Nassau New York Accident Policy is an insurance coverage offered to residents of Nassau County, New York, to protect against various accidents and injuries that may occur. This policy provides financial assistance and support to individuals and families in the event of an accident, helping them cover medical expenses, lost wages, and other related costs. Accidents can happen unexpectedly, and having the right insurance policy in place can provide peace of mind and financial security. The Nassau New York Accident Policy aims to safeguard individuals and their loved ones from the financial repercussions resulting from accidents, which can often lead to substantial expenses. There are various types of accident policies available in Nassau County, New York, tailored to meet different needs and lifestyles. Some common types of Nassau New York Accident Policies include: 1. Personal Accident Insurance: This policy provides coverage for accidents resulting in bodily injury, disability, or accidental death. It typically includes benefits for medical expenses, hospital stays, ambulance services, and rehabilitation costs. 2. Auto Accident Insurance: This type of accident policy focuses on providing coverage for accidents involving vehicles. It may include benefits such as medical expenses, repair costs, and liability coverage in case of injury to others. 3. Workplace Accident Insurance: This policy is designed specifically for employees and offers coverage for accidents that occur in the workplace. It provides compensation for medical expenses, disability benefits, and lost wages due to work-related accidents. 4. Sports Accident Insurance: This policy targets individuals who participate in high-risk sports activities. It covers accidents that occur during sports events or related activities, providing financial assistance for medical treatment and rehabilitation. 5. Travel Accident Insurance: This accident policy is ideal for individuals who frequently travel. It offers coverage for accidents that happen while traveling, including medical expenses, emergency medical evacuation, and repatriation. Other variations of accident policies may exist, catering to specific needs and requirements of the insured. It is crucial to carefully review the terms, conditions, and coverage options offered by each policy type before selecting the most suitable one. In conclusion, Nassau New York Accident Policy provides valuable coverage for individuals and families in Nassau County, New York, protecting them from the financial burden often associated with accidents. With various types of accident policies available, individuals can choose the coverage that best aligns with their lifestyle, ensuring they have the necessary support in case of an unfortunate event.

Nassau New York Accident Policy

Description

How to fill out Nassau New York Accident Policy?

Preparing paperwork for the business or individual needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Nassau Accident Policy without professional help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Nassau Accident Policy by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Nassau Accident Policy:

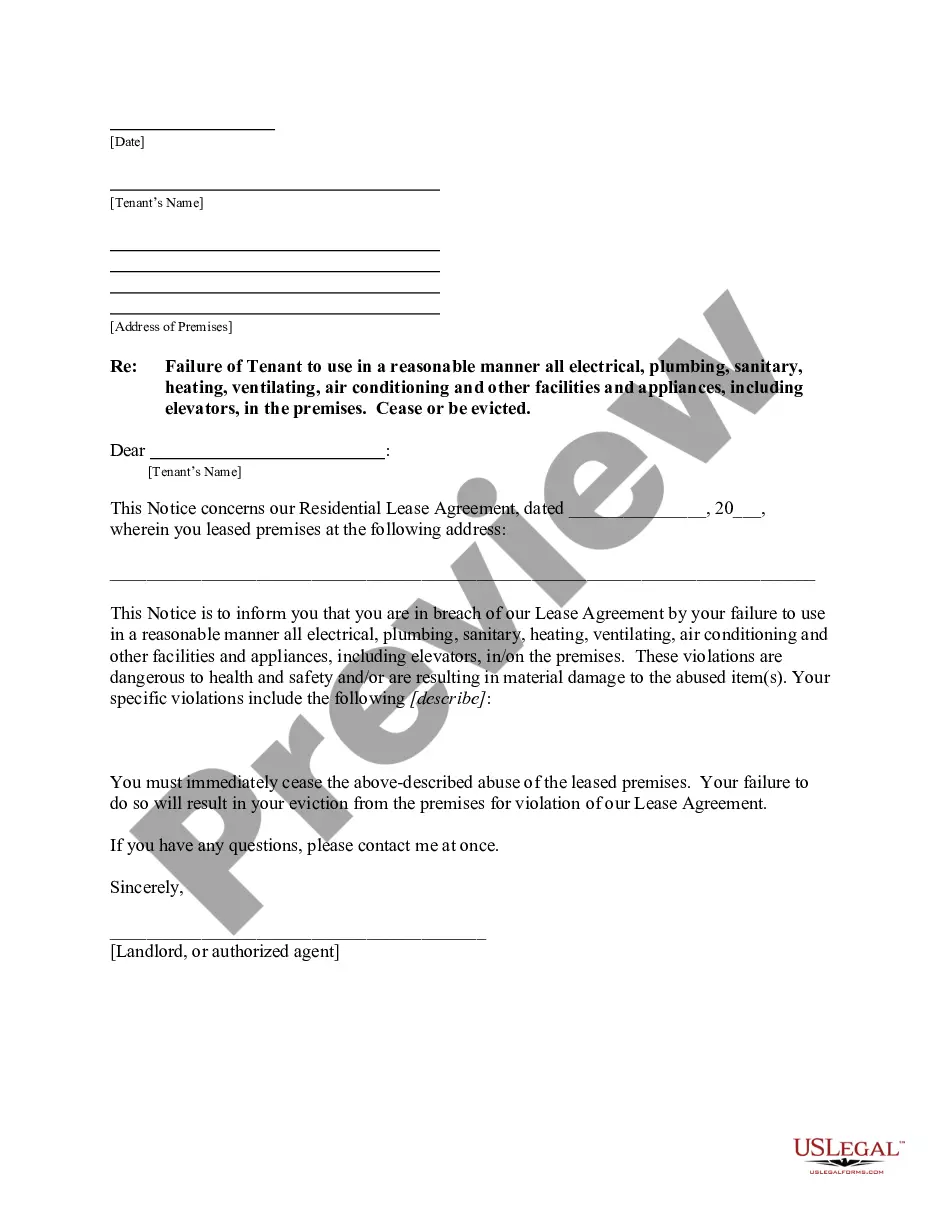

- Look through the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that suits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!