Hennepin County, located in Minnesota, has specific jury instructions that guide the legal proceedings. One such instruction is Hennepin Minnesota Jury Instruction — 1.9.4.1, which pertains to the classification of workers as either employees, self-employed individuals, or independent contractors. This instruction plays a crucial role in cases that involve disputes over employment status and the rights and responsibilities associated with different classifications. When it comes to employee self-employed independent contractor cases in Hennepin County, this specific jury instruction provides detailed guidance to jurors on how to interpret the facts and evidence related to this issue. The content of each instruction may vary based on the case's specific circumstances, but the primary objective remains consistent throughout. In these cases, the jury needs to determine the worker's proper classification based on various factors outlined in Hennepin Minnesota Jury Instruction — 1.9.4.1. Factors that may be considered include the extent of control exerted by the employer, the worker's opportunity for profit or loss, the permanency of the relationship, the worker's investment in their tools and equipment, and the individual's right to work for others. By analyzing and weighing these factors, jurors can arrive at a just and fair decision. Hennepin Minnesota Jury Instruction — 1.9.4.1: Employee Self-Employed Independent Contractor has different types or variations that may arise in distinct cases, such as: 1. Employee vs. Independent Contractor: This variation of the instruction focuses on distinguishing between a traditional employee and an independent contractor. It explores the degree of control the employer has over the worker, the worker's independence in performing tasks, and the presence or absence of certain benefits or protections normally associated with traditional employment contracts. 2. Self-Employed vs. Independent Contractor: This type of instruction involves determining whether the individual is genuinely self-employed or instead should be treated as an independent contractor. It often considers factors such as the worker's level of autonomy in setting their work hours, their ability to negotiate rates, and the extent of their involvement in business decisions. 3. Employee Misclassification: This variation tackles cases where there is a dispute regarding the misclassification of a worker as an independent contractor when they should have been classified as an employee. The instruction may delve into factors such as the control exercised by the employer, the integration of the worker into the business, and the degree of economic dependence on the employer. The Hennepin Minnesota Jury Instruction — 1.9.4.1 Employee Self-Employed Independent Contractor embodies the legal guidelines and principles used in Hennepin County to assist jurors in their decision-making process. It ensures that accurate and fair determinations are made regarding the employment classification, addressing the nuanced variations that may arise depending on the specific circumstances of each case.

Hennepin Minnesota Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor

Description

How to fill out Hennepin Minnesota Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor?

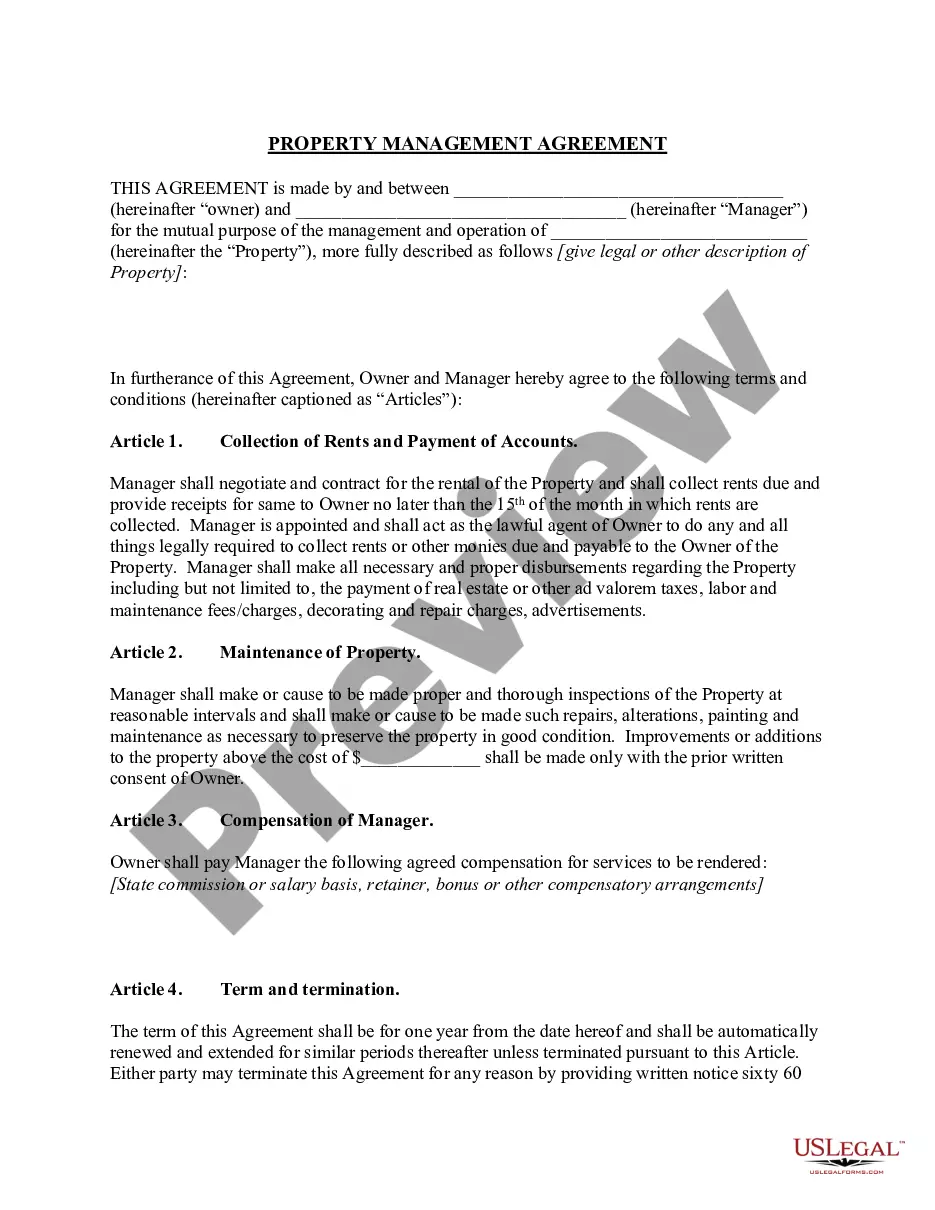

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life situation, locating a Hennepin Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often pricey. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Aside from the Hennepin Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Hennepin Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Hennepin Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!