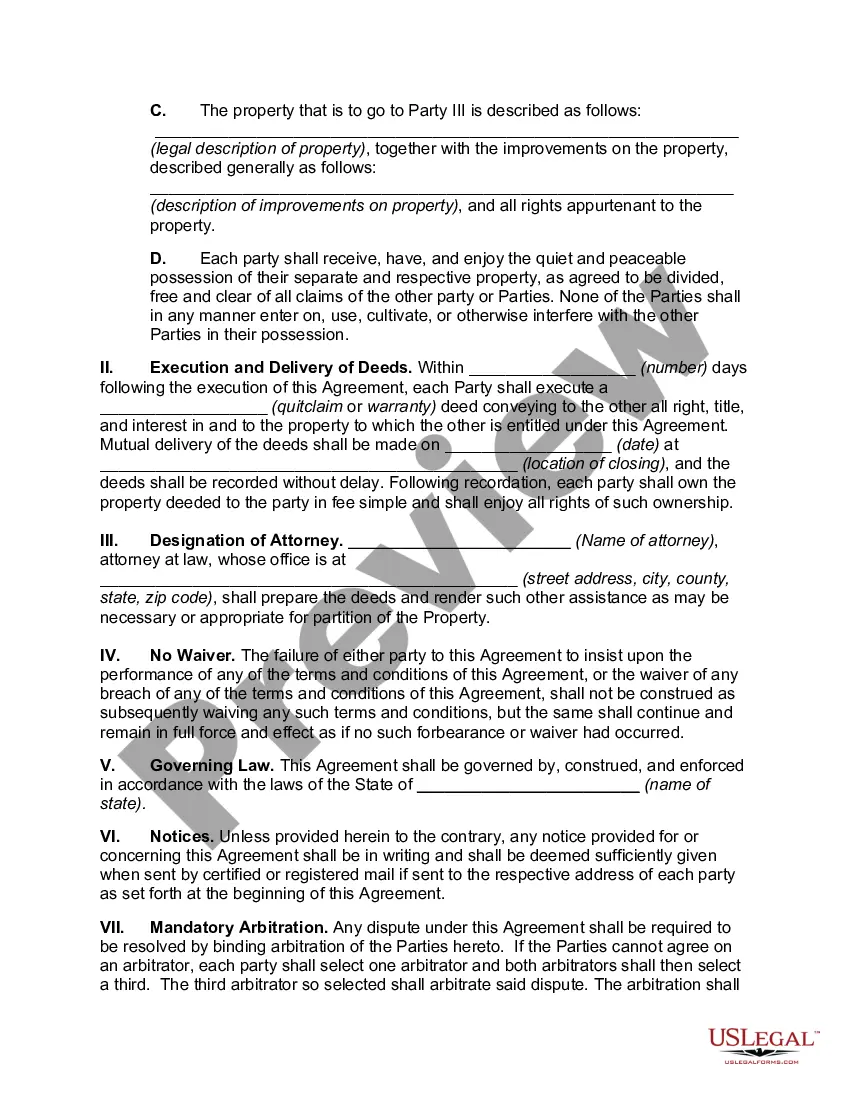

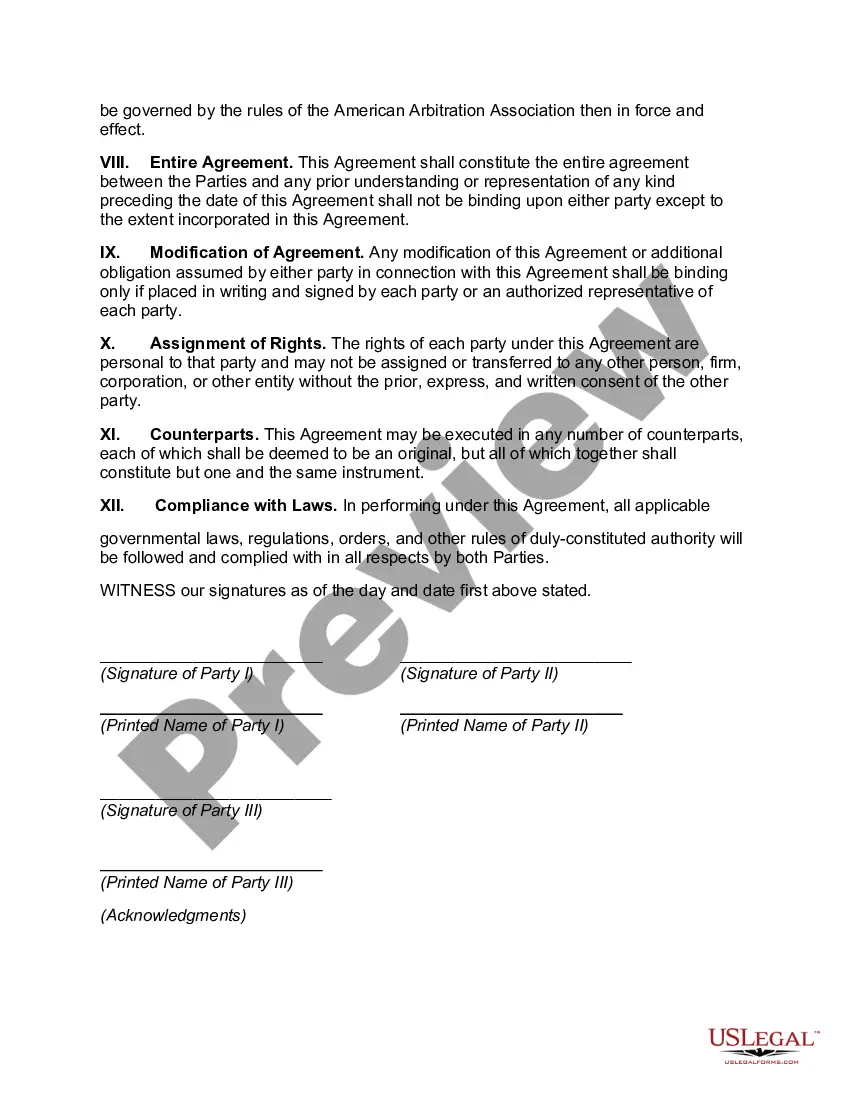

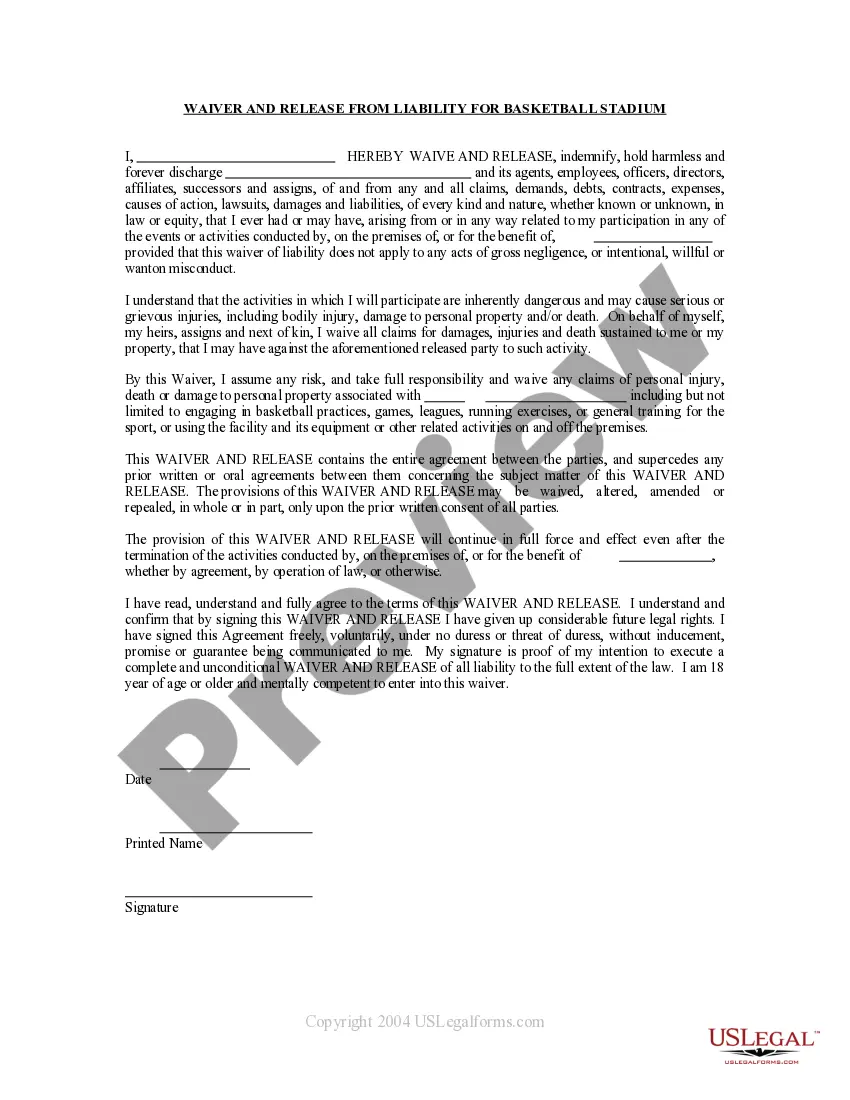

The Harris Texas Agreement to Partition Real Property among Surviving Spouse and Children of Decedent is a legal document that outlines the division of real estate assets between a surviving spouse and children after the death of the property owner. It is a crucial component of the probate process, ensuring fair distribution of the decedent's real property. This agreement serves as a legally binding contract and is utilized when the deceased individual in Harris Texas has not left behind a will or a comprehensive estate plan. Without a clear set of instructions, the agreement acts as a framework for dividing the real property fairly among the surviving spouse and children. Key provisions within the Harris Texas Agreement to Partition Real Property among Surviving Spouse and Children of Decedent include: 1. Property Description: This section provides a detailed description of the real estate assets involved in the partition agreement. It includes the address, legal description, and any necessary identifying information. 2. Identification of Surviving Spouse and Children: This section identifies the surviving spouse and children who are entitled to a share of the decedent's real property. It includes their full names, addresses, and relationship to the decedent. 3. Percentage of Distribution: Here, the agreement outlines the percentage of ownership each party will receive in the real property. This division is determined either by mutual agreement among the parties involved or as per the laws of intestate succession if no agreement can be reached. 4. Property Management: In cases where the real property is not sold immediately, this section addresses the responsibilities and rights of each party regarding leasing, maintenance, and property management. It may also establish the process for making decisions regarding the property, such as selling, renting, or refinancing. 5. Dispute Resolution: In the event of disagreements or disputes regarding the partition, this section establishes a dispute resolution process, such as mediation or arbitration, to resolve any issues amicably and avoid unnecessary litigation. Types of Harris Texas Agreement to Partition Real Property among Surviving Spouse and Children of Decedent may include: 1. Agreement to Partition Real Property with an Estate Administrator: This version of the agreement may involve an estate administrator overseeing the process and ensuring compliance with probate laws. The administrator acts as a neutral party and assists in facilitating the fair distribution of real property. 2. Agreement to Partition Real Property without an Estate Administrator: In situations where there is no appointed estate administrator, the surviving spouse and children may directly establish the terms of the agreement. This scenario requires open communication and cooperation between all parties involved to achieve a fair resolution. The Harris Texas Agreement to Partition Real Property among Surviving Spouse and Children of Decedent plays a critical role in determining how real estate assets are divided, ensuring the interests of both the surviving spouse and children are protected. It allows for a transparent and equitable distribution process, promoting peace and harmony within the family during a challenging time.

Harris Texas Agreement to Partition Real Property among Surviving Spouse and Children of Decedent

Description

How to fill out Harris Texas Agreement To Partition Real Property Among Surviving Spouse And Children Of Decedent?

Do you need to quickly create a legally-binding Harris Agreement to Partition Real Property among Surviving Spouse and Children of Decedent or probably any other document to take control of your personal or corporate affairs? You can go with two options: contact a legal advisor to write a valid document for you or draft it entirely on your own. The good news is, there's a third option - US Legal Forms. It will help you get neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific document templates, including Harris Agreement to Partition Real Property among Surviving Spouse and Children of Decedent and form packages. We offer documents for a myriad of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the necessary document without extra troubles.

- To start with, double-check if the Harris Agreement to Partition Real Property among Surviving Spouse and Children of Decedent is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to check what it's intended for.

- Start the search again if the form isn’t what you were hoping to find by using the search box in the header.

- Select the subscription that best suits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Harris Agreement to Partition Real Property among Surviving Spouse and Children of Decedent template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Moreover, the paperwork we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!