Nassau New York Jury Instruction — 10.10.4 Business Loss vs. Hobby Loss Explanation: The Nassau New York Jury Instruction — 10.10.4 provides a detailed explanation distinguishing between business losses and hobby losses. Tailoring to jurors in Nassau County, New York, this instruction aims to clarify the key factors that differentiate a business activity from a hobby and its subsequent impact on taxation and reducibility. Keywords: Nassau New York, Jury Instruction, Business Loss, Hobby Loss, Taxation, Reducibility, Differentiation, Factors. Types of Nassau New York Jury Instruction — 10.10.4 Business Loss vs. Hobby Loss: 1. Standard Definition: This type of instruction provides a standard definition of business loss and hobby loss, focusing on the key distinguishing factors that jurors should consider when evaluating a taxpayer's claims. 2. Reducibility Guidelines: This instruction delves deeper into the reducibility guidelines for business losses and hobby losses. It explains the specific criteria that need to be met for business losses to be recognized as deductible expenses and contrasts them with the limitations imposed on hobby losses. 3. Evidence Evaluation: This instruction guides jurors on how to evaluate the evidence presented regarding a taxpayer's activities. It outlines the factors they should consider, such as the taxpayer's intent, effort, profit motive, expertise, and previous success or failure, in order to determine whether the activity qualifies as a business or a hobby. 4. Case Studies: This instruction might include examples and case studies to illustrate the application of the business loss versus hobby loss distinction. By examining real-life scenarios, jurors can better understand how the factors outlined in the instruction can affect the categorization of a taxpayer's activity. 5. Legal Precedents: This type of instruction references relevant legal precedents regarding business losses and hobby losses. It informs the jurors of significant court cases that have helped establish the criteria for distinguishing between the two and highlights any specific considerations specific to Nassau County or New York state. By providing a comprehensive understanding of the differences between business losses and hobby losses, this Nassau New York Jury Instruction — 10.10.4 equips jurors to make informed decisions in cases involving tax disputes and ensures consistency in determining the legitimacy and reducibility of taxpayers' losses.

Nassau New York Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

How to fill out Nassau New York Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

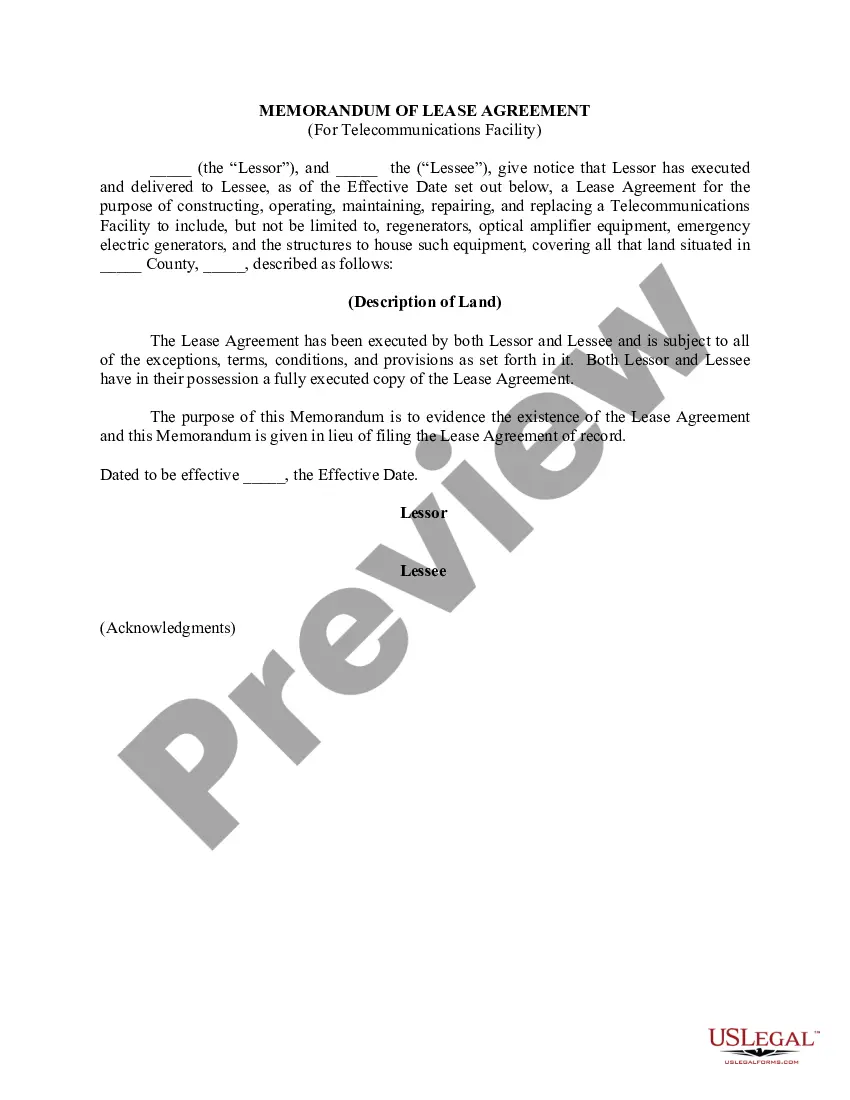

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a legal professional to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Nassau Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Consequently, if you need the latest version of the Nassau Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Nassau Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Nassau Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Jury service can only be deferred once. Applications to be excused from jury services are only considered in exceptional circumstances. You also have the right to be excused from jury service if you have previously served or attended to serve on a jury in the previous 2 years.

BY WEB: Visit our website at NYJUROR.GOV and click on the link "Postpone your jury service." Follow the instructions. You will need to supply information from your jury summons. BY TELEPHONE: Choose a date between 2 and 6 months from the date of your summons. Your request can be made by calling 1-800-449-2819.

To calculate some damages, the jury will simply need to review the evidence that was presented in court. For example, the plaintiff's attorney should have presented the plaintiff's medical records and expenses to the jury.

The Juror Qualification Questionnaire simply allows the Court to determine if a person is qualified to serve as a juror. If a person is selected to serve and receives a summons to report, he/she may ask to be excused at that time.

A hung jury, also known as a deadlocked jury, is a jury whose members are unable to agree on a verdict by the required voting margin after extensive deliberations, resulting in a mistrial.

Juror Qualification Questionnaires are sent to people randomly selected from the voter rolls (these are not to be confused with the update cards found at the back of the Summons to Jury Duty). The questionnaires are used to determine who is qualified to serve jury duty.

Common Effective Jury Duty Excuses Extreme Financial Hardship.Full-Time Student Status.Surgery/Medical Reasons.Being Elderly.Being Too Opinionated.Mental/Emotional Instability.Relation to the Case/Conflict of Interest.Line of Work.

If the date your are summoned is inconvenient, the law allows you one postponement to an available jury term date of your choice within six months.

9 Ways To Get Out Of Jury Duty Be an "expert" on the case at hand.Tell the judge you're not in a very good place in your life.Dig into your personal life for connections to the case.Mention your mental illness or other "sensitivities."Be a rebel.Have a crappy attitude.

If you do not answer the questionnaire correctly or do not provide proof that you are a non-citizen, you will receive a summons ordering you to appear at court.