A Bexar Texas Joint-Venture Agreement is a legal document that outlines the terms and conditions of a partnership between two or more parties for the purpose of engaging in real estate speculation within the Bexar County, Texas area. This agreement provides a framework for joint investment, profit sharing, and decision-making processes. The Bexar Texas Joint-Venture Agreement — Speculation in Real Estate is a popular strategy employed by investors looking to profit from the fluctuating real estate market in the region. By pooling their resources, partners can leverage their financial capabilities, knowledge, and expertise to undertake speculative activities such as buying undervalued properties, purchasing land for future development, or acquiring distressed assets for a potential turnaround. There can be different types of Bexar Texas Joint-Venture Agreements — Speculation in Real Estate, depending on the specific objectives and preferences of the involved parties. Some common variations include: 1. Equity Joint Venture: In this type of agreement, partners contribute capital or assets to fund real estate purchases or developments. Profits and losses are typically shared proportionally to the initial investment percentage of each party. 2. Development Joint Venture: This agreement focuses on undertaking real estate development projects, such as constructing residential or commercial properties. Partners may bring in their expertise, financial resources, and market knowledge to undertake such projects collectively. 3. Land Speculation Joint Venture: This type of agreement specifically targets the acquisition and speculation on vacant land or undeveloped properties. Partners may study market trends, zoning regulations, and potential future developments to identify lucrative investment opportunities. 4. Distressed Asset Joint Venture: Partners collaborate to acquire distressed properties, such as foreclosed homes or financially troubled commercial buildings, with the aim of rehabilitating or reselling them for a profit. This type of agreement may involve various strategies, such as flipping properties or long-term repositioning. A Bexar Texas Joint-Venture Agreement — Speculation in Real Estate typically includes essential clauses, such as the purpose of the joint venture, the contribution of each partner, profit distribution, decision-making processes, dispute resolution mechanisms, and exit strategies. These agreements are crucial for establishing clear expectations, minimizing conflicts, and ensuring a fair distribution of profits and risks among the parties involved. In conclusion, a Bexar Texas Joint-Venture Agreement — Speculation in Real Estate allows investors to collaborate and leverage their resources to engage in real estate speculation activities within Bexar County. By identifying and capitalizing on profitable opportunities, joint-venture partners can maximize their chances of success in the dynamic real estate market.

Bexar Texas Joint-Venture Agreement - Speculation in Real Estate

Description

How to fill out Bexar Texas Joint-Venture Agreement - Speculation In Real Estate?

Creating paperwork, like Bexar Joint-Venture Agreement - Speculation in Real Estate, to manage your legal matters is a challenging and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents created for different scenarios and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Bexar Joint-Venture Agreement - Speculation in Real Estate template. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before downloading Bexar Joint-Venture Agreement - Speculation in Real Estate:

- Make sure that your template is compliant with your state/county since the rules for creating legal paperwork may vary from one state another.

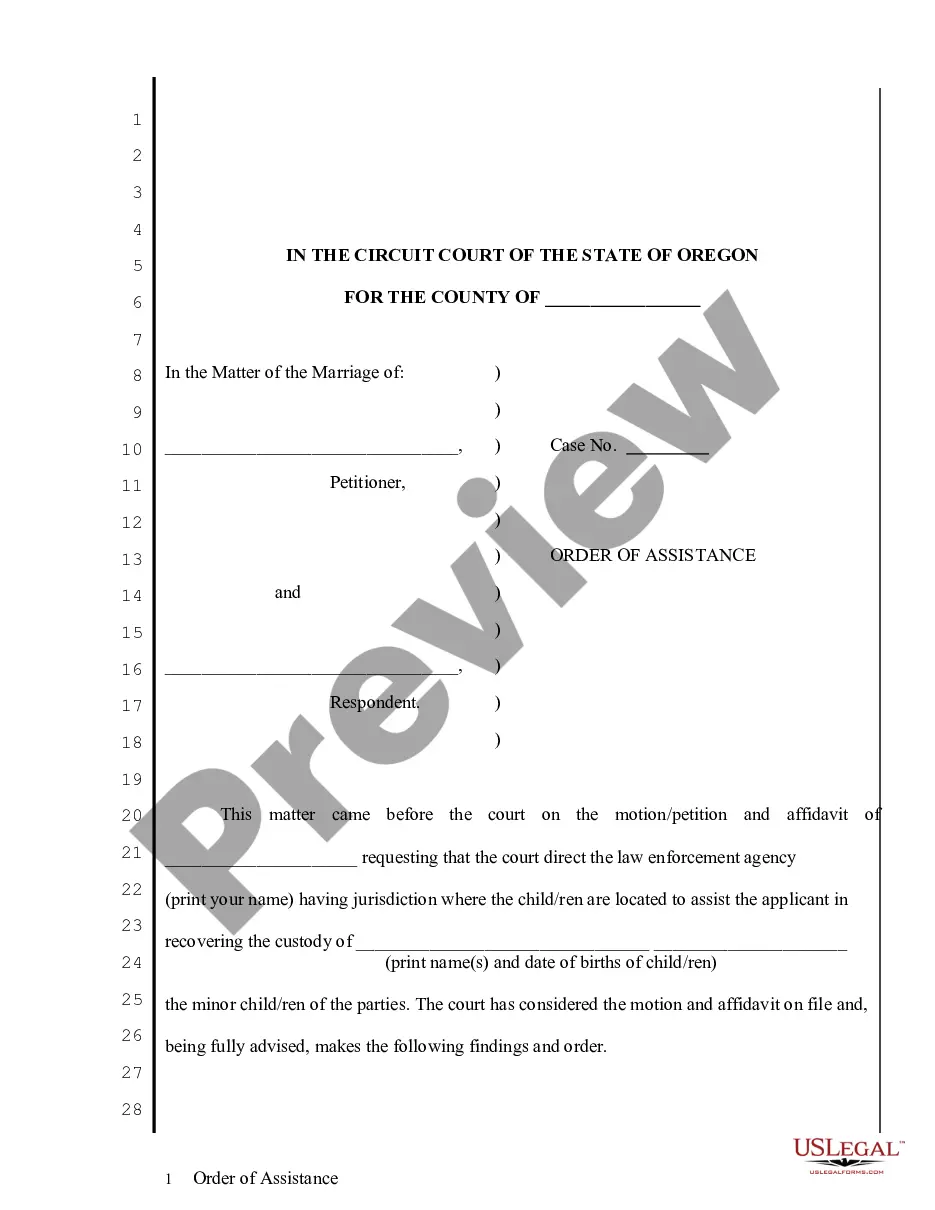

- Learn more about the form by previewing it or going through a quick intro. If the Bexar Joint-Venture Agreement - Speculation in Real Estate isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin using our service and download the document.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!