Orange, California, is a vibrant city located in Orange County, known for its rich history, diverse culture, and thriving business community. It is home to various industries, including real estate, retail, healthcare, and manufacturing. With its prime location, Orange attracts entrepreneurs and investors seeking commercial loans to start or expand their business ventures. When it comes to securing a commercial loan, businesses often need to file a UCC-1 Financing Statement, particularly if the loan is tied to fixtures. A fixture filing refers to the act of declaring a specific collateral asset, usually a fixture, as security for a loan. This allows lenders to claim a priority interest in the collateral if the borrower defaults. In Orange, California, there are several types of exhibits that can be included in a UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan, such as: 1. Fixture Description: This exhibit provides a detailed description of the fixtures being used to secure the loan. It includes information about the quantity, type, and location of the fixtures attached to the property. For example, it might list fixtures like commercial kitchen equipment, office furniture, or medical equipment. 2. Legal Description of Property: This exhibit contains the legal description of the property where the fixtures are located. It includes specific details such as the property address, lot numbers, and any applicable parcel identification numbers. This information is essential for accurately identifying and locating the collateral. 3. Identity of the Debtor: This exhibit includes the necessary information about the business or individual borrowing the funds. It provides the legal name, address, and other identifying details of the debtor, helping to establish a clear link between the borrower and the collateral assets. 4. Identity of the Secured Party: This exhibit outlines the details of the lender or secured party involved in the commercial loan agreement. It includes their legal name, address, and contact information. This information is vital for future communication and documentation related to the loan. 5. Financing Statement Addendum: This exhibit allows the debtor or secured party to include additional information that may be relevant to the fixture filing. It may contain details about any lease agreements, subordination agreements, or other relevant documents related to the collateral assets. By including these exhibits in the UCC-1 Financing Statement, parties involved in the commercial loan process can ensure a clear and comprehensive representation of the fixture filing. This documentation helps protect the rights of both the debtor and the secured party, establishing a legally binding agreement while reducing the potential for disputes or confusion.

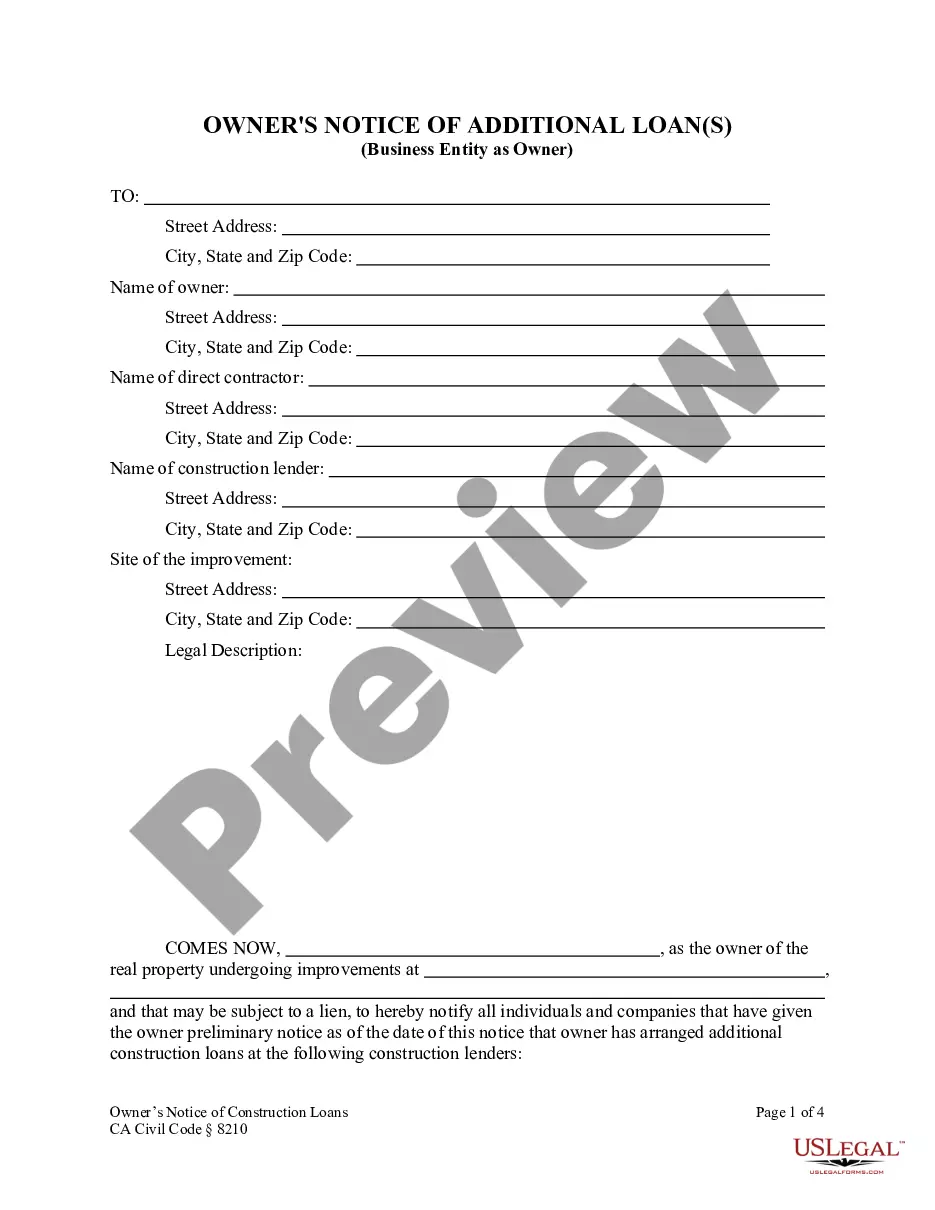

Orange California Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan

Description

How to fill out Orange California Exhibit To UCC-1 Financing Statement Regarding A Fixture Filing For A Commercial Loan?

Whether you intend to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Orange Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Orange Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan. Adhere to the guide below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Orange Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!