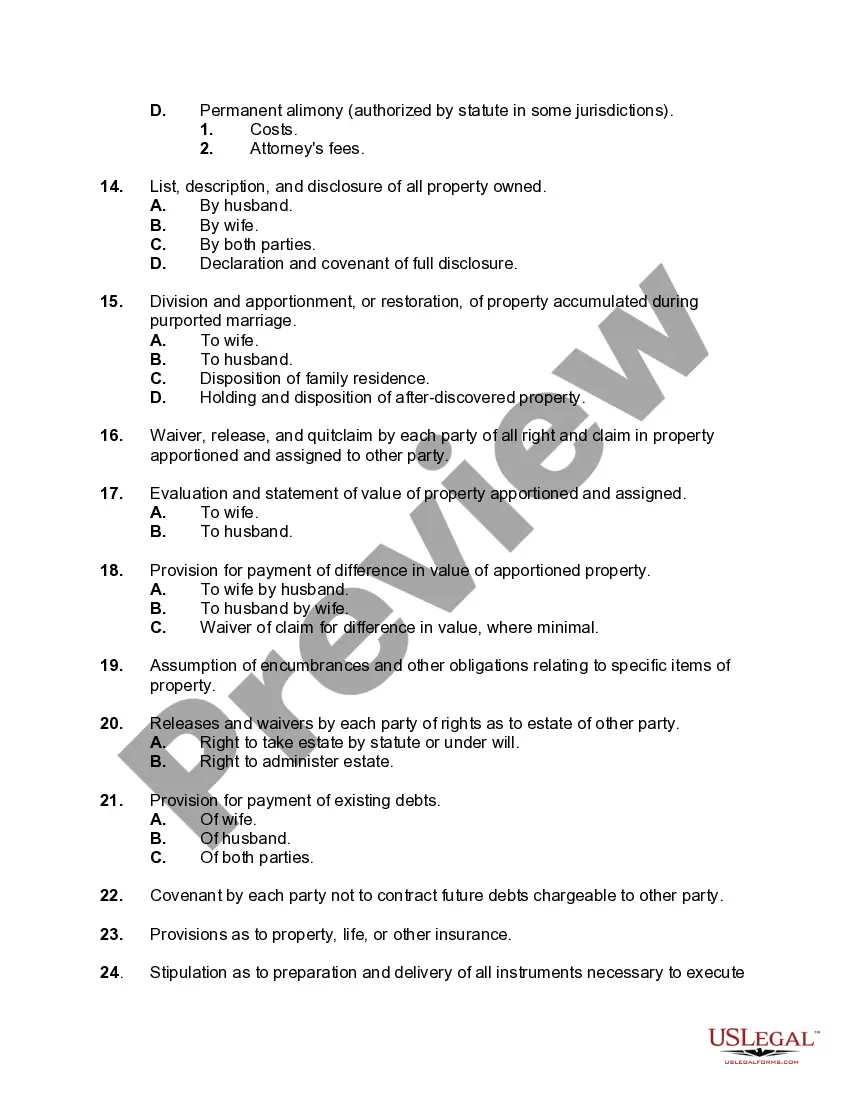

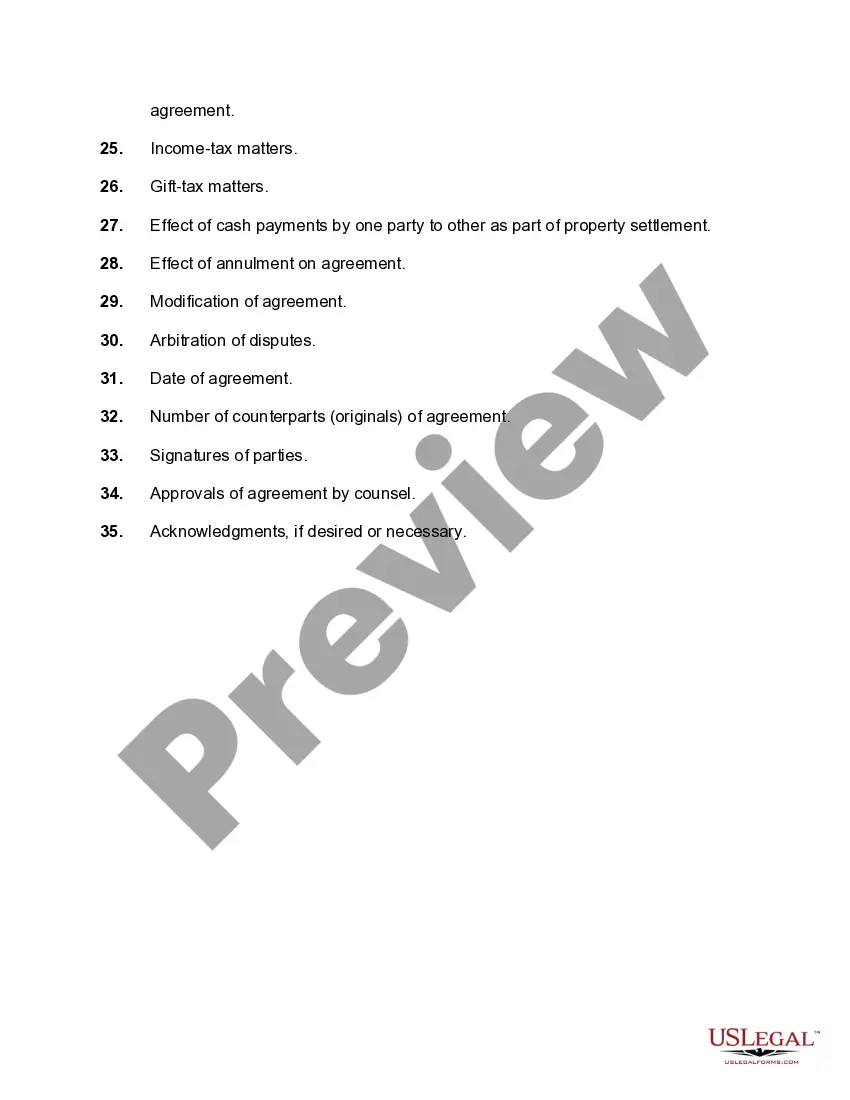

Fairfax, Virginia is a county located in the northern part of the state. It is considered one of the wealthiest counties in the United States and is known for its excellent educational opportunities, diverse community, and proximity to the nation's capital, Washington, D.C. When going through a proceeding for annulment of a marriage in Fairfax, Virginia, there are several matters that need to be taken into consideration in drafting an agreement for division or restoration of property. Here is a checklist of key areas to address: 1. Marital Property: Identify and categorize all assets and liabilities acquired during the marriage, including real estate, vehicles, bank accounts, investments, business interests, retirement accounts, debts, and any other valuable items. 2. Separate Property: Determine and differentiate between marital property and separate property, which includes assets acquired before the marriage, gifts received individually, inheritances, and any other property legally classified as separate. 3. Valuation of Assets: Assign a monetary value to each asset or liability, taking into account factors such as current market value, depreciation, outstanding loans, and any professional appraisals. 4. Division of Property: Decide on the division of marital property between the parties. This may include allocating specific assets or selling them and dividing the proceeds. Consider the fairness and future financial implications of the proposed division. 5. Real Estate: Determine the fate of any real estate owned by the couple, such as the family home or investment properties. Options may involve selling the property, transferring ownership, or arranging a buyout. 6. Alimony or Spousal Support: Discuss the possibility of alimony or spousal support payments to be made by one spouse to the other following the annulment. Factors such as income disparity, earning capacity, duration of the marriage, and the standard of living should be taken into account. 7. Child Custody and Support: If there are children from the marriage, address matters related to child custody, visitation schedules, and child support payments. Ensure that the best interests of the children are prioritized. 8. Insurance and Benefits: Determine how existing insurance policies, including health, life, auto, and disability, will be handled after the annulment. Additionally, consider any employee benefits, such as retirement plans or stock options, and whether they will be divided or remain with the original owner. 9. Tax Implications: Be aware of potential tax consequences resulting from the division of property and assets. Consult with a tax professional to understand the tax implications of the agreement. 10. Legal Assistance: Seek the guidance and assistance of an experienced family law attorney in Fairfax, Virginia, to ensure that the agreement complies with state laws and is in your best interests. Be aware of any other types of checklists depending on the specific circumstances of your case, such as agreements for the division of businesses or unique assets. In conclusion, when drafting an agreement for division or restoration of property in connection with an annulment proceeding in Fairfax, Virginia, it is crucial to consider these matters and seek professional advice to protect your rights and interests.

Fairfax Virginia Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage

Description

How to fill out Fairfax Virginia Checklist Of Matters To Be Considered In Drafting An Agreement For Division Or Restoration Of Property In Connection With A Proceeding For Annulment Of A Marriage?

If you need to get a reliable legal paperwork provider to obtain the Fairfax Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage, look no further than US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can select from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support make it easy to get and execute different documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply type to look for or browse Fairfax Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage, either by a keyword or by the state/county the form is created for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Fairfax Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less expensive and more reasonably priced. Create your first company, organize your advance care planning, create a real estate agreement, or complete the Fairfax Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage - all from the comfort of your sofa.

Sign up for US Legal Forms now!