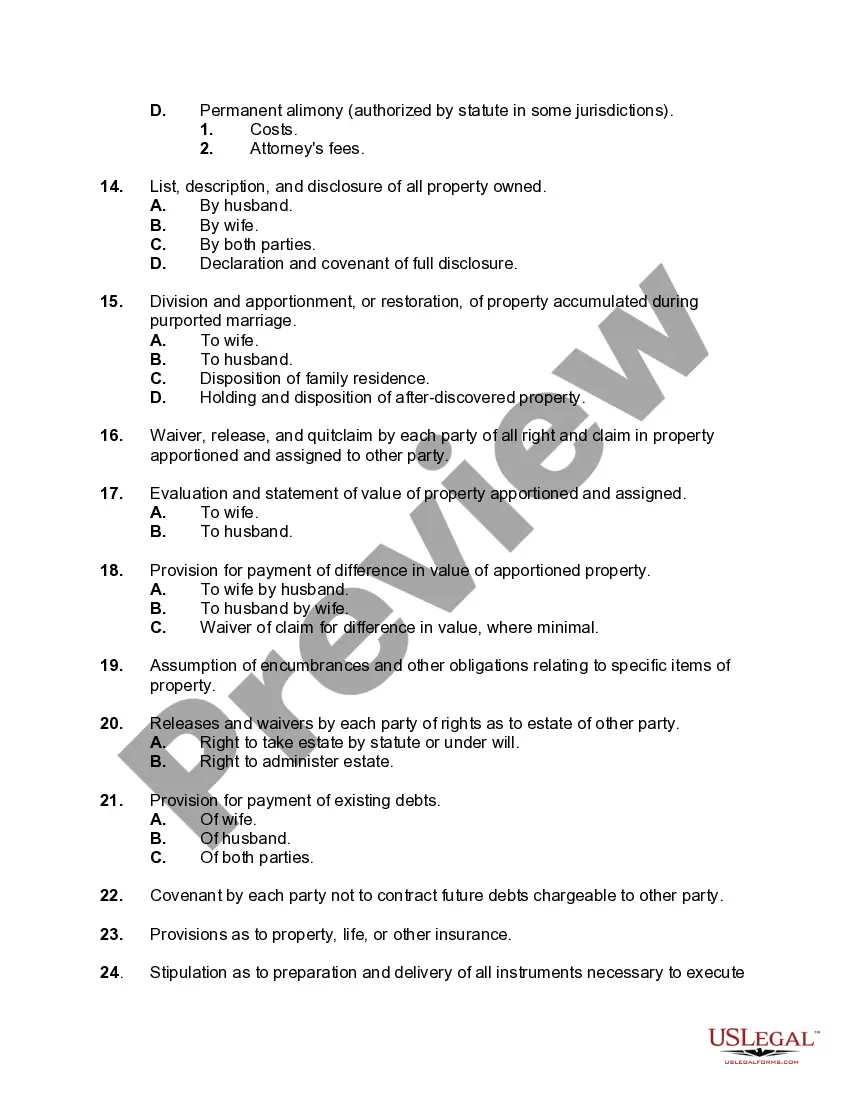

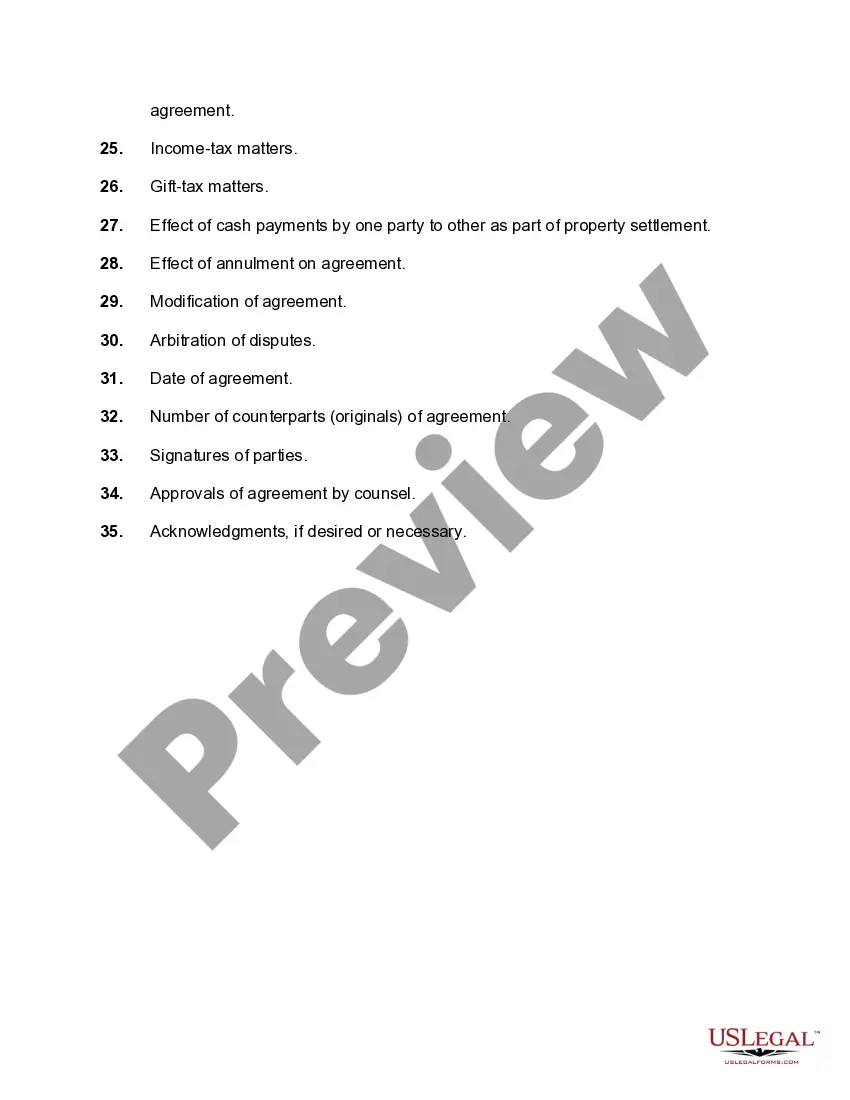

The Harris Texas Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage is a comprehensive guide that outlines important factors to consider when dividing or restoring property in the event of a marriage annulment in Harris County, Texas. This checklist serves as a helpful tool for individuals, attorneys, and mediators involved in the dissolution of a marriage and ensures that all necessary legal and financial aspects are taken into account. Key elements included in the Harris Texas Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property may include: 1. Identification of Marital Property: This involves determining what assets and debts are considered marital property, subject to division or restoration. It is essential to properly identify and classify all properties involved to ensure a fair and equitable resolution. 2. Separate Property Assessment: Clarifying and distinguishing between marital property and separate property is crucial. This encompasses assets acquired before marriage, through inheritance, or as gifts solely intended for one spouse. Separate property should be accurately assessed and exempted from the division or restoration process. 3. Valuation of Assets and Debts: Properly valuing all assets and debts is essential to achieve a fair distribution. This involves obtaining accurate appraisals or assessments for real estate, vehicles, investments, business interests, retirement accounts, and liabilities such as mortgages, loans, and credit card debts. 4. Spousal Support or Alimony Considerations: Determining whether spousal support or alimony is appropriate and if so, its duration and amount, should be discussed. Factors such as the length of marriage, each spouse's financial situation, and earning potential are taken into account. 5. Child Custody and Support: If children are involved, child custody and support arrangements must be addressed. Consideration should be given to the best interests of the child, visitation schedules, and financial obligations associated with child support. 6. Health Insurance and Benefits: Reviewing the status of health insurance coverage and determining how it will be managed post-annulment is important. This may involve discussing continuation or separate coverage options and the potential impact on premium costs and benefits. 7. Tax Implications: Evaluating the potential tax consequences of property division or restoration is crucial. This may include reviewing tax liability for different types of assets, potential capital gains taxes, and the allocation of tax deductions or credits. It is important to note that there may be variations or specific considerations within the Harris Texas Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property based on individual circumstances or court preferences. Therefore, it is advisable to consult with a qualified family law attorney in Harris County for personalized guidance and to ensure compliance with local regulations.

Harris Texas Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage

Description

How to fill out Harris Texas Checklist Of Matters To Be Considered In Drafting An Agreement For Division Or Restoration Of Property In Connection With A Proceeding For Annulment Of A Marriage?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Harris Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Consequently, if you need the recent version of the Harris Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Harris Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Harris Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!