Montgomery Maryland Jury Instruction — 10.10.4 Business Loss vs. Hobby Loss aims to provide guidance to the jurors in understanding the distinction between a business loss and a hobby loss in a legal context. This instruction helps in determining whether an individual's financial endeavors should be considered a business or merely a hobby for tax purposes. Understanding this distinction is crucial as it affects the ability to deduct losses from taxable income. Business Loss: A business loss refers to financial losses incurred by an individual who engages in a trade or profession with the intent of making a profit. This can include various types of businesses such as sole proprietorship, partnerships, or corporations. The instruction guides the jurors in evaluating the factors that demonstrate a genuine business intent, such as the degree of time and effort invested, the expectation of future profitability, the individual's expertise, and the history of income or losses generated. Hobby Loss: On the other hand, a hobby loss refers to the financial losses generated by activities pursued primarily for personal satisfaction, rather than with a profit motive. The instruction assists jurors in understanding the key factors that distinguish a hobby from a business, including the absence of a genuine profit motive, the limited amount of time and effort dedicated to the activity, the indication that the taxpayer primarily engages in the activity for personal pleasure, and the presence of other sources of income to cover potential losses. Keywords: — Montgomery Maryland JurInstructionio— - Business Loss vs. Hobby Loss — Taxablincomeom— - Trade or profession - Sole proprietorship — Partnership— - Corporations - Financial endeavors Profitabilityit— - Genuine business intent — Expectatioprofitabilityit— - Individual's expertise — History of incomlossesse— - Personal satisfaction — Limited time aneffortor— - Profit motive — Personal pleas—re - Sources of income

Montgomery Maryland Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

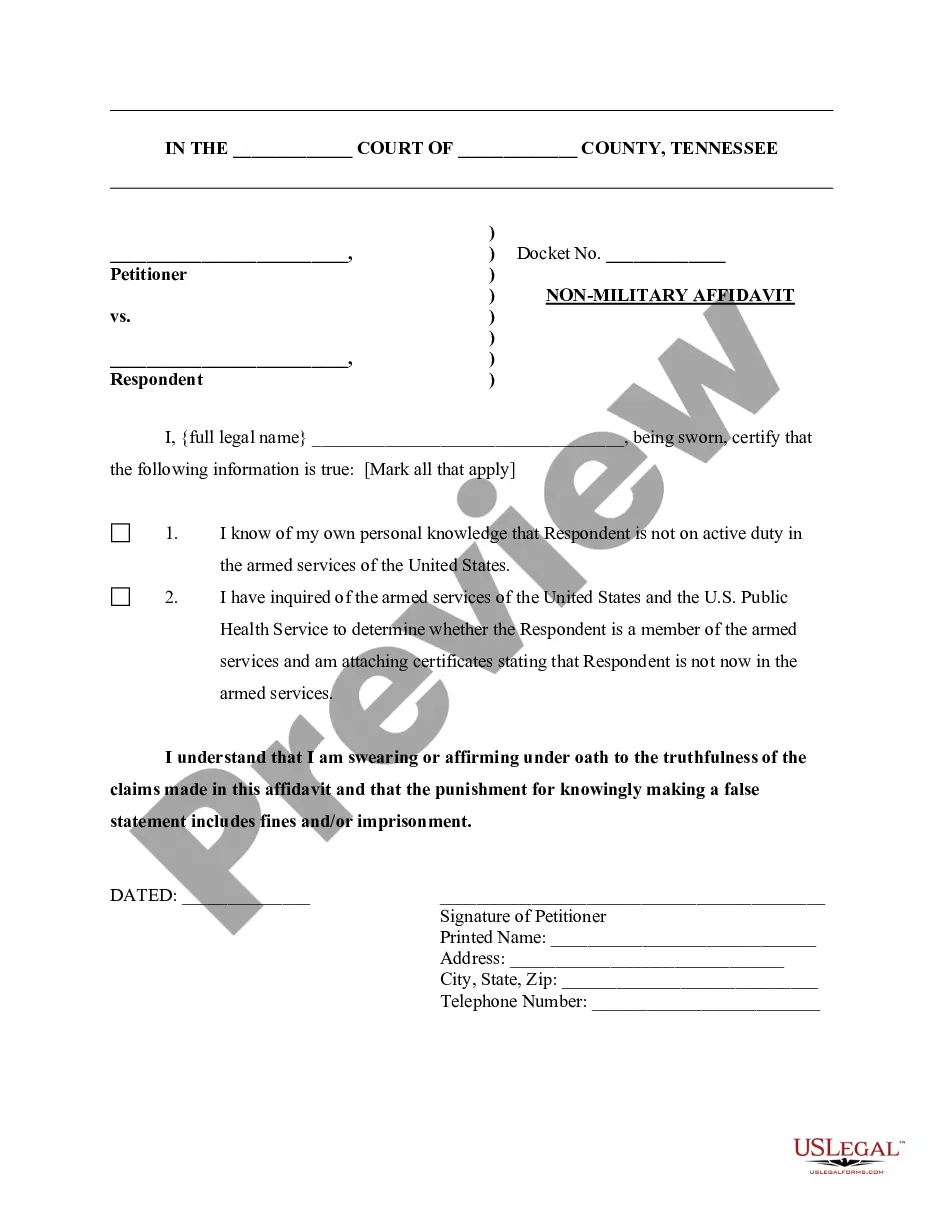

How to fill out Montgomery Maryland Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

Preparing paperwork for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft Montgomery Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss without expert help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Montgomery Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Montgomery Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss:

- Look through the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To find the one that suits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any situation with just a couple of clicks!

Form popularity

FAQ

No copyright is claimed to the text of the jury instructions, bench notes, authority, other Task Force and Advisory Committee commentary, or references to secondary sources. CITE THIS BOOK: Judicial Council of California Criminal Jury Instructions (2021 edition) Cite these instructions: CALCRIM No.

A deadlocked jury is unable to reach a verdict by the required unanimity. In California, if a jury (all 12 jurors) in a criminal murder trial cannot all agree to a guilty verdict on a first degree murder charge after 10 days of jury deliberation it is fair to say that the jury is deadlocked.

How should the new instructions be cited? The full cite should be to "Judicial Council of California Civil Jury Instructions (year)". The short cite to particular instructions should be to "CACI No.

If the court declares a mistrial, it does not mean the defendant is innocent or will no longer be charged with a crime. It means that based on the facts and circumstances, it is no longer just for the trial to proceed to a verdict of either not guilty or guilty.

Secondary Authority Sources Common sources are legal dictionaries, treatises, legal periodicals, hornbooks (study primers for law students), law reviews, restatements (summaries of case law) and jury instructions.

A hung jury, also known as a deadlocked jury, is a jury whose members are unable to agree on a verdict by the required voting margin after extensive deliberations, resulting in a mistrial.

The Bluebook does not provide a format for the California jury instructions but the instructions provide their own suggested citation formats on the backs of their title pages: CACI Recommended Citation.

Jury Instructions as a Statement of the Law: While jury instructions are not a primary source of the law, they are a statement or compendium of the law, a secondary source.

The instructions for a Virginia civil jury generally differ from those given to a criminal jury. A jury for the Virginia Circuit civil court contains 5 jurors. For a conviction to be made, all members of the jury must come to a unanimous decision.