San Diego California Jury Instruction — 1.9.4.1 Employee Self-Employed Independent Contractor is a legal guideline provided to juries in San Diego, California, specifically addressing the classification of workers as employees, self-employed individuals, or independent contractors. This instruction is crucial in determining the legal rights and obligations of individuals in the workforce. Keywords: San Diego California, jury instruction, 1.9.4.1, employee, self-employed, independent contractor There aren't different types of San Diego California Jury Instruction — 1.9.4.1 Employee Self-Employed Independent Contractor. However, within this instruction, there are various factors that the jury needs to consider in order to decide whether an individual should be classified as an employee, self-employed, or independent contractor. These factors may include: 1. Control: The extent to which the employer has direct control over the worker's activities, such as the ability to dictate working hours, methods, and the right to terminate the worker. 2. Financial arrangement: How the worker is compensated, including whether they receive a set wage or salary, or if they are compensated based on the completion of specific projects. 3. Nature of work: Whether the work performed by the individual is an integral part of the employer's regular business operations. 4. Duration of relationship: The length of time the worker has been employed by the employer. 5. Skill level: The level of expertise and specialized skill required for the job. 6. Tools and equipment: Whether the employer provides the necessary tools and equipment for the work or if the worker must provide their own. 7. Taxes and benefits: How taxes, insurance, and other benefits are handled for the worker. By considering these factors, the jury can assess the overall relationship between the worker and the employer and determine the appropriate classification under applicable labor laws. It is important to note that misclassifying workers may result in legal consequences for both the employer and the worker. Overall, the San Diego California Jury Instruction — 1.9.4.1 Employee Self-Employed Independent Contractor provides comprehensive guidance to the jury, ensuring a fair and accurate evaluation of the employment relationship to protect the rights of both parties involved.

San Diego California Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor

Description

How to fill out San Diego California Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor?

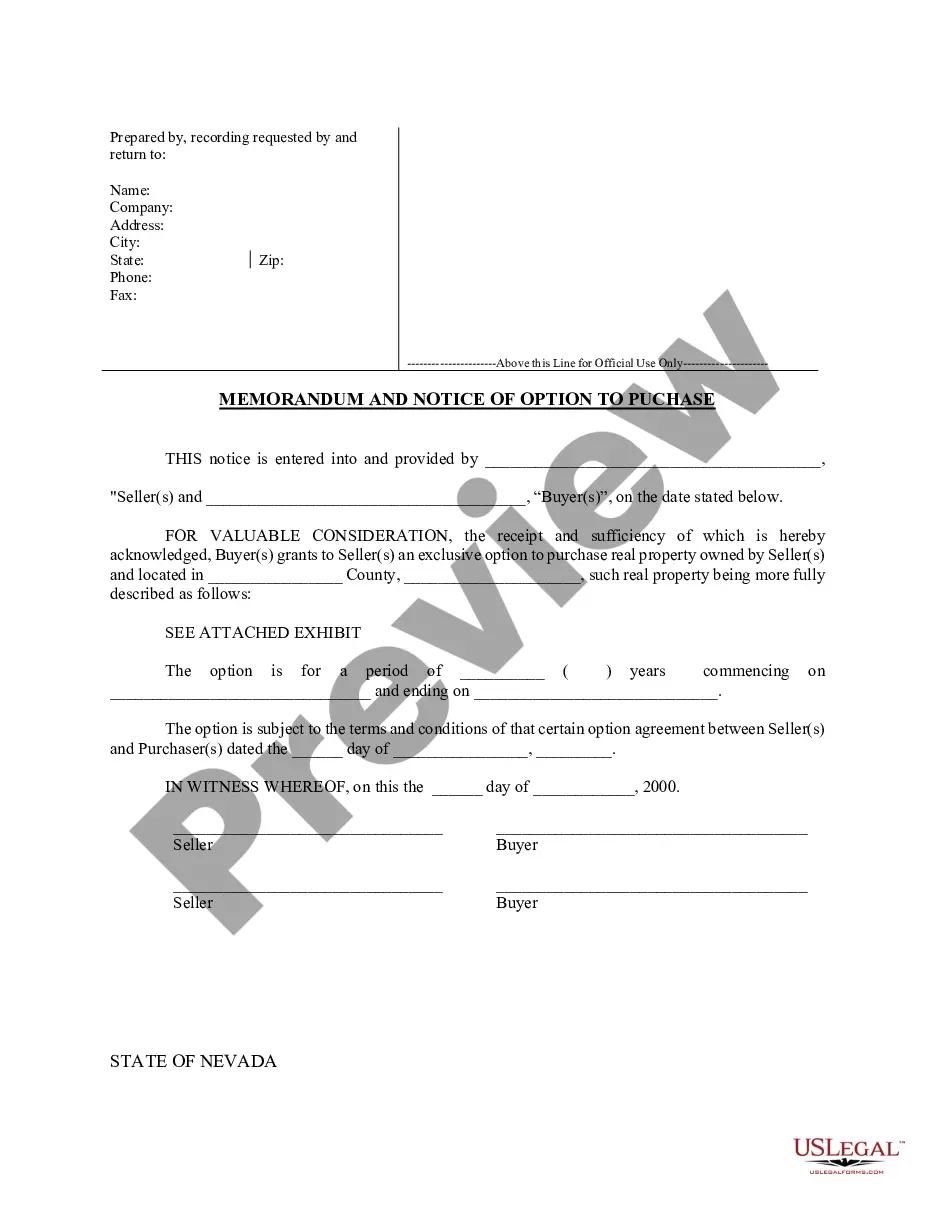

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the San Diego Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Consequently, if you need the recent version of the San Diego Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Diego Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your San Diego Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!