Wayne Michigan Jury Instruction — 10.10.3 Employee vs. Self-Employed Independent Contractor is a legal guideline provided to a jury in a Wayne County, Michigan court case involving a dispute over an individual's employment status. This instruction outlines the factors that should be considered when determining whether a person should be classified as an employee or as a self-employed independent contractor. The main purpose of this jury instruction is to assist the jury in understanding the legal criteria set forth by the court for differentiating between an employee and an independent contractor. By analyzing these factors, the jury can accurately assess the nature of the working relationship and make an informed decision in favor of either the plaintiff or the defendant. The Wayne Michigan Jury Instruction — 10.10.3 lists several key points that the jury should take into consideration, including: 1. Control: The degree of control or supervision exercised by the employer over the worker. This involves assessing how much direction, guidance, and instructions the employer provides. 2. Autonomy: The level of independence and freedom the worker has in performing their job tasks. This includes evaluating whether the worker sets their own hours, chooses their own working methods, or has the ability to work for multiple clients. 3. Compensation: The method and structure of payment is examined, such as whether the worker is paid a fixed salary, by the hour, or if they receive a percentage of profits. Additionally, the criteria consider whether the worker is responsible for their own expenses. 4. Equipment and materials: The ownership, provision, and maintenance of tools, materials, and equipment needed to perform the job are taken into account. This includes evaluating whether the worker supplies their own tools or whether they are provided by the employer. 5. Integration: The level to which the worker is integrated into the employer's business. This can involve assessing whether the worker is simply performing a specific task or if they are an integral part of the employer's day-to-day operations. It is crucial for the jury to carefully analyze each of these factors and consider the totality of the circumstances before making a determination on whether the individual in question should be classified as an employee or a self-employed independent contractor. Different types of Wayne Michigan Jury Instruction — 10.10.3 Employee vs. Self-Employed Independent Contractor may include variations based on specific industries or occupations. For example, there may be separate instructions provided for cases involving construction workers, healthcare professionals, or truck drivers. The specific requirements and considerations within each industry can vary, and the jury instructions may reflect these nuances. It is important for the jury to carefully review the instruction provided and apply it to the specific facts and circumstances of the case at hand. By doing so, the jury can ensure a fair and accurate determination of the individual's employment status in accordance with the laws applicable in Wayne County, Michigan.

Wayne Michigan Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor

Description

How to fill out Wayne Michigan Jury Instruction - 10.10.3 Employee Vs. Self-Employed Independent Contractor?

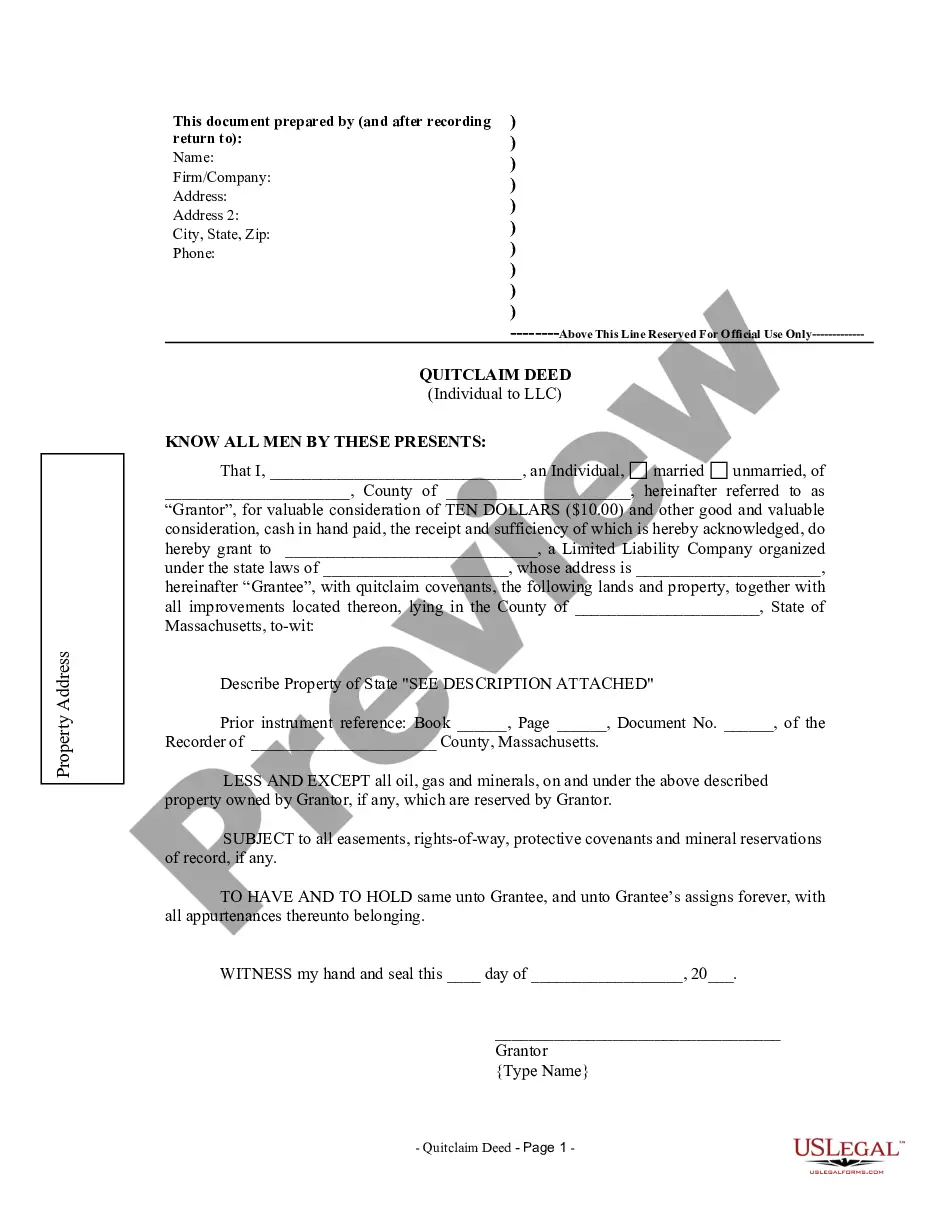

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life scenario, finding a Wayne Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor suiting all local requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Apart from the Wayne Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Wayne Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Wayne Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!