Lima Arizona Jury Instruction 10.10.3, titled "Employee vs. Self-Employed Independent Contractor," provides essential guidance for juries in Lima, Arizona, when determining whether an individual is an employee or a self-employed independent contractor. This particular instruction helps clarify the legal distinctions between these two categories and assists juries in correctly categorizing workers in various legal disputes, such as wage claims, workers' compensation cases, and employment classification lawsuits. When distinguishing between employees and self-employed independent contractors, the Lima Arizona Jury Instruction 10.10.3 emphasizes key factors including control, method of payment, right to terminate, provision of materials, opportunity for profit or loss, integration of the services, and the intent of the parties involved. Jurors are instructed to carefully consider the evidence presented and weigh these factors to determine the appropriate classification of the worker in question. Different types or variations of Lima Arizona Jury Instruction 10.10.3 Employee vs. Self-Employed Independent Contractor may include specific instructions for different industries or legal contexts, such as construction, healthcare, or transportation. These variations would address industry-specific factors or regulations that can significantly influence the employment relationship determination. In summary, Lima Arizona Jury Instruction 10.10.3 is a crucial legal guideline that assists juries in Lima, Arizona, with deciding whether an individual should be considered an employee or a self-employed independent contractor. Understanding this instruction is vital for both legal professionals and individuals involved in disputes concerning employment classification.

Pima Arizona Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor

Description

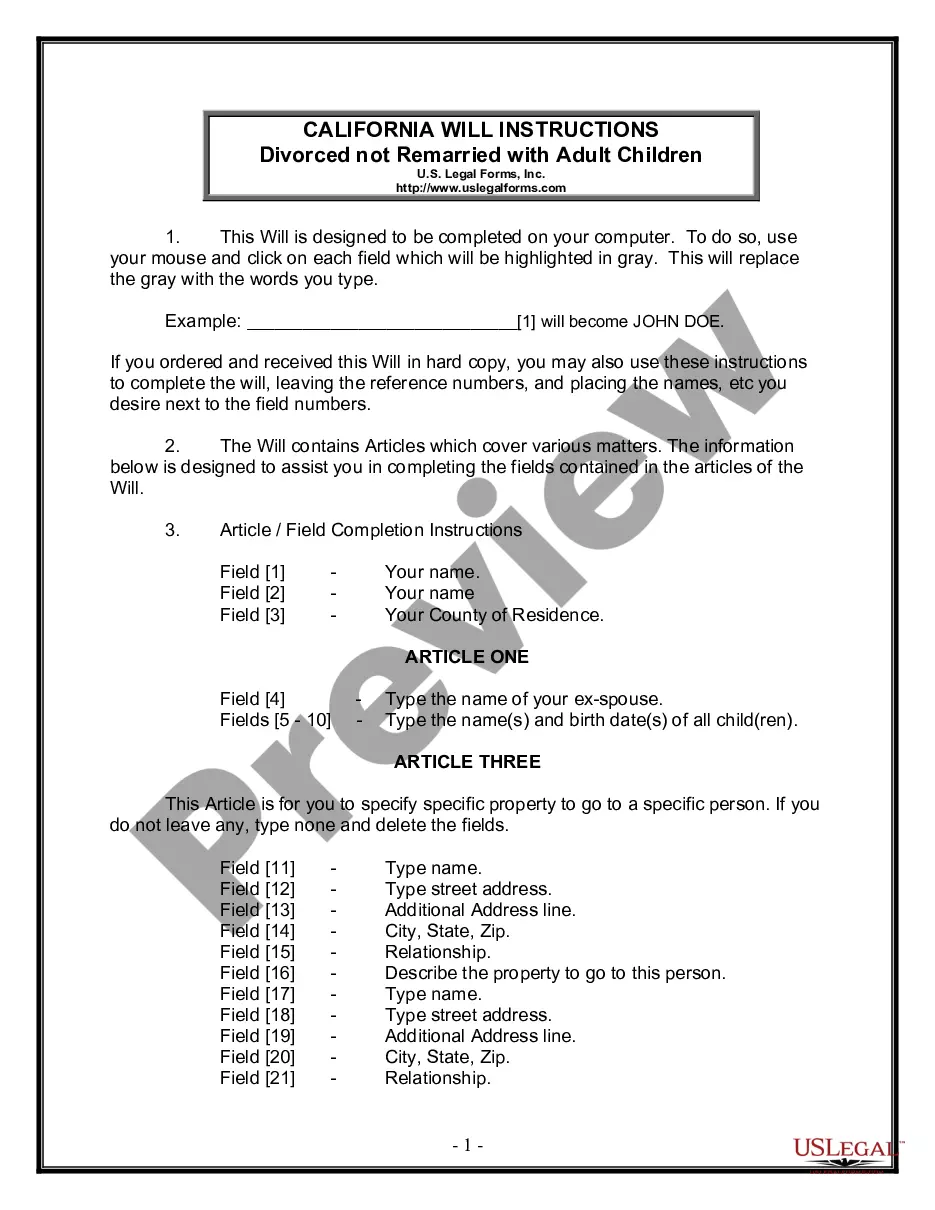

How to fill out Pima Arizona Jury Instruction - 10.10.3 Employee Vs. Self-Employed Independent Contractor?

If you need to get a reliable legal form supplier to obtain the Pima Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can select from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of supporting materials, and dedicated support team make it easy to find and complete different papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply type to search or browse Pima Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor, either by a keyword or by the state/county the form is intended for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Pima Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor template and take a look at the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately available for download once the payment is completed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes this experience less pricey and more reasonably priced. Create your first company, arrange your advance care planning, create a real estate contract, or complete the Pima Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor - all from the comfort of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

The new law allows Arizona employing units and independent contractors to establish their shared intent for the status of their relationship from its inception by permitting employing units to require their independent contractors to execute declarations affirming that their relationship with the business is as an

Some of the common characteristics of an independent contractor include: Furnishes equipment and has control over that equipment. Submits bids for jobs, contracts, or fixes the price in advance. Has the capacity to accept or refuse an assignment or work. Pay relates more to completion of a job.

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

The 5 personality traits that make a successful contractor Confidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.

An independent contractor is defined as an individual who contracts to work for others without having the legal status of an employee. By engaging independent contractors, employers can avoid many of the costs associated with hiring employees.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.