Orange California Jury Instruction — 10.10.4 Business Loss vs. Hobby Loss: Detailed Description In Orange, California, the jury instruction 10.10.4 focuses on distinguishing between business losses and hobby losses. This instruction provides essential guidance to jurors when determining whether an individual's activities should be classified as a legitimate business or merely a hobby. By understanding the key differences between these two categories, jurors can reach a fair and accurate verdict. Business Loss vs. Hobby Loss: The Orange California Jury Instruction — 10.10.4 explains the various factors that differentiate business losses from hobby losses, and how these factors should be evaluated in a legal context. This instruction ensures that jurors follow a standardized methodology when assessing whether an individual's activities can be classified as a business, deserving of tax deductions for related losses, or categorized as a non-deductible hobby. Key Factors Considered in Distinguishing Business Loss from Hobby Loss: 1. Profit Motive: Jurors are instructed to analyze whether the individual engaged in the activity with the primary intention of making a profit. If the motive is purely personal enjoyment or diversion, it leans towards a hobby, whereas a genuine intent to generate profit indicates a business. 2. Regular and Continuous Effort: The instruction emphasizes the need for consistent and ongoing efforts in running the activity like a business. Factors such as time, effort, and systematic conduct help differentiate an enterprise from a casual hobby pursuit. 3. Expertise and Knowledge: Jurors are guided to consider whether the individual possesses the necessary knowledge, skills, and experience to operate the activity in a business-like manner. Demonstrating expertise enhances the likelihood of the endeavor being deemed a business. 4. Investment of Time and Capital: The jury instruction highlights the significance of substantial investments in terms of time and money. Adequate participation in the enterprise, including dedicated working hours and significant financial commitments, suggests a business operation. Different Types of Orange California Jury Instruction — 10.10.4 Business Loss vs. Hobby Loss: While there might not be different versions or subtypes of this specific jury instruction, Orange California's jury system may have other related instructions addressing specific aspects or case scenarios within the realm of business losses vs. hobby losses. These potential supplementary instructions could further delve into factors like the nature of the activity, the intent to conduct a profit-oriented venture, or the presence of a valid business plan. In conclusion, Orange California Jury Instruction — 10.10.4 plays a vital role in guiding jurors to differentiate between business losses and hobby losses. By considering various factors such as profit motive, regular efforts, expertise, and investment, jurors can determine whether an individual's activities should be treated as a legitimate business with potential tax deductions or classified as a mere hobby lacking deductible losses.

Orange California Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

How to fill out Orange California Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

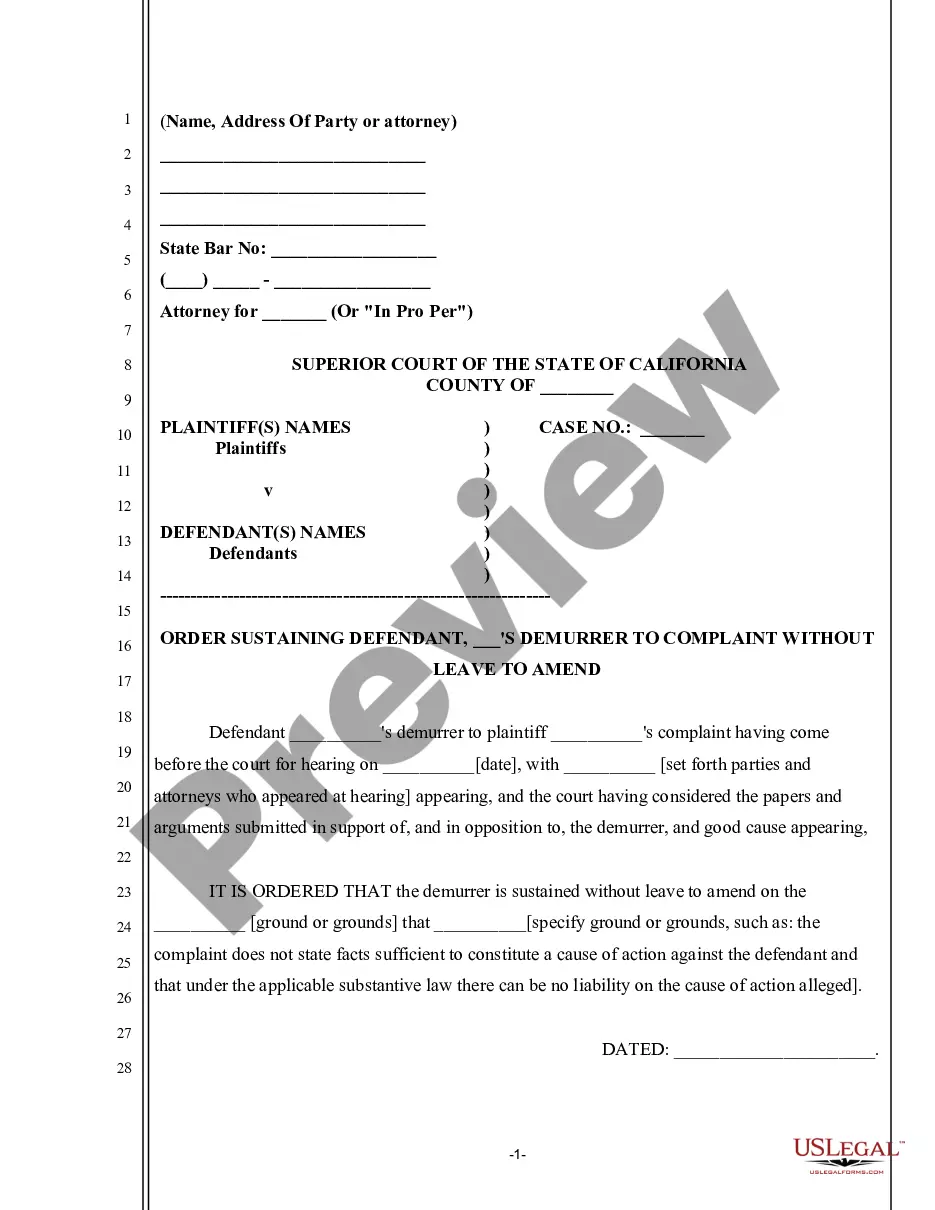

Are you looking to quickly create a legally-binding Orange Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss or probably any other form to take control of your own or corporate affairs? You can select one of the two options: hire a legal advisor to write a legal document for you or create it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific form templates, including Orange Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the necessary document without extra hassles.

- First and foremost, carefully verify if the Orange Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss is tailored to your state's or county's regulations.

- In case the document comes with a desciption, make sure to verify what it's intended for.

- Start the search over if the form isn’t what you were seeking by using the search bar in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Orange Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. In addition, the paperwork we provide are updated by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!