Suffolk New York Accident Policy is a type of insurance coverage that provides financial protection to individuals residing in Suffolk County, New York, in the event of an accident. This policy is designed to offer coverage for various types of accidents, ensuring that policyholders can receive compensation for medical expenses, lost income, and other associated costs resulting from an accident. The Suffolk New York Accident Policy offers a range of benefits and coverage options tailored to meet the unique needs of individuals living in Suffolk County. This policy takes into account the specific geographical and demographic factors that may influence accident risks in the area. It provides residents with comprehensive coverage against accidents occurring on roads, at workplaces, or during recreational activities. Various types of Suffolk New York Accident Policies are available to cater to different needs and budgets. These policies may include: 1. Auto Accident Policy: As Suffolk County experiences a high volume of traffic, auto accident policies offer coverage for car accidents, providing compensation for medical expenses, vehicle repair costs, and potential legal liabilities. 2. Workplace Accident Policy: This type of policy is aimed at employees working within Suffolk County and covers accidents that occur in the workplace. It provides benefits such as medical expenses, disability benefits, and lost wage reimbursement. 3. Recreational Accident Policy: Suffolk County offers numerous recreational activities, such as boating, hiking, and sports. Recreational accident policies provide coverage for accidents and injuries sustained during these activities, ensuring policyholders receive the necessary financial support for medical treatments and rehabilitation. 4. Slip and Fall Accident Policy: Slip and fall accidents are common and can occur anywhere, including public places, residences, or commercial establishments. This policy focuses on offering coverage for injuries resulting from slip and fall accidents, providing compensation for medical expenses and potential legal issues. 5. Personal Injury Protection (PIP) Policy: PIP policies are designed to provide coverage for various types of accidents resulting in personal injuries. This policy extends benefits such as medical expenses, rehabilitation costs, and lost income due to disability. It is essential to carefully evaluate the specific coverage options and terms provided by different insurers offering Suffolk New York Accident Policies. Policyholders should consider factors such as premium amounts, deductible options, coverage limits, and additional riders to select the most suitable policy that fits their individual needs.

Suffolk New York Accident Policy

Description

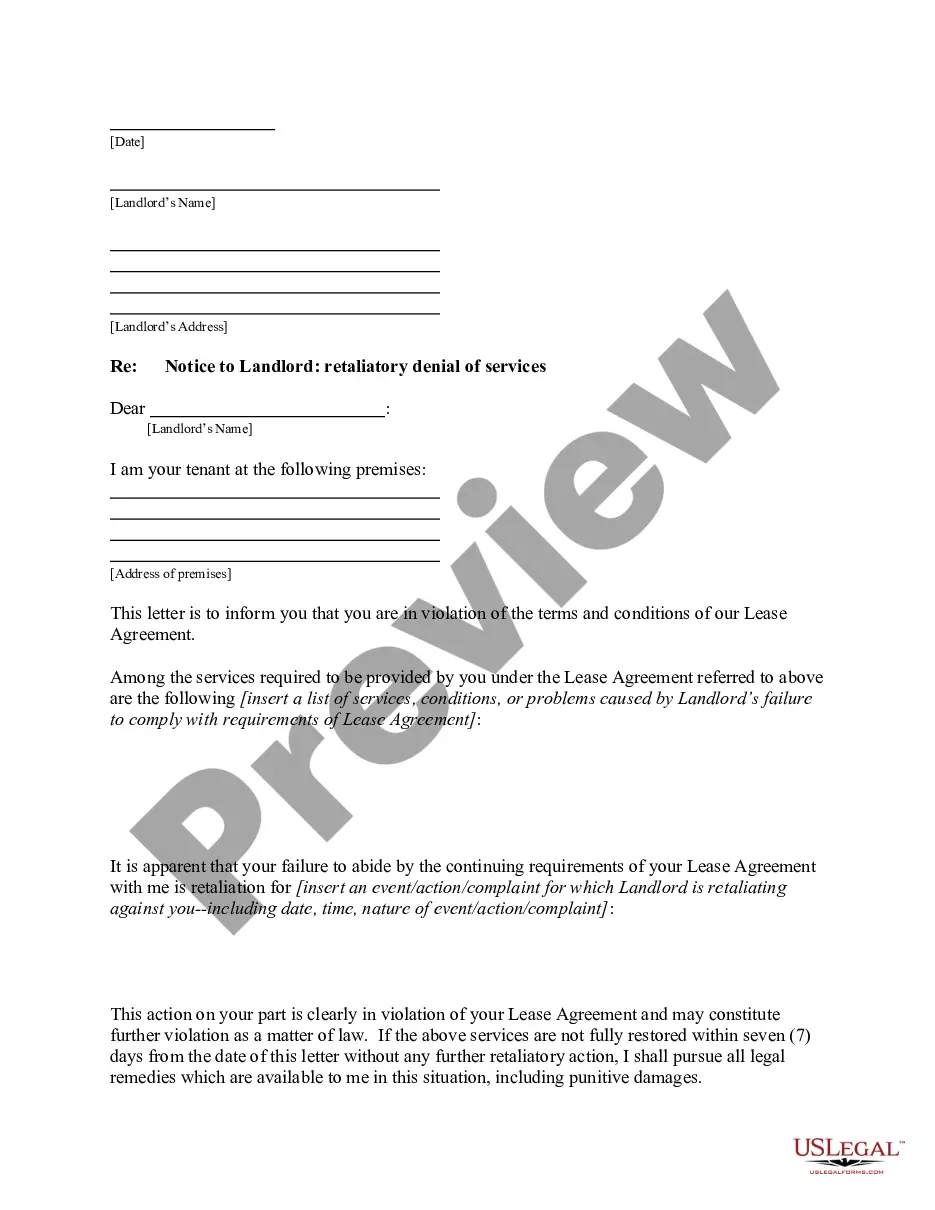

How to fill out Suffolk New York Accident Policy?

Do you need to quickly create a legally-binding Suffolk Accident Policy or maybe any other document to handle your own or business affairs? You can select one of the two options: contact a professional to draft a legal paper for you or create it entirely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you receive professionally written legal documents without having to pay sky-high prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-compliant document templates, including Suffolk Accident Policy and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the needed document without extra troubles.

- To start with, carefully verify if the Suffolk Accident Policy is tailored to your state's or county's laws.

- In case the document comes with a desciption, make sure to verify what it's intended for.

- Start the search over if the document isn’t what you were seeking by using the search box in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Suffolk Accident Policy template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Moreover, the paperwork we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!