Kings New York Jury Instruction — 10.10.4 Business Loss vs. Hobby Loss is a legal instruction that provides guidance to juries in Kings County, New York, regarding the distinction between business losses and hobby losses in a court case. This instruction helps jurors understand the factors that differentiate a legitimate business activity from a mere hobby for tax and liability purposes. In cases involving financial losses claimed by individuals or businesses, it is crucial to determine whether the claimed losses are related to a genuine business endeavor or simply a hobby pursuit. This jury instruction aims to clarify the standards and criteria used to make this determination. The Kings New York Jury Instruction — 10.10.4 Business Loss vs. Hobby Loss educates jurors on the following key concepts: 1. Material Participation: This instruction explains that for an activity to be considered a business rather than a hobby, the individual or entity must have materially participated in the operations. Material participation refers to the involvement necessary to control the enterprise actively, make strategic or key decisions, and have a significant impact on its success or failure. 2. Profit Motive: The instruction emphasizes that a genuine business enterprise should have a profit motive, meaning the primary purpose of the activity should be to make a profit. It guides jurors to consider various elements that might indicate a profit motive, such as the taxpayer's efforts to improve profitability, seeking professional advice, modifying business strategies to increase revenue, and the expectation of future profits. 3. Continuous and Regular Activity: The instruction explains that for a venture to be considered a business, the taxpayer must engage in it continuously and regularly. The frequency and regularity of the operations are evaluated to determine whether they are consistent with a legitimate business activity or more aligned with sporadic hobby engagement. 4. Losses Claimed: The instruction also addresses the significance of the claimed losses. It states that if significant losses are being claimed, the jury should consider whether those losses are typical for a startup or whether they exceed what could reasonably be expected in the early stages of a business. It is important to note that different versions or variations of Kings New York Jury Instruction — 10.10.4 Business Loss vs. Hobby Loss may exist, as updates or modifications may be made to reflect changing legislation or court precedents. Furthermore, it is recommended to refer to the most current and relevant version of the instruction while considering its application in a specific case.

Kings New York Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

How to fill out Kings New York Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Kings Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching experience less challenging. You can also find information materials and guides on the website to make any tasks related to paperwork completion simple.

Here's how to purchase and download Kings Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss.

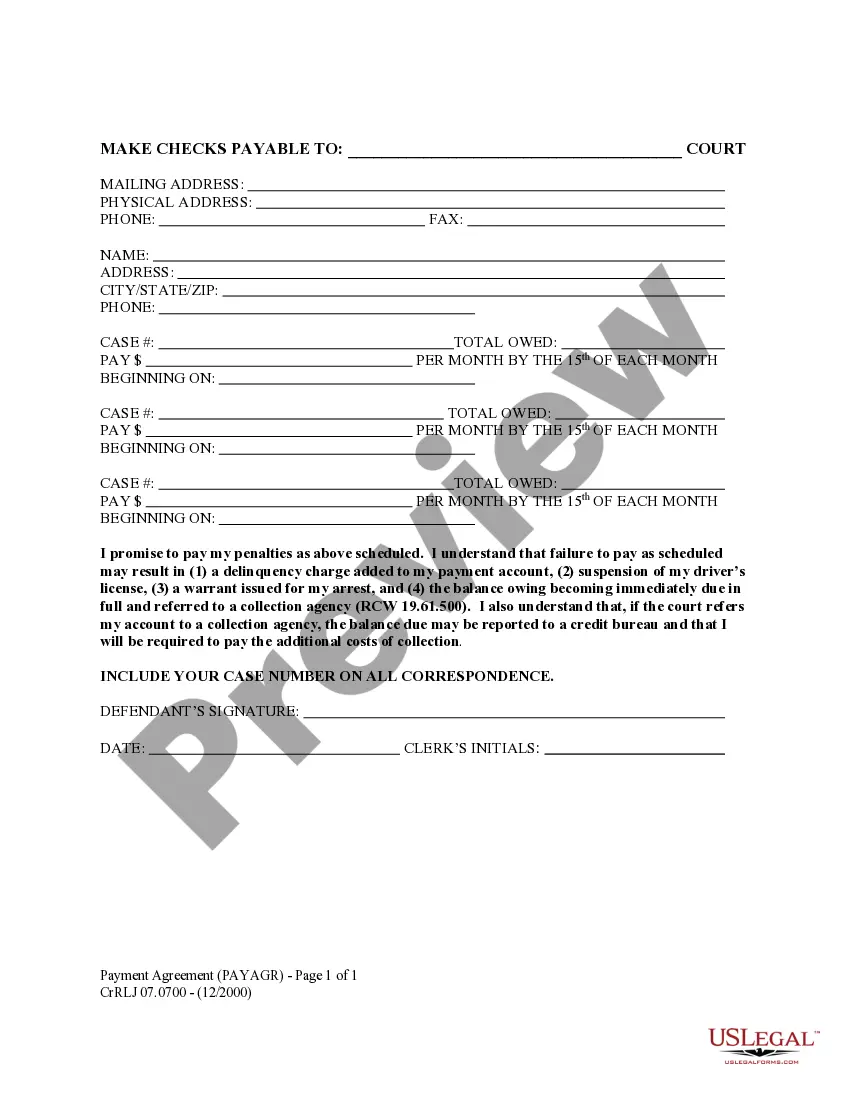

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can impact the legality of some documents.

- Examine the related document templates or start the search over to find the correct file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Kings Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Kings Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney entirely. If you have to cope with an exceptionally complicated case, we recommend getting an attorney to examine your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-compliant paperwork with ease!