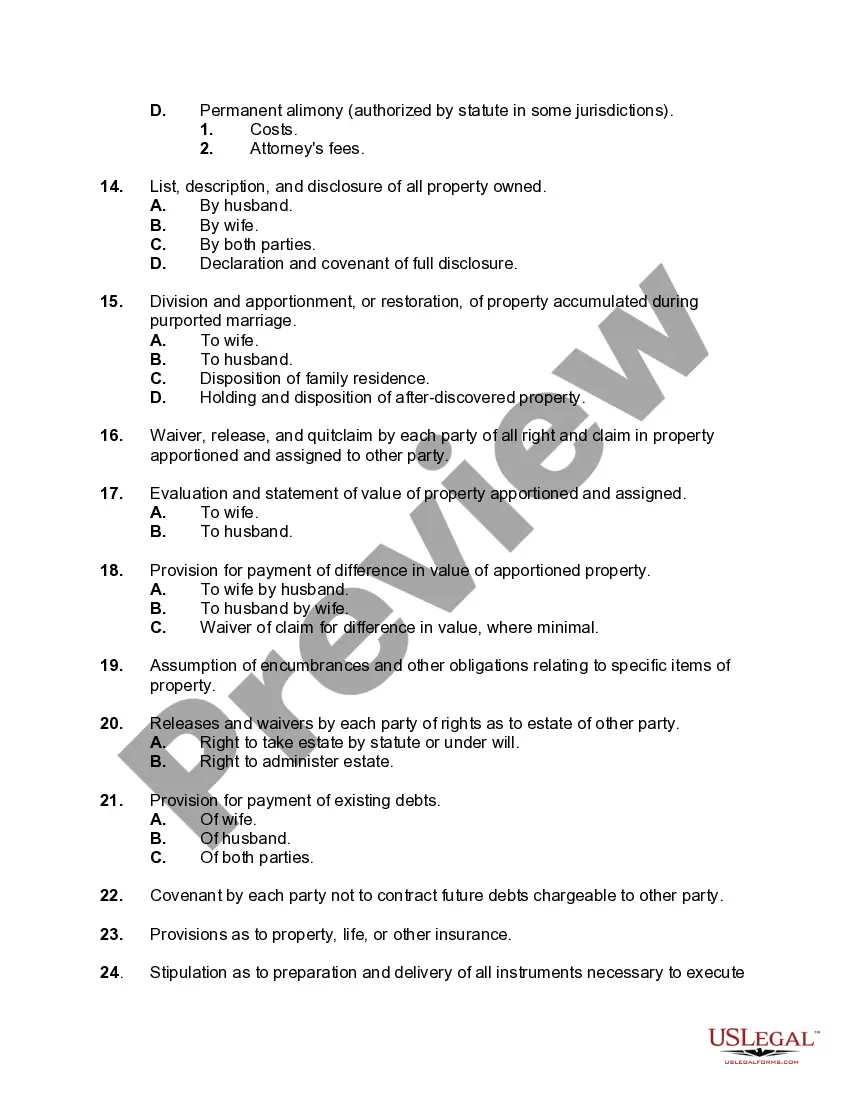

Wake North Carolina Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage encompasses various factors that need to be considered when drafting an agreement for the division or restoration of property during the annulment process. These considerations are crucial in ensuring a fair and equitable distribution of assets between the spouses involved. Some key aspects to be included in the checklist are as follows: 1. Marital property identification: The first step entails identifying all assets and liabilities that qualify as marital property, including real estate, bank accounts, vehicles, investments, retirement accounts, household items, and debts incurred during the marriage. 2. Valuation of assets: Determining the fair market value of each asset is essential to ensure an accurate division. This may require appraisals, expert opinions, or reviewing financial statements. 3. Separate property distinction: Separate property, including assets acquired before the marriage, inheritances, gifts, or personal injury settlements, needs to be identified and excluded from the division process. 4. Debts and liabilities: All outstanding debts, mortgages, loans, credit card balances, and other liabilities should be accounted for and assigned appropriately. 5. Spousal support or alimony: Depending on the circumstances, one spouse may be entitled to receive alimony. The agreement should outline the terms and duration of the support, considering factors like income disparity, earning capacity, and the length of the marriage. 6. Child custody and support: If the couple has children, custody arrangements, visitation schedules, and child support obligations must be addressed in accordance with the best interests of the child. 7. Insurance coverage: Existing insurance policies, such as health insurance, life insurance, or disability insurance, should be evaluated to ensure appropriate coverage for both spouses and children, if applicable. 8. Tax implications: The agreement should consider any potential tax consequences, such as capital gains taxes, transfer taxes, or implications of selling or transferring specific assets. 9. Legal fees and costs: Determining how legal fees and costs associated with the annulment proceeding will be allocated between the parties should also be addressed. 10. Dispute resolution: Including a provision for alternative dispute resolution methods, such as mediation or arbitration, can help mitigate conflicts should issues arise in the future. While this checklist provides a comprehensive overview, it is important to consult with an experienced family law attorney who is familiar with Wake County, North Carolina's specific laws and guidelines regarding property division during an annulment. By doing so, individuals can ensure that their agreement for the division or restoration of property reflects their unique circumstances and adheres to the relevant legal standards.

Wake North Carolina Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage encompasses various factors that need to be considered when drafting an agreement for the division or restoration of property during the annulment process. These considerations are crucial in ensuring a fair and equitable distribution of assets between the spouses involved. Some key aspects to be included in the checklist are as follows: 1. Marital property identification: The first step entails identifying all assets and liabilities that qualify as marital property, including real estate, bank accounts, vehicles, investments, retirement accounts, household items, and debts incurred during the marriage. 2. Valuation of assets: Determining the fair market value of each asset is essential to ensure an accurate division. This may require appraisals, expert opinions, or reviewing financial statements. 3. Separate property distinction: Separate property, including assets acquired before the marriage, inheritances, gifts, or personal injury settlements, needs to be identified and excluded from the division process. 4. Debts and liabilities: All outstanding debts, mortgages, loans, credit card balances, and other liabilities should be accounted for and assigned appropriately. 5. Spousal support or alimony: Depending on the circumstances, one spouse may be entitled to receive alimony. The agreement should outline the terms and duration of the support, considering factors like income disparity, earning capacity, and the length of the marriage. 6. Child custody and support: If the couple has children, custody arrangements, visitation schedules, and child support obligations must be addressed in accordance with the best interests of the child. 7. Insurance coverage: Existing insurance policies, such as health insurance, life insurance, or disability insurance, should be evaluated to ensure appropriate coverage for both spouses and children, if applicable. 8. Tax implications: The agreement should consider any potential tax consequences, such as capital gains taxes, transfer taxes, or implications of selling or transferring specific assets. 9. Legal fees and costs: Determining how legal fees and costs associated with the annulment proceeding will be allocated between the parties should also be addressed. 10. Dispute resolution: Including a provision for alternative dispute resolution methods, such as mediation or arbitration, can help mitigate conflicts should issues arise in the future. While this checklist provides a comprehensive overview, it is important to consult with an experienced family law attorney who is familiar with Wake County, North Carolina's specific laws and guidelines regarding property division during an annulment. By doing so, individuals can ensure that their agreement for the division or restoration of property reflects their unique circumstances and adheres to the relevant legal standards.