Broward Florida Jury Instruction — 10.10.3 Employee vs. Self-Employed Independent Contractor is a legal guideline that specifically addresses the distinction between an employee and a self-employed independent contractor in employment-related cases within the jurisdiction of Broward County, Florida. This particular jury instruction is crucial in helping jurors understand the factors that differentiate an individual as an employee versus a self-employed independent contractor. The instruction aims to ensure a fair evaluation of employment relationships in various legal disputes, including wage and hour claims, workers' compensation cases, and wrongful termination lawsuits. The Broward Florida Jury Instruction 10.10.3 outlines the key factors that must be considered when determining whether an individual is an employee or a self-employed contractor. It emphasizes that the classification hinges on the degree of control exercised by the employer over the individual's work. The instruction may reference the following relevant keywords: 1. Control: The instruction highlights the level of control that the employer has over the worker's performance, including the manner and means to accomplish tasks. Factors such as the extent of supervision, instruction, and training provided by the employer are considered in assessing control. 2. Discretion: The instruction may discuss the level of discretion the worker has in making decisions related to the job. If the worker has the freedom to determine the methods and processes used, it can lean towards being classified as a self-employed contractor. 3. Financial Arrangement: This aspect examines the economic relationship between the worker and the employer. Factors evaluated may include how the worker is compensated, whether there are written contracts, payment of business expenses, provision of benefits, and tax arrangements. 4. Equipment and Tools: The possession of tools and equipment is relevant in distinguishing between an employee and a self-employed contractor. The instruction may explore whether the worker or the employer provides the necessary tools to perform the job. 5. Integration: Another factor assessed is whether the worker's tasks are integrated into the employer's overall business operations. An employee is typically more closely aligned and integrated into the employer's organization, while a self-employed contractor operates autonomously. It's important to note that the Broward Florida Jury Instruction — 10.10.3 Employee vs. Self-Employed Independent Contractor may have different versions or variations depending on the specific case or updated legal precedents. These variations may involve minor adjustments to the language or additional considerations based on recent legal developments. Understanding this instruction is crucial for jurors as it provides clear guidance on evaluating the employment relationship in a fair and consistent manner, allowing for a just resolution in employment-related disputes in Broward County, Florida.

Broward Florida Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor

Description

How to fill out Broward Florida Jury Instruction - 10.10.3 Employee Vs. Self-Employed Independent Contractor?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Broward Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Broward Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Broward Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor:

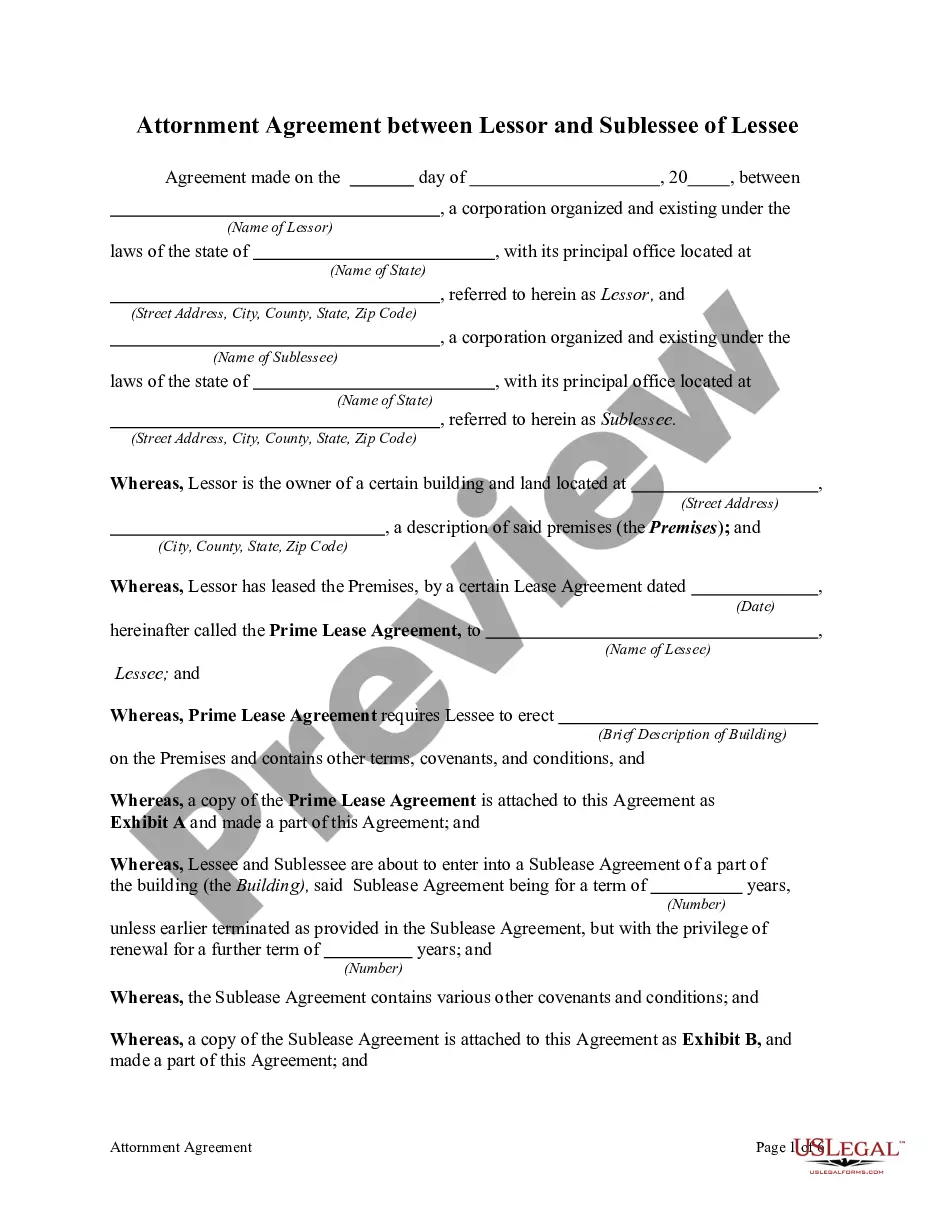

- Take a look at the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!