Allegheny Pennsylvania Jury Instruction — 10.10.3 Employee vs. Self-Employed Independent Contractor The Allegheny Pennsylvania Jury Instruction — 10.10.3 Employee vs. Self-Employed Independent Contractor, provides guidance to juries when determining whether an individual should be classified as an employee or a self-employed independent contractor. This instruction is crucial in employment-related legal disputes as it helps establish the rights, responsibilities, and liabilities of the parties involved. When determining the classification, several factors should be considered, such as the level of control exerted by the hiring party, the nature of the work performed, the method of payment, and the overall relationship between the parties. The instruction ensures that the jury comprehends these factors and is able to evaluate the circumstances of each case objectively. The purpose of this jury instruction is to prevent misclassification and protect the rights of workers. It assists in determining whether an individual is entitled to the benefits and protections afforded to employees, such as minimum wage, overtime pay, workers' compensation, and unemployment benefits. The instruction also clarifies the distinction between employees and self-employed independent contractors, as this classification carries significant legal and financial implications for both parties involved. If an individual is misclassified as a self-employed independent contractor instead of an employee, they may suffer from an absence of employment benefits, reduced job security, and the burden of paying self-employment taxes. Different types of Allegheny Pennsylvania Jury Instruction — 10.10.3 Employee vs. Self-Employed Independent Contractor may include variations based on specific industries or professions. For example: 1. Allegheny Pennsylvania Jury Instruction — 10.10.— - Construction Industry: This variation would focus on the unique aspects of determining employee vs. self-employed independent contractor status within the construction industry. It would consider factors specific to the construction trade, such as the use of specialized tools, adherence to project specifications, and contractual relationships with subcontractors. 2. Allegheny Pennsylvania Jury Instruction — 10.10.— - Gig Economy: With the rise of the gig economy, a variation of this instruction may address the classification issues arising from app-based platforms, where individuals perform tasks on a flexible basis. This instruction would emphasize factors like control exerted by platform operators, work requirements, and the degree of independence in decision-making. It is important to note that these variations are hypothetical examples and not actual subtypes of the instruction. In conclusion, the Allegheny Pennsylvania Jury Instruction — 10.10.3 Employee vs. Self-Employed Independent Contractor plays a vital role in defining the legal relationship between workers and employers. By considering relevant factors and applying these instructions, juries help ensure fair and just outcomes in employment disputes, protecting the rights and interests of all parties involved.

Allegheny Pennsylvania Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor

Description

How to fill out Allegheny Pennsylvania Jury Instruction - 10.10.3 Employee Vs. Self-Employed Independent Contractor?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Allegheny Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Allegheny Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Allegheny Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor:

- Analyze the page content to ensure you found the correct sample.

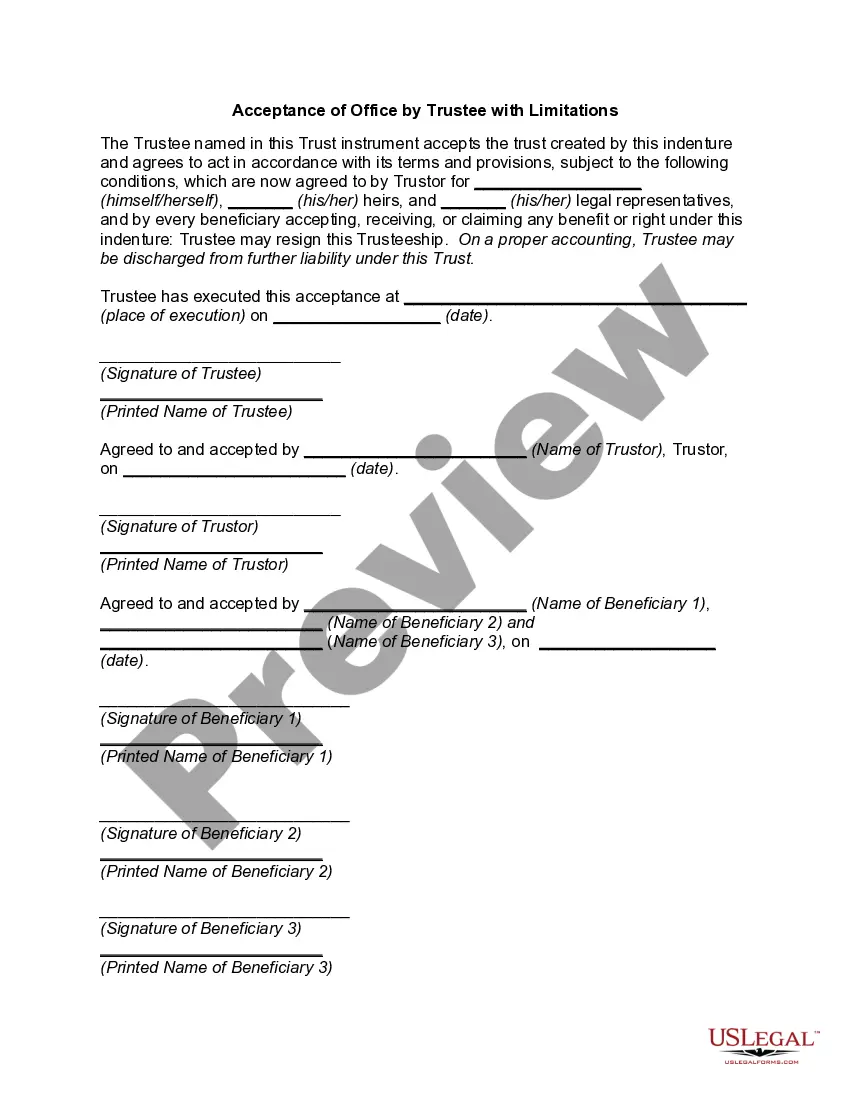

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!