Houston Texas Jury Instruction — 10.10.5 Real Estate Held Primarily for Sale is a legal guideline that instructs jurors on the specific considerations and criteria for determining whether a property can be classified as "real estate held primarily for sale" in the context of a legal case. This instruction aims to provide clarity and guidance to jurors, allowing them to make informed decisions based on the facts presented during a trial. The main purpose of Houston Texas Jury Instruction — 10.10.5 is to assist jurors in understanding the distinction between properties held primarily for sale and those held for investment or personal use. This distinction is crucial as it affects various legal aspects, such as taxation, contract terms, and liability. Keywords for this topic may include: 1. Real estate held primarily for sale: This refers to properties or land that is primarily owned and used by an individual or entity for the purpose of selling it for a profit. The instruction helps jurors determine if a property falls under this category. 2. Classification of ownership: The instruction may explore the criteria for classifying a property as real estate held primarily for sale, taking into account factors such as the intent of the owner, the frequency of sales, and the quantity or volume of properties involved. 3. Legal implications: By providing jurors with a thorough understanding of the concept of real estate held primarily for sale, the instruction enables them to consider its implications in various legal matters such as contractual disputes, tax assessments, or zoning regulations. Additional types or subtopics within Houston Texas Jury Instruction — 10.10.5 Real Estate Held Primarily for Sale may include: 1. Property development and flipping: This instruction may address cases where a property owner engages in substantial improvements or renovations with the sole intent of selling the property at a higher value. Jurors may need to determine whether such actions classify the property as real estate held primarily for sale. 2. Investments and rental properties: The instruction may distinguish between properties used primarily for generating rental income or long-term investment purposes versus those actively marketed for sale. Determining the owner's intent and the property's allocation of resources can be pivotal in this context. 3. Tax considerations: Jurors may be instructed on how the classification of real estate held primarily for sale can impact tax assessments, exemptions, or deductions. Understanding the tax implications can play a significant role in reaching a fair verdict. In summary, Houston Texas Jury Instruction — 10.10.5 Real Estate Held Primarily for Sale serves as a vital compass for jurors when dealing with legal cases related to the classification and legal implications of properties held primarily for sale. By providing clear guidance and relevant keywords, this instruction assists jurors in making accurate determinations based on the presented facts and the applicable law.

Houston Texas Jury Instruction - 10.10.5 Real Estate Held Primarily For Sale

Description

How to fill out Houston Texas Jury Instruction - 10.10.5 Real Estate Held Primarily For Sale?

Preparing paperwork for the business or personal needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to generate Houston Jury Instruction - 10.10.5 Real Estate Held Primarily For Sale without expert help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Houston Jury Instruction - 10.10.5 Real Estate Held Primarily For Sale by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, adhere to the step-by-step guide below to obtain the Houston Jury Instruction - 10.10.5 Real Estate Held Primarily For Sale:

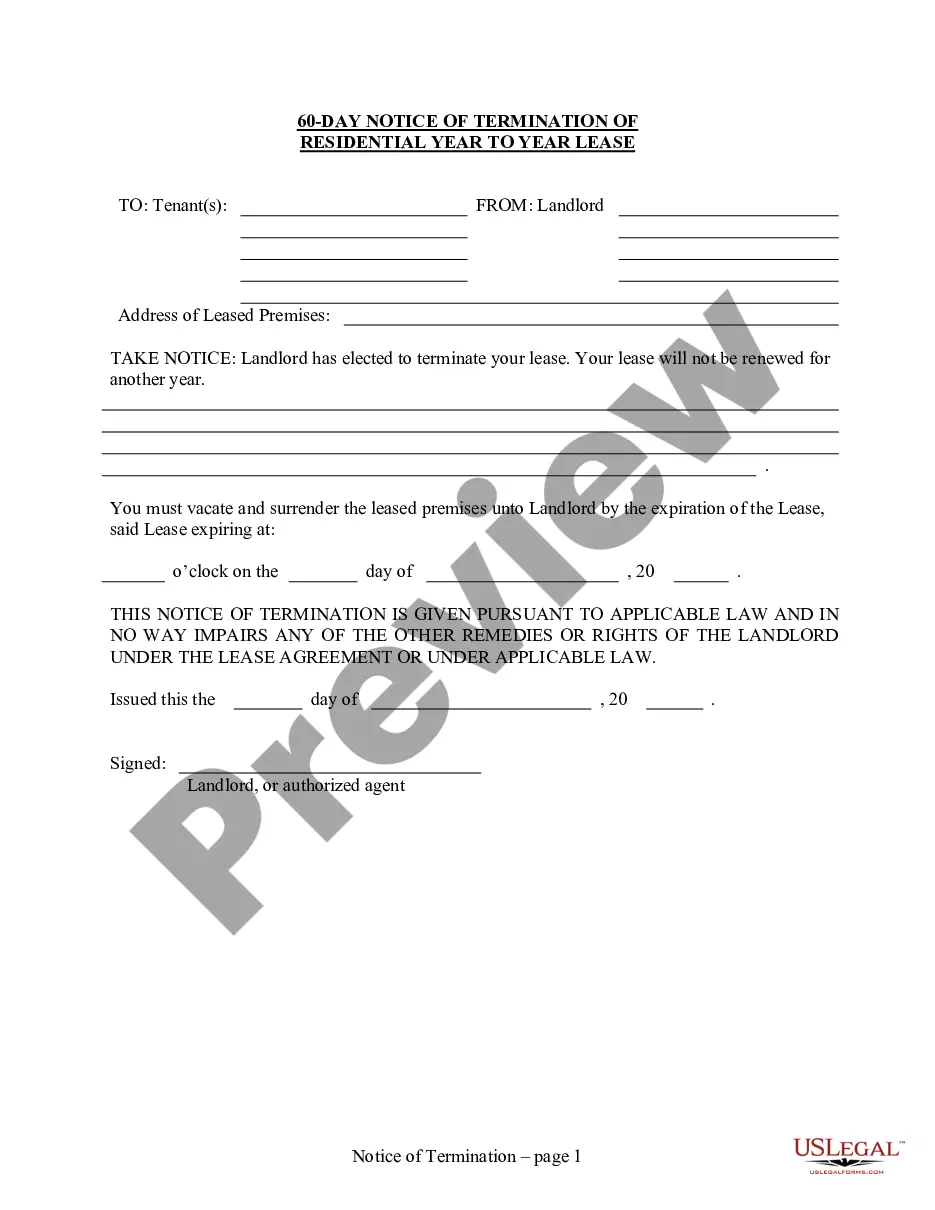

- Look through the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a few clicks!