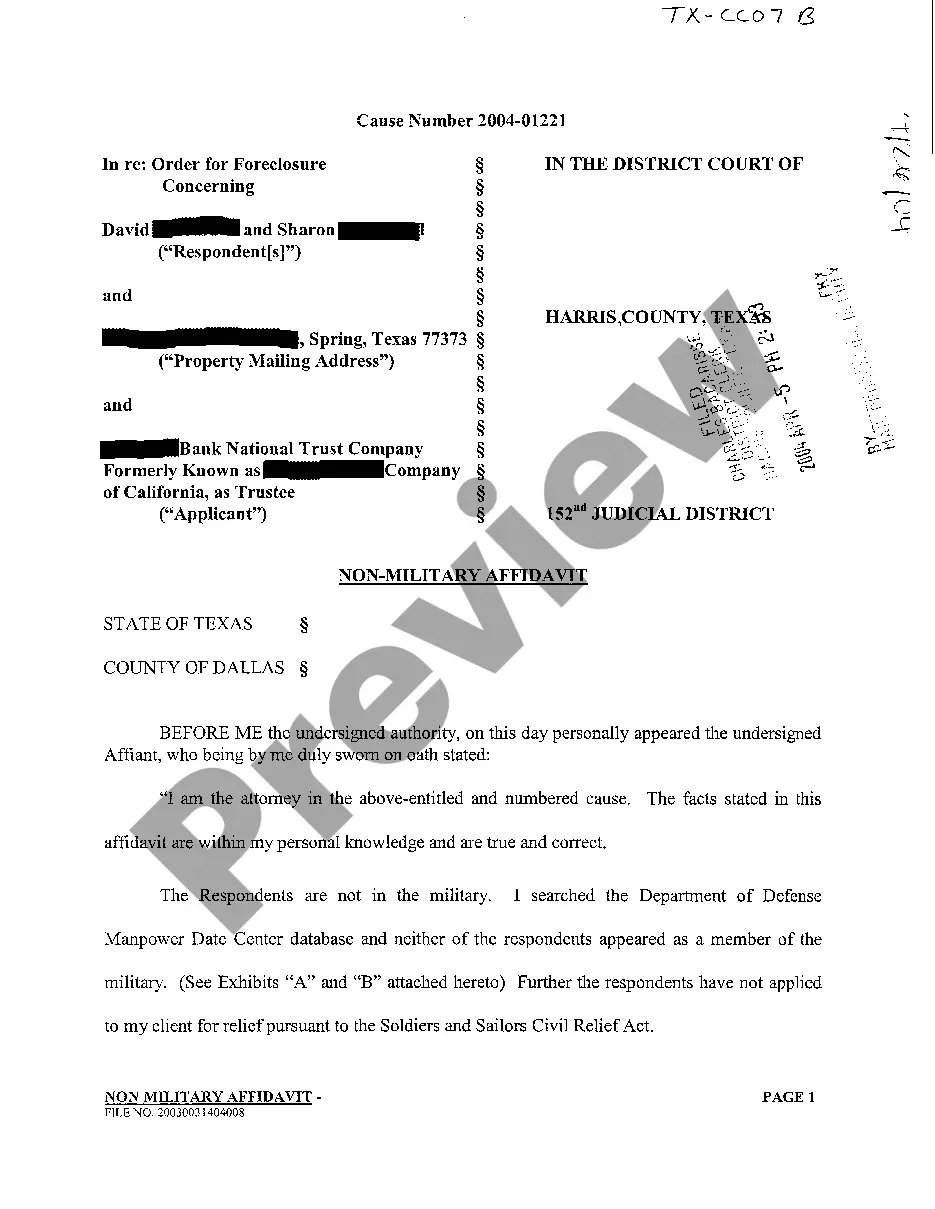

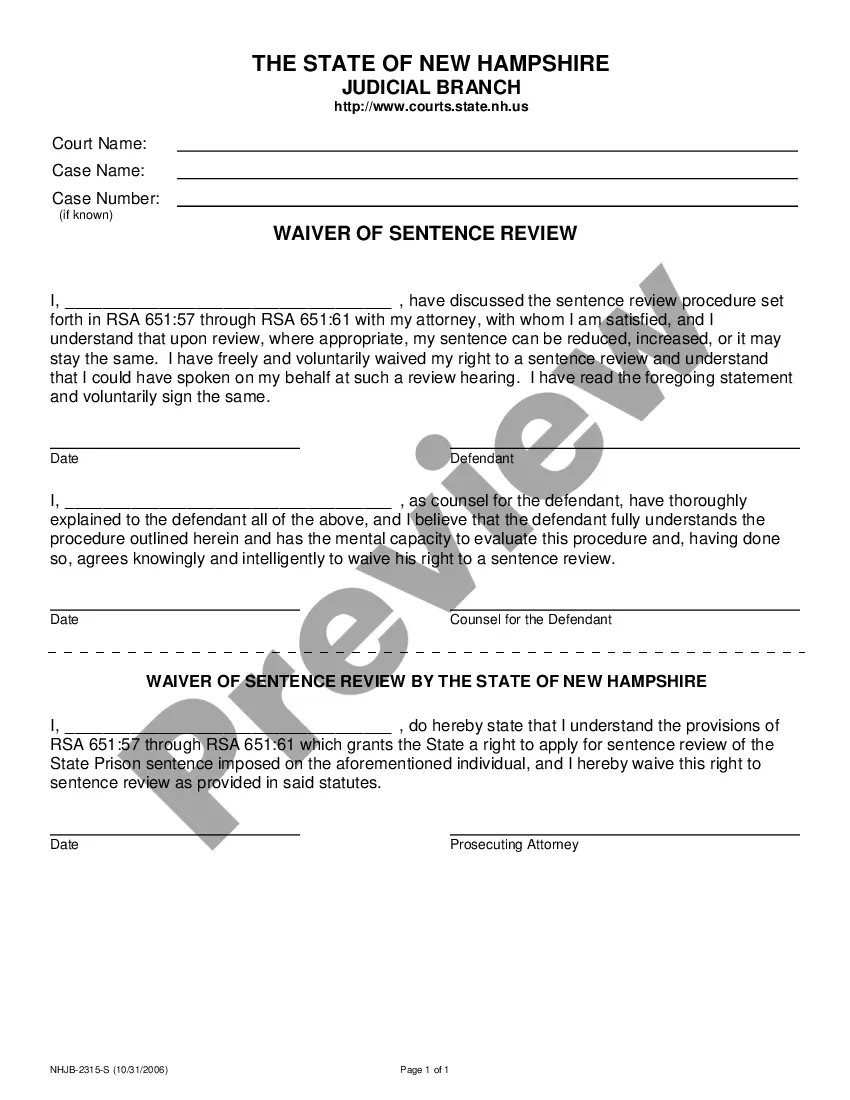

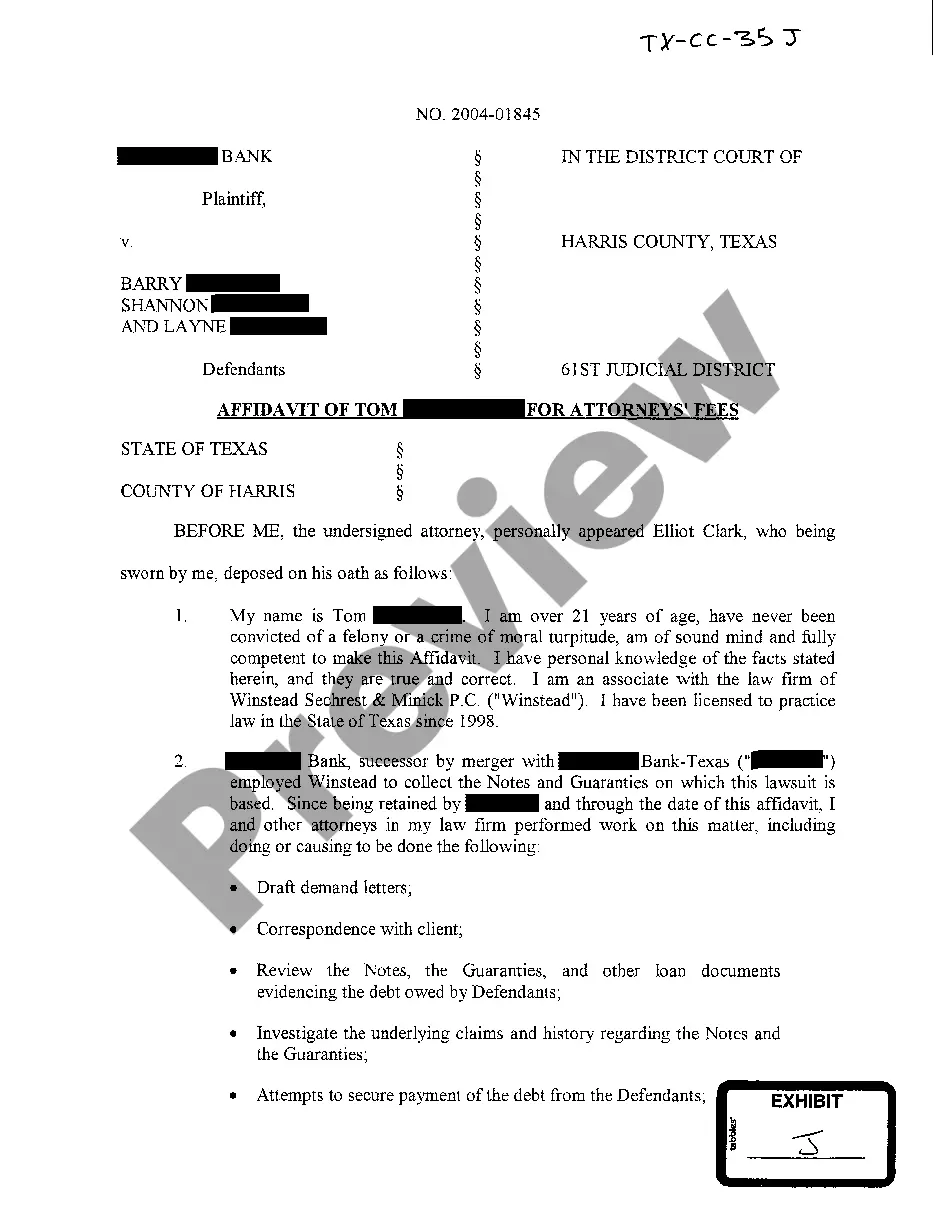

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

A filing on a fixture is a standard UCC-1 financing statement recorded with a secretary of state. It includes the fixture in the description of the collateral. It's important to know it doesn't attach a lien to real estate; you have a subordinate interest to the property owner and other creditors.

UCC stands for Uniform Commercial Code. The Uniform Commercial Code is a uniform law that governs commercial transactions, including sales of goods, secured transactions and negotiable instruments. The Uniform Commercial Code is a comprehensive set of statutes created to provide consistency among the states.

Fixtures, is defined by UCC Section 92010102(a)(41) as goods that have become so related to particular real property that an interest in them arises under real property law. Under this definition, fixtures have characteristics of both personal property and real property.

Central Registry Filings (UCC 1-F and UCC 3-F's) UCC and Crop filing $35.

A UCC filing is a legal statement that a lender would file when you take out a business loan that requires you to put up some or all of your business assets as collateral. A UCC filing gives the lender the right to claim those assets if you default on your payments.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

Financing statement. The purpose of the financing statement, which is filed with a public office such as the Secretary of State, is to put other people on notice of the secured party's security interest in the collateral. The UCC specifies what must be contained in a financing statement: the name of the debtor.

UCC stands for Uniform Commercial Code. The Uniform Commercial Code is a uniform law that governs commercial transactions, including sales of goods, secured transactions and negotiable instruments. The Uniform Commercial Code is a comprehensive set of statutes created to provide consistency among the states.

UCC-1 Financing Statements, commonly referred to as simply UCC-1 filings, are used by lenders to announce their rights to collateral or liens on secured loans. They're usually filed by lenders with the debtor's state's secretary of state office when a loan is first originated.

A fixture filing is the filing of a financing statement that covers goods that are or will become fixtures. These fixtures are goods that are so tied to a certain real property that an interest in them arises under property law.