San Diego California Accident Policy refers to the insurance coverage that individuals or businesses located in San Diego can obtain to protect themselves against financial loss or damages resulting from accidents. This policy is crucial in providing necessary compensation for medical expenses, property damage, and legal costs incurred due to accidents. There are various types of San Diego California Accident Policies available, each offering specific coverage and benefits. Some different types of accident policies that individuals or businesses can consider in San Diego include: 1. Personal Accident Insurance: This policy provides coverage to individuals for accidental bodily injuries, disability, or death resulting from accidents. It helps in covering medical expenses, hospitalization costs, and can provide a lump sum payment in case of permanent disability or death. 2. Auto Accident Insurance: This policy is usually mandatory in California and provides coverage for accidents involving automobiles. It covers medical expenses, vehicle repairs, liability claims, and can also offer personal injury protection for the policyholder or passengers. 3. Commercial Accident Insurance: This policy is designed for businesses in San Diego, covering accidents that may occur in the workplace or during work-related activities. It protects against liability claims, medical expenses for injured employees, and can also extend coverage to cover damage caused to third-party property. 4. Motorcycle Accident Insurance: Specifically tailored for motorcycle riders in San Diego, this policy provides coverage for accidents that occur while riding motorcycles. It offers medical expense coverage, property damage liability, and can also include coverage for theft or damage to motorcycles. 5. Recreational Accident Insurance: This policy covers accidents that may occur during recreational activities such as sports, adventure tours, and outdoor adventures. It provides coverage for medical expenses, emergency medical evacuation, and personal accident benefits related to recreational accidents. 6. Public Liability Insurance: While not strictly an accident policy, public liability insurance is relevant to accidents as it covers legal liabilities arising from accidents that occur on a business premises. It protects against claims made by third parties for injuries or property damage suffered due to accidents or negligence. In conclusion, San Diego California Accident Policy is essential for individuals and businesses in San Diego to safeguard themselves against the unexpected financial implications of accidents. The different types of accident policies available offer specific coverage and benefits, catering to the unique needs of individuals or businesses in different situations.

San Diego California Accident Policy

Description

How to fill out San Diego California Accident Policy?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a lawyer to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Diego Accident Policy, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Therefore, if you need the current version of the San Diego Accident Policy, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Diego Accident Policy:

- Look through the page and verify there is a sample for your region.

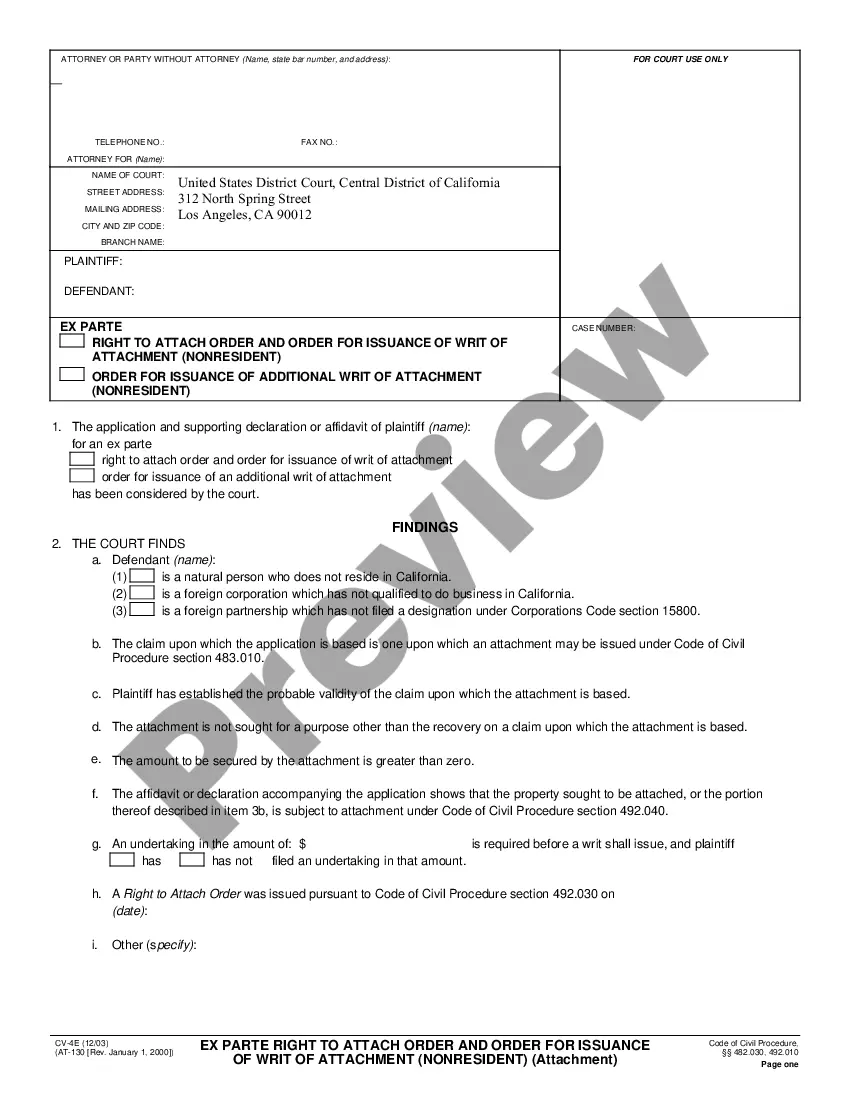

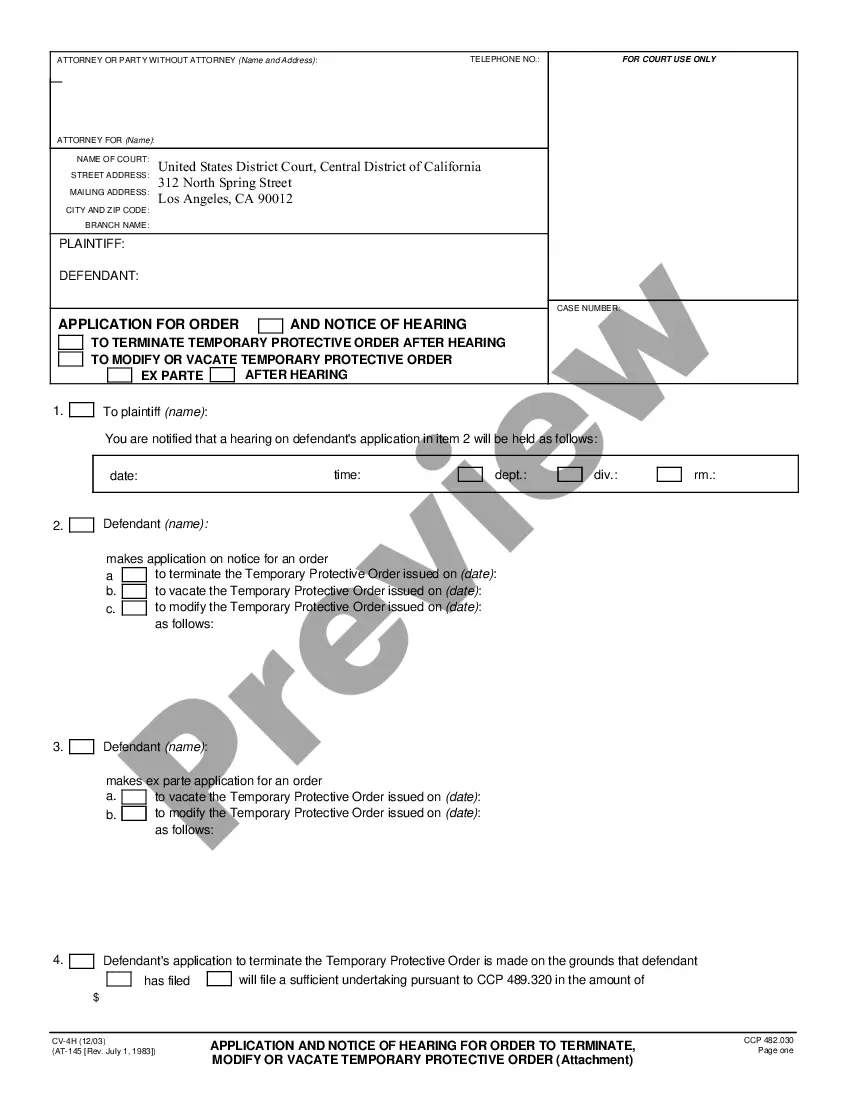

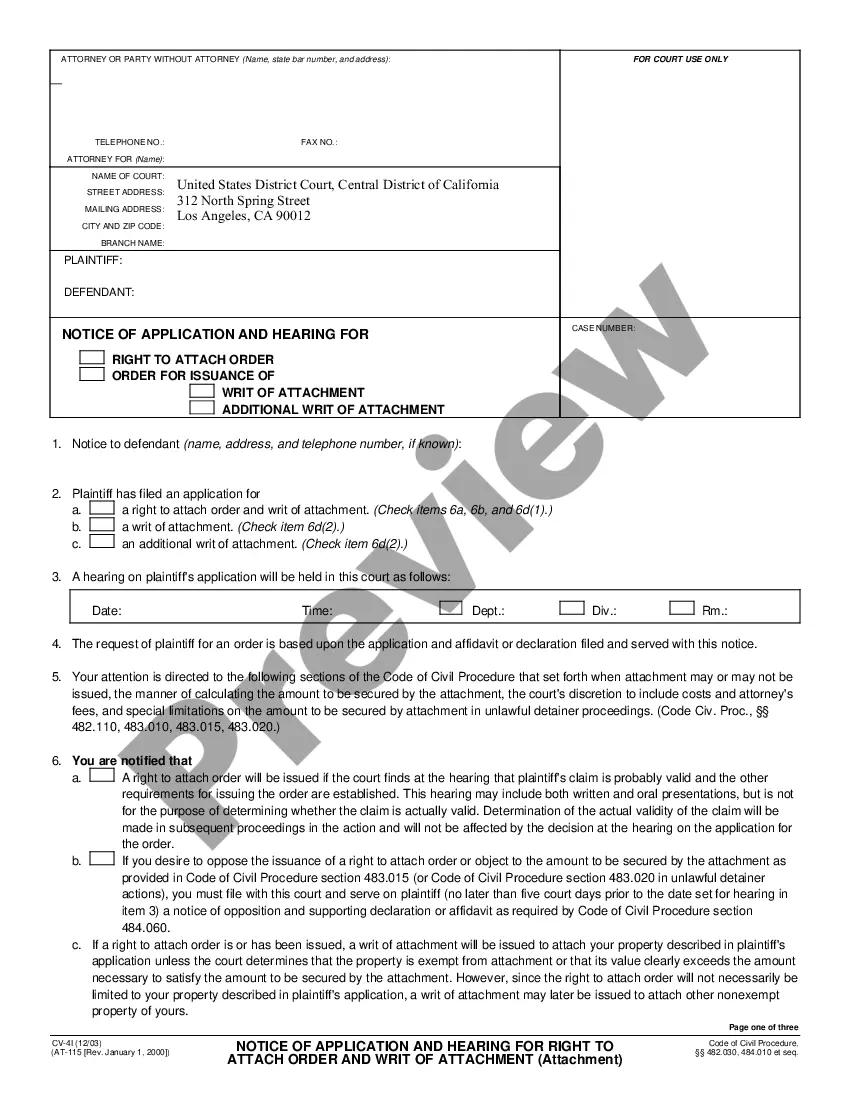

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your San Diego Accident Policy and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!