Alameda California Jury Instruction — 10.10.2 Debt vs. Equity is a legal guideline that outlines the key differences and characteristics between debt and equity investments in a company. This instruction is crucial in civil cases that involve disputes over financial transactions, investments, or corporate matters. Here's a detailed description of what Alameda California Jury Instruction — 10.10.2 Debt vs. Equity entails, along with relevant keywords: 1. Alameda California Jury Instruction — 10.10.2 Debt vs. Equity: This instruction serves as a comprehensive guide for the jury members involved in cases related to financial disputes in the Alameda County jurisdiction of California. It provides them with the necessary information and legal guidelines to understand the concepts of debt and equity in the context of business investments. Keywords: Alameda California, jury instruction, 10.10.2, debt vs. equity, financial disputes, business investments, legal guidelines. 2. Debt: The instruction educates the jury regarding debt, explaining it as a financial instrument where an entity (the debtor) borrows funds from another entity (the creditor) with the obligation to repay the borrowed amount over a specific period, typically with interest. It covers various types of debt, such as loans, bonds, or promissory notes, and clarifies their characteristics, terms, and legal implications. Keywords: debt, financial instrument, debtor, creditor, repayment, interest, loans, bonds, promissory notes, terms, legal implications. 3. Equity: The instruction further delineates equity, describing it as a form of ownership or investment in a company. It elaborates on the concept of stocks or shares, which represent proportional ownership in a corporation, giving shareholders a claim on the company's assets and future profits. It explains the different types of equity, such as common stock and preferred stock, outlining their rights, dividends, voting power, and potential risks. Keywords: equity, ownership, investment, stocks, shares, shareholders, claim, assets, profits, common stock, preferred stock, rights, dividends, voting power, risks. 4. Debt vs. Equity: This portion of the instruction focuses on the distinctions and comparisons between debt and equity. It emphasizes the advantages and disadvantages of each form of financing, including factors like risk, payment obligations, priority during liquidation, influence over company decisions, and potential returns. Jury members are guided on how to assess the facts and circumstances of the case to determine if a transaction involved debt or equity. Keywords: debt vs. equity, financing, risk, payment obligations, liquidation, influence, returns, assessment, transactions, facts, circumstances. By providing a clear understanding of debt and equity in business contexts, Alameda California Jury Instruction — 10.10.2 Debt vs. Equity empowers jury members to make informed decisions regarding litigation related to financial matters.

Alameda California Jury Instruction - 10.10.2 Debt vs. Equity

Description

How to fill out Alameda California Jury Instruction - 10.10.2 Debt Vs. Equity?

Preparing paperwork for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to create Alameda Jury Instruction - 10.10.2 Debt vs. Equity without professional assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Alameda Jury Instruction - 10.10.2 Debt vs. Equity on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Alameda Jury Instruction - 10.10.2 Debt vs. Equity:

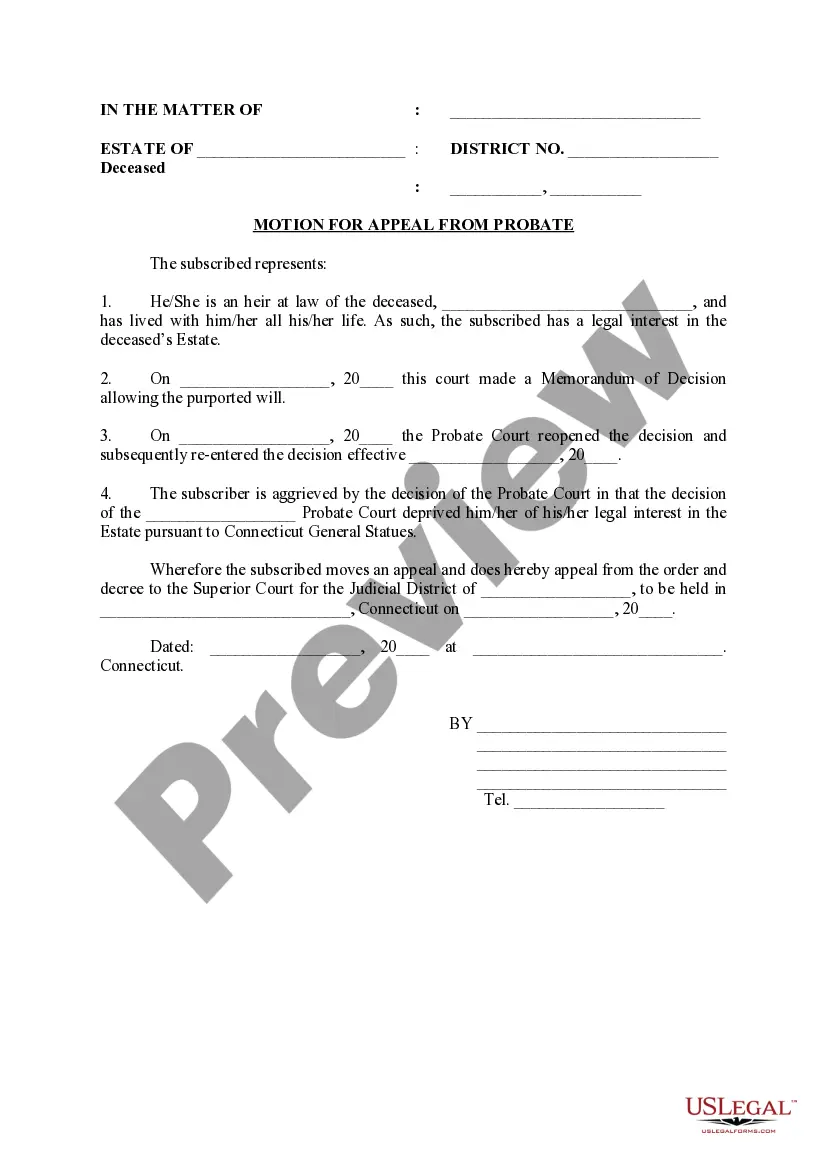

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that suits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any scenario with just a couple of clicks!