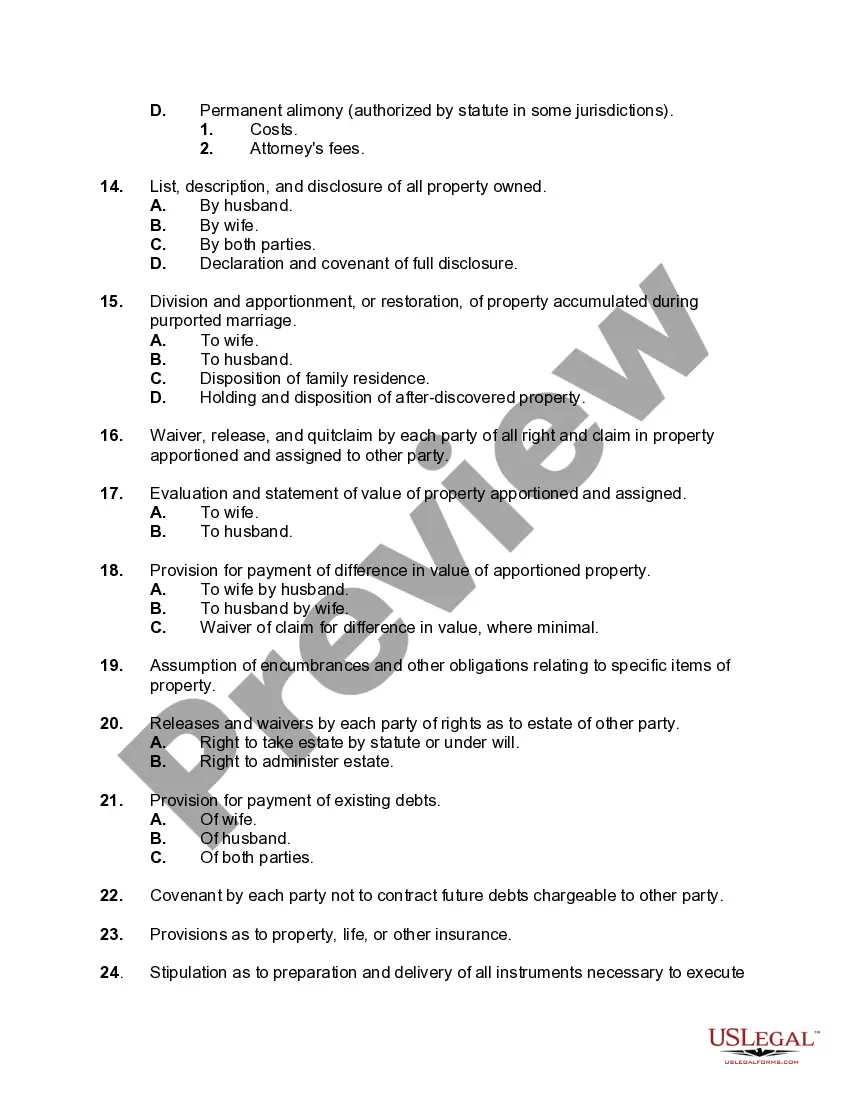

Allegheny Pennsylvania Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage

Description

How to fill out Checklist Of Matters To Be Considered In Drafting An Agreement For Division Or Restoration Of Property In Connection With A Proceeding For Annulment Of A Marriage?

If you require a dependable legal document provider to locate the Allegheny Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage, think about US Legal Forms. Whether you need to initiate your LLC enterprise or organize your asset distribution, we have you covered. You don't have to be an expert in law to find and download the required template.

You can simply enter keywords to search for or browse the Allegheny Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage, either by keyword or by the relevant state/county for the document. Once you find the necessary template, you can Log In to download it or store it in the My documents section.

Don't have an account? It's easy to begin! Just search for the Allegheny Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage template and review the form's preview and description (if available). If you are comfortable with the terminology of the template, proceed and select Buy now. Register an account and choose a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Managing your legal matters doesn’t need to be costly or cumbersome. US Legal Forms is here to prove that. Our extensive range of legal forms helps make this process less expensive and more economical. Establish your first business, arrange your advance care planning, draft a property contract, or execute the Allegheny Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage - all from the comfort of your home.

Sign up for US Legal Forms today!

- You can search through over 85,000 forms organized by state/county and case.

- The intuitive interface, diverse educational materials, and dedicated assistance make it easy to obtain and complete various documents.

- US Legal Forms is a trustworthy service providing legal documents to millions of users since 1997.

Form popularity

FAQ

The grounds for a null and void marriage generally include circumstances like bigamy, underage marriage without consent, or lack of mental capacity. Such conditions render the marriage invalid from the start. Knowing these grounds can inform decisions about annulments and property division. Resources like the Allegheny Pennsylvania Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage can provide additional context and legal guidance.

A divorce ends a legal marriage and declares the spouses to be single again. Annulment: A legal ruling that erases a marriage by declaring the marriage null and void and that the union was never legally valid. However, even if the marriage is erased, the marriage records remain on file.

Couples going through a divorce must decide how to divide their property and debtsor ask a court to do it for them. Under California's community property laws, assets and debts spouses acquire during marriage belong equally to both of them, and they must divide them equally in a divorce. (Cal.

The most obvious effect of an annulment is that it renders the marriage null and void. But there are other possible consequences. For example, it could impact a spouse's ability to get support (alimony) from the other spouse. Likewise, it might affect a spouse's rights to property acquired during the marriage.

How is Property Handled After an Annulment of Marriage? Since annulments are typically done soon after marriage, it avoids a lot of property-division hassles. Each spouse remains with his or her own assets and debts. If they did happen to acquire an asset or carry debt in that short time, they can split it evenly.

The grounds for annulment of marriage must have been existing at the time of marriage, and include lack of parental consent (FC, Article 451), insanity (FC, Article 452), fraud (FC, Article 453), duress (FC, Article 454), impotence (FC, Article 455), and serious and incurable sexually transmissible disease (

On the other hand, a marital settlement agreement is an agreement between husband and wife for separation without the involvement of cumbersome court procedures and the administration. Although Marital settlement agreements are not legally enforceable in India, they can aid the Court while dealing with divorce.

If the case used to end the marriage is Annulment, then the following would happen: Net Conjugal Property is divided between the Spouses. The family home goes to the Spouse with whom the children live. Exclusive Properties are returned to the Spouses.

If the case used to end the marriage is Annulment, then the following would happen: Net Conjugal Property is divided between the Spouses. The family home goes to the Spouse with whom the children live. Exclusive Properties are returned to the Spouses.

Whether you live in a community property state like California, you might choose to keep some assets separate in marriage. To do so, consider consulting with a family law attorney before marriage to create a prenuptial agreement, or if you're already married, something called a post-nuptial agreement.