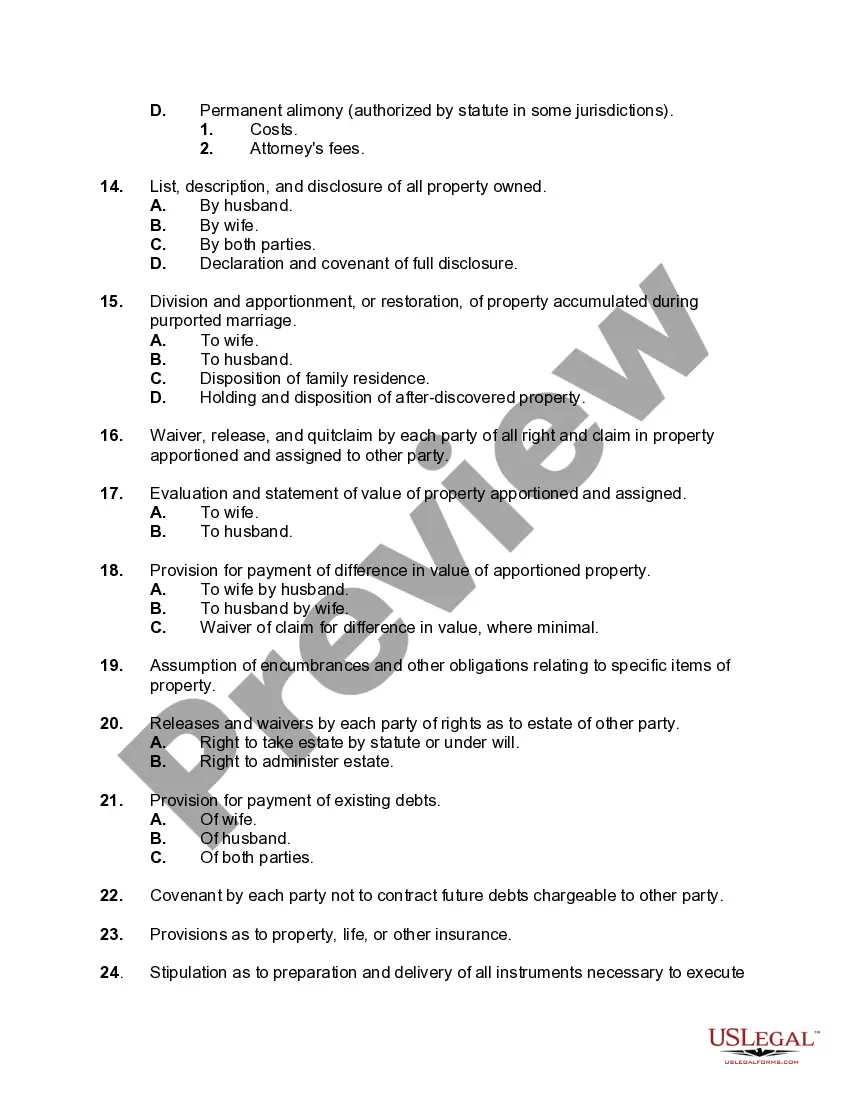

Chicago Illinois is a bustling city located in the Midwest region of the United States. Known for its rich history, diverse culture, and stunning architecture, Chicago offers its residents and visitors a wide array of attractions and experiences. From iconic landmarks such as the Willis Tower and Navy Pier to world-class museums like the Art Institute of Chicago, this city has something for everyone. When drafting an agreement for the division or restoration of property in connection with a proceeding for annulment of a marriage in Chicago, there are several matters that must be considered. These considerations aim to ensure a fair and equitable distribution of assets between the parties involved. Here is a checklist of some key points to be taken into account: 1. Marital Property: Identify all assets acquired during the course of the marriage, including real estate, vehicles, financial accounts, investments, and personal belongings. Determine whether these assets are classified as marital property, separate property, or a combination of both. 2. Valuation of Assets: Appraise the value of each marital asset, taking into consideration factors such as fair market value, depreciation, and outstanding debts or liabilities. 3. Asset Division: Decide on a methodology for dividing the marital property, whether it be through an equal distribution or an arrangement that considers the individual circumstances of each party. Consider factors such as the duration of the marriage, financial contributions, and future earning potential. 4. Child Custody and Support: If there are children involved, outline custody arrangements and determine child support obligations. Focus on the best interests of the child, ensuring their well-being and stability in the aftermath of the annulment. 5. Spousal Support (Alimony): Evaluate the need for spousal support, considering factors such as the length of the marriage, the financial situation of both parties, and the ability to maintain a similar standard of living post-annulment. 6. Debt Allocation: Address the allocation of both marital and separate debts incurred during the marriage, such as mortgages, loans, credit card debts, and outstanding bills. Determine responsibility for repayment and ensure a fair distribution. 7. Insurance and Healthcare: Review any shared insurance policies, including health, life, or property insurance. Decide whether to maintain joint coverage or make necessary changes to individual policies. 8. Retirement Accounts and Benefits: Consider pension plans, retirement accounts, and other employment-related benefits. Determine how these assets will be divided or retained by each party. 9. Tax Considerations: Understand the potential tax implications of the property division agreement. Seek professional advice to ensure compliance with the relevant tax laws and regulations. 10. Dispute Resolution: Include a provision for resolving any future disputes that may arise from the agreement. Consider mediation or arbitration as alternative methods for settling disagreements. These matters can vary based on individual circumstances, and it is important to consult with legal professionals to tailor the agreement to specific needs. By considering these factors and addressing them in a comprehensive division or restoration of property agreement, parties going through an annulment in Chicago can ensure a smooth and equitable resolution.

Chicago Illinois Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage

Description

How to fill out Chicago Illinois Checklist Of Matters To Be Considered In Drafting An Agreement For Division Or Restoration Of Property In Connection With A Proceeding For Annulment Of A Marriage?

How much time does it normally take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, finding a Chicago Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage suiting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. Aside from the Chicago Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Chicago Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!