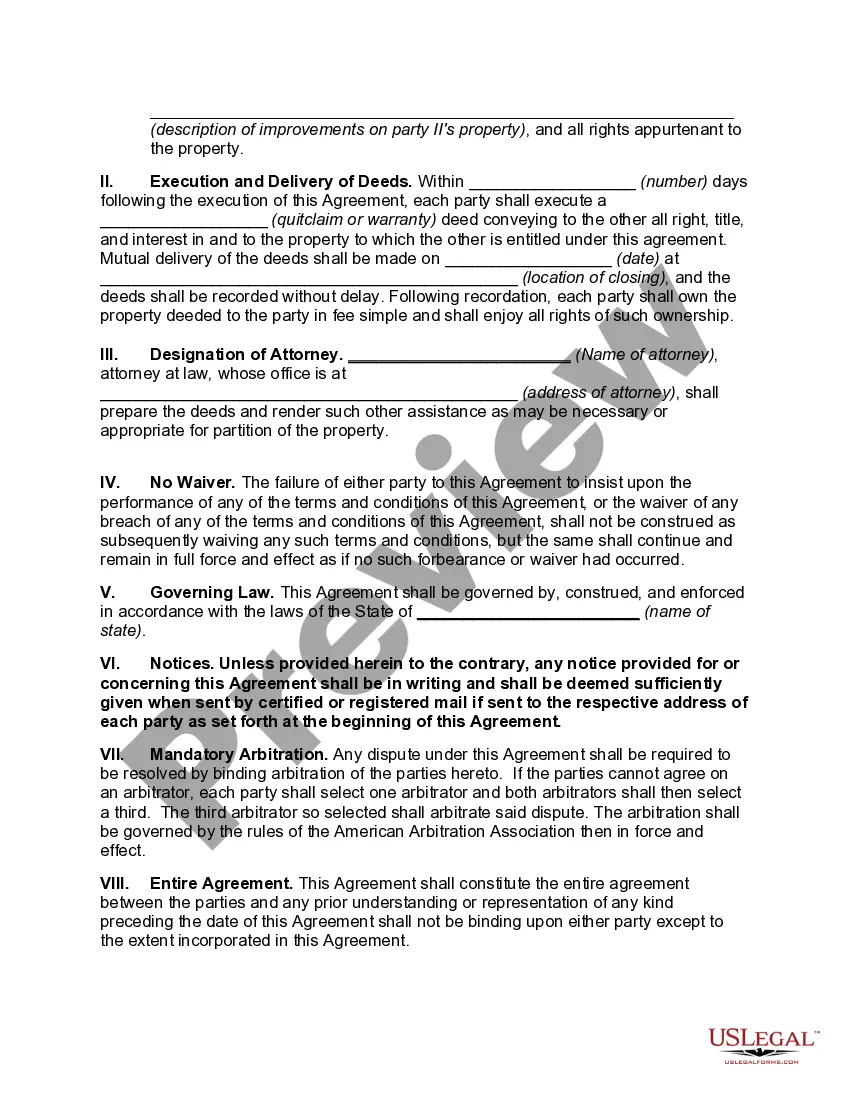

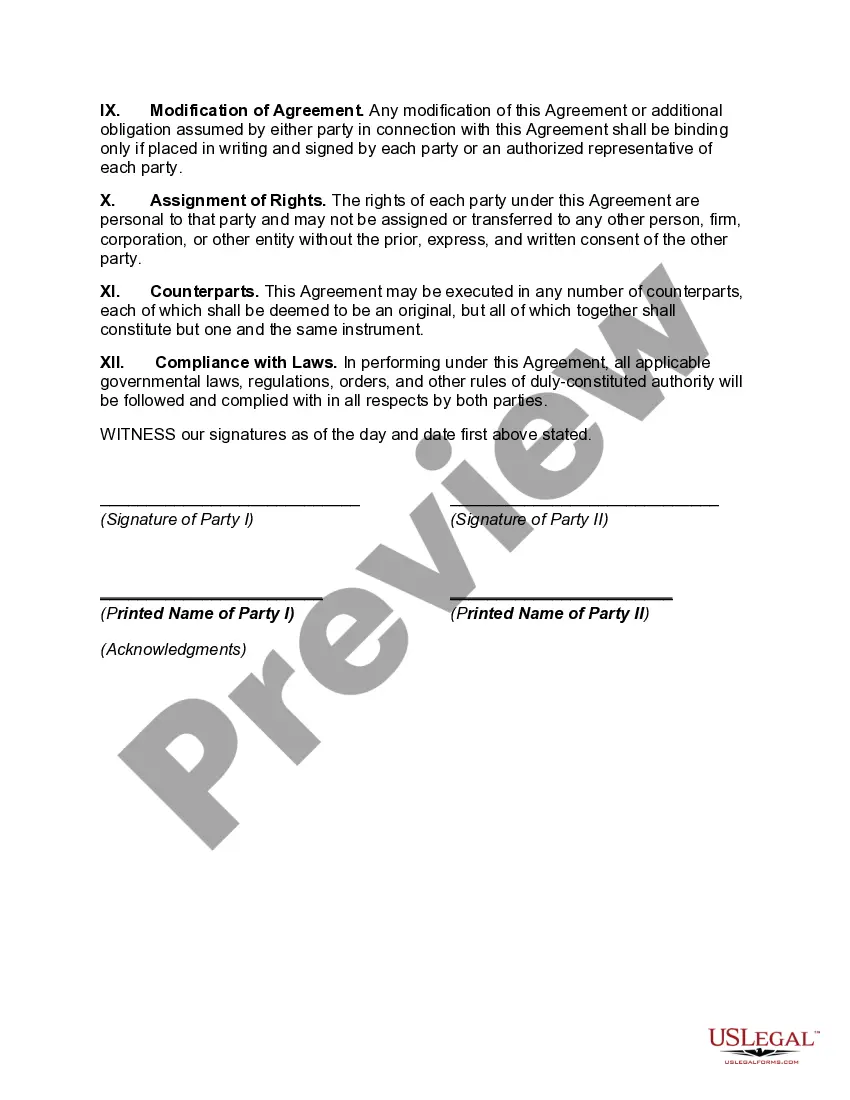

Travis Texas Agreement to Partition Real Property Between Children of Decedent is a legal document that outlines the division of real estate assets among the offspring of a deceased individual. This agreement is designed to avoid potential disputes or conflicts between heirs and provides a fair and equitable distribution of the property. When it comes to different types of Travis Texas Agreement to Partition Real Property Between Children of Decedent, we can identify several variations based on specific circumstances. These variations may include: 1. Travis Texas Agreement to Partition Real Property Between Children of Decedent with Multiple Properties: In cases where the decedent owned more than one property, this type of agreement specifies how each property will be divided among the children. It outlines the allocation of assets, including land, buildings, and any additional structures. 2. Travis Texas Agreement to Partition Real Property Between Children of Decedent with Unequal Shares: In situations where the decedent desired to distribute the property unequally among their children, this agreement reflects the specific percentages or fractions each heir will receive. It ensures transparency and avoids potential disputes. 3. Travis Texas Agreement to Partition Real Property Between Children of Decedent with Specific Guidelines: This type of agreement may include specific guidelines for the allocations, such as requirements for maintaining the property, potential restrictions on selling or transferring their portion, or any other conditions set forth by the decedent. 4. Travis Texas Agreement to Partition Real Property Between Children of Decedent with Special Provisions: In some cases, there may be unique circumstances or provisions that need to be addressed in the agreement. This can include provisions related to easements, mineral rights, zoning restrictions, or any other specific elements relevant to the property. It is essential to consult a qualified attorney experienced in estate planning and real estate law to draft a Travis Texas Agreement to Partition Real Property Between Children of Decedent. This legal professional can guide you through the process, ensuring that the agreement meets all legal requirements and considers the unique circumstances of your situation.

Travis Texas Agreement to Partition Real Property Between Children of Decedent is a legal document that outlines the division of real estate assets among the offspring of a deceased individual. This agreement is designed to avoid potential disputes or conflicts between heirs and provides a fair and equitable distribution of the property. When it comes to different types of Travis Texas Agreement to Partition Real Property Between Children of Decedent, we can identify several variations based on specific circumstances. These variations may include: 1. Travis Texas Agreement to Partition Real Property Between Children of Decedent with Multiple Properties: In cases where the decedent owned more than one property, this type of agreement specifies how each property will be divided among the children. It outlines the allocation of assets, including land, buildings, and any additional structures. 2. Travis Texas Agreement to Partition Real Property Between Children of Decedent with Unequal Shares: In situations where the decedent desired to distribute the property unequally among their children, this agreement reflects the specific percentages or fractions each heir will receive. It ensures transparency and avoids potential disputes. 3. Travis Texas Agreement to Partition Real Property Between Children of Decedent with Specific Guidelines: This type of agreement may include specific guidelines for the allocations, such as requirements for maintaining the property, potential restrictions on selling or transferring their portion, or any other conditions set forth by the decedent. 4. Travis Texas Agreement to Partition Real Property Between Children of Decedent with Special Provisions: In some cases, there may be unique circumstances or provisions that need to be addressed in the agreement. This can include provisions related to easements, mineral rights, zoning restrictions, or any other specific elements relevant to the property. It is essential to consult a qualified attorney experienced in estate planning and real estate law to draft a Travis Texas Agreement to Partition Real Property Between Children of Decedent. This legal professional can guide you through the process, ensuring that the agreement meets all legal requirements and considers the unique circumstances of your situation.