Salt Lake Utah Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor

Description

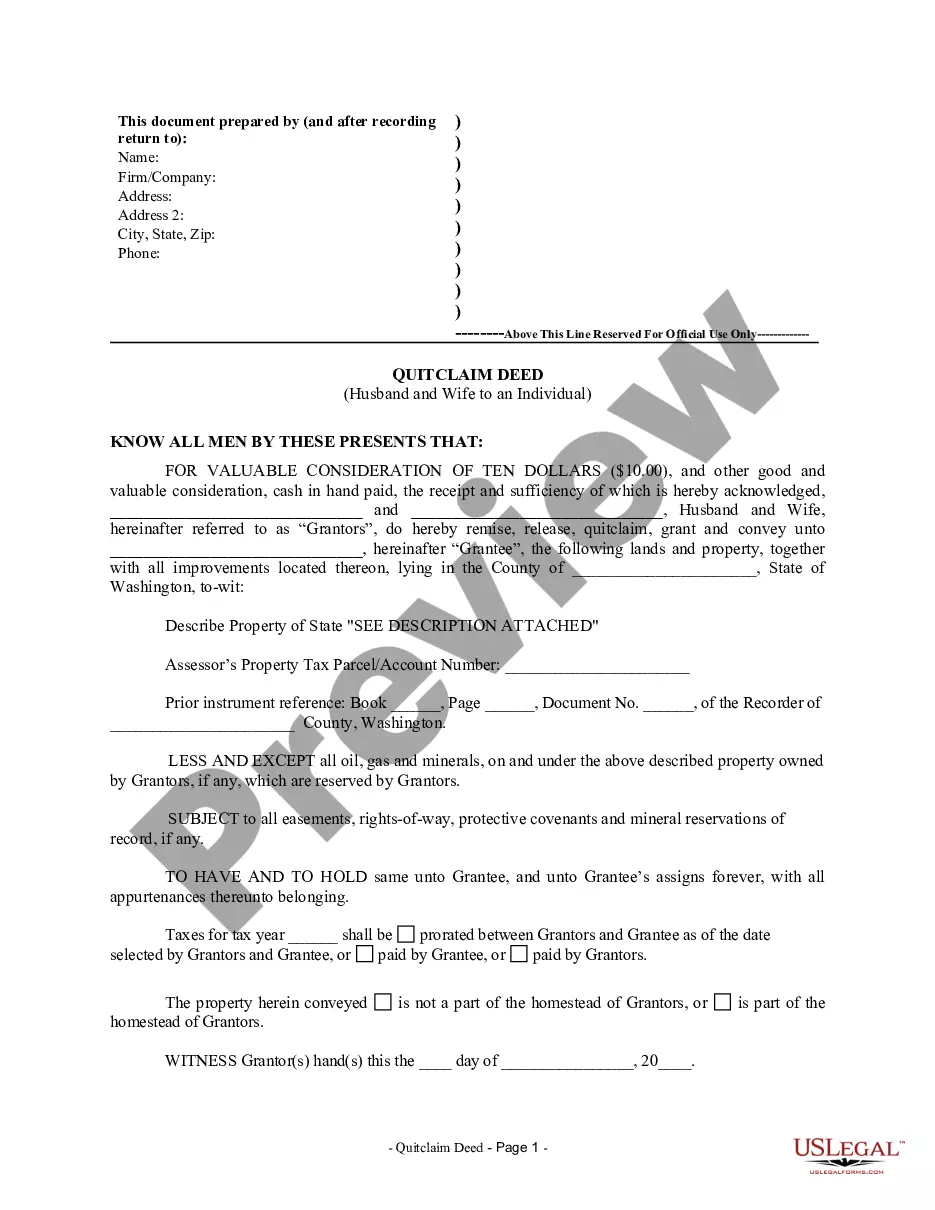

How to fill out Jury Instruction - 10.10.3 Employee Vs. Self-Employed Independent Contractor?

Generating documentation, such as Salt Lake Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor, to manage your legal matters is a challenging and time-intensive endeavor.

Numerous circumstances necessitate an attorney’s participation, which also renders this endeavor rather costly.

Nevertheless, you can take control of your legal matters and manage them independently. US Legal Forms is here to assist you.

The onboarding process for new clients is just as simple! Here’s what you need to do prior to acquiring Salt Lake Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor: Ensure your document complies with your state/county since the rules for drafting legal papers may vary from one state to another.

- Our site features over 85,000 legal documents designed for a wide range of cases and life events.

- We guarantee that each document complies with the laws of every state, alleviating your concerns regarding legal compliance.

- If you’re already acquainted with our offerings and have a subscription with US, you understand how simple it is to obtain the Salt Lake Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor template.

- Just Log In to your account, download the template, and adjust it as per your requirements.

- Have you misplaced your form? No problem. You can retrieve it from the My documents section in your account - available on both desktop and mobile.

Form popularity

FAQ

As of the 2020 tax year, the IRS Form 1099-NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year. This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income.

A worker does not have to meet all 20 criteria to qualify as an employee or independent contractor, and no single factor is decisive in determining a worker's status. The individual circumstances of each case determine the weight IRS assigns different factors.

1 - 1099 - Independent Contractors.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

While being an independent contractor means you have to pay more in self-employment taxes, there is an upside: You can take business deductions. These business deductions reduce the amount of profit you pay income taxes on. You'll report these deductions along with your income on Schedule C.

There must be a written contract in place. Contractors must have income tax withheld.

An employee does not have the same tax advantages as the self-employed for business expenses. While unreimbursed employee business expenses are limited in deductibility, the independent contractor can write off all reasonable and necessary business expenses.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

More affordable Although you may pay more per hour for an independent contractor, your overall costs are likely to be less. You don't have to withhold taxes, pay for unemployment and workers comp insurance or provide healthcare benefits, nor do you have to cover the cost of office space or equipment.