Travis Texas Jury Instruction — 10.10.4 Business Loss vs. Hobby Loss serves as a crucial set of guidelines used by the jury in Texas courts to differentiate between business loss and hobby loss. This particular instruction provides detailed information and criteria to determine whether an activity qualifies as a legitimate business or merely a hobby. The main objective of Travis Texas Jury Instruction — 10.10.4 is to assist the jury in assessing whether the taxpayer engaged in the activity with a genuine intent to make a profit or if it was pursued primarily for personal enjoyment. The instruction emphasizes the importance of considering various factors to make an informed decision based on the evidence presented during the trial. Some of the relevant keywords that can be associated with Travis Texas Jury Instruction — 10.10.4 Business Loss vs. Hobby Loss include: 1. Business loss determination in Texas courts 2. Rules for distinguishing business loss from hobby loss 3. Jury instruction for assessing profit intent 4. Taxpayer's motive as a decisive factor 5. Factors considered in determining business or hobby loss 6. Income tax consequences of business vs. hobby activities 7. Evaluation of objective profit-making potential 8. Subjective personal pleasure or enjoyment as a consideration 9. Genuine intent versus negative profit motive 10. Burden of proof on the taxpayer to establish a business activity. It is important to note that there may be slight variations or different types of Travis Texas Jury Instruction — 10.10.4 Business Loss vs. Hobby Loss, depending on the specific court or jurisdiction within Travis County, Texas. However, the core content and purpose of these instructions remain consistent, aiming to guide the jury in making fair and informed determinations regarding business and hobby losses.

Travis Texas Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

How to fill out Travis Texas Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Travis Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Travis Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss from the My Forms tab.

For new users, it's necessary to make some more steps to get the Travis Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss:

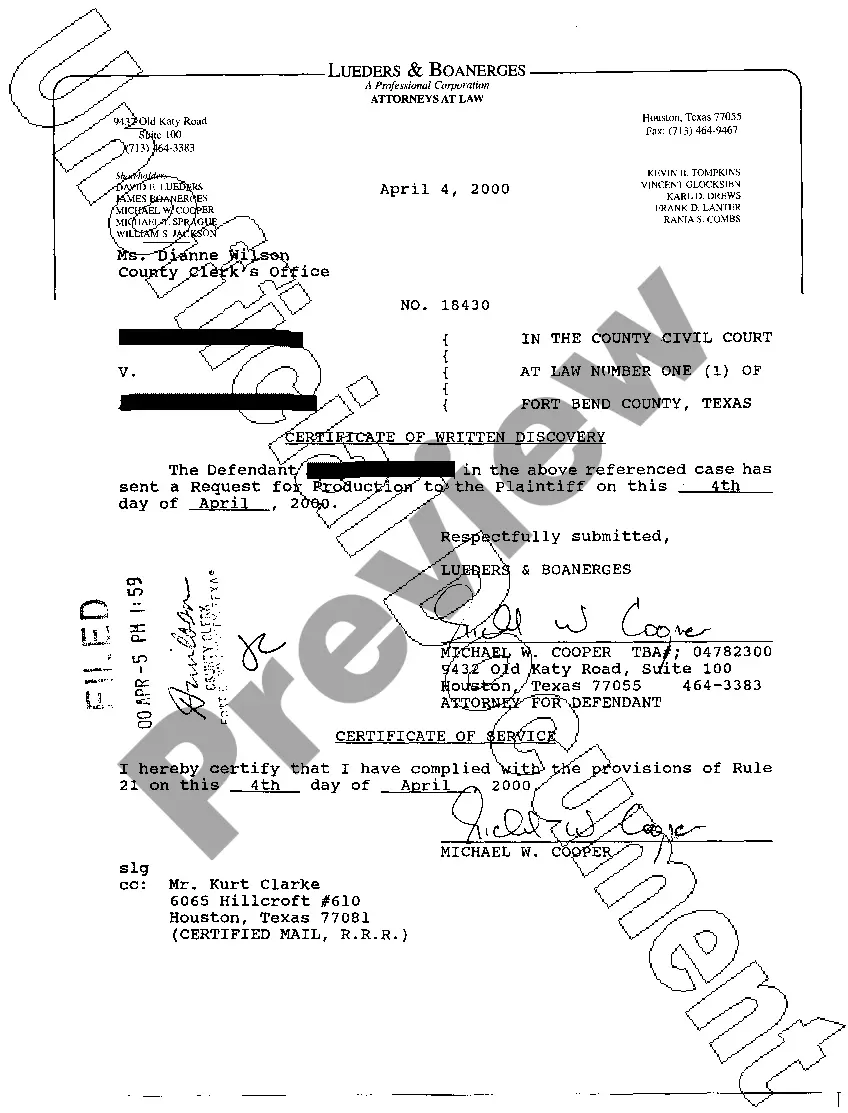

- Take a look at the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!