Bronx New York Jury Instruction — 10.10.6 Section 6672 Penalty is a legal instruction given to jurors in a Bronx, New York courtroom regarding a specific provision under Section 6672 of the Internal Revenue Code. This instruction relates to penalties imposed on individuals who are found responsible for willfully failing to collect, account for, or pay over federal payroll taxes. The purpose of the Bronx New York Jury Instruction — 10.10.6 Section 6672 Penalty is to inform the jury about the specific provisions of Section 6672 and the potential penalties that may be imposed if the defendant is found guilty of violating the law. Jurors are instructed to carefully review the evidence presented during the trial and determine whether the accused individual willfully failed to comply with their payroll tax obligations. There are no different types of Bronx New York Jury Instruction — 10.10.6 Section 6672 Penalty instructions, as it is a specific instruction tailored to cases involving willful non-compliance with federal payroll tax obligations. However, it is important to note that there may be variations in the application of this instruction depending on the specific facts and circumstances of each case. Keywords: Bronx New York, Jury Instruction, 10.10.6, Section 6672, Penalty, legal instruction, Internal Revenue Code, payroll taxes, federal payroll tax obligations, willful non-compliance, evidence, trial, non-compliance.

Bronx New York Jury Instruction - 10.10.6 Section 6672 Penalty

Description

How to fill out Bronx New York Jury Instruction - 10.10.6 Section 6672 Penalty?

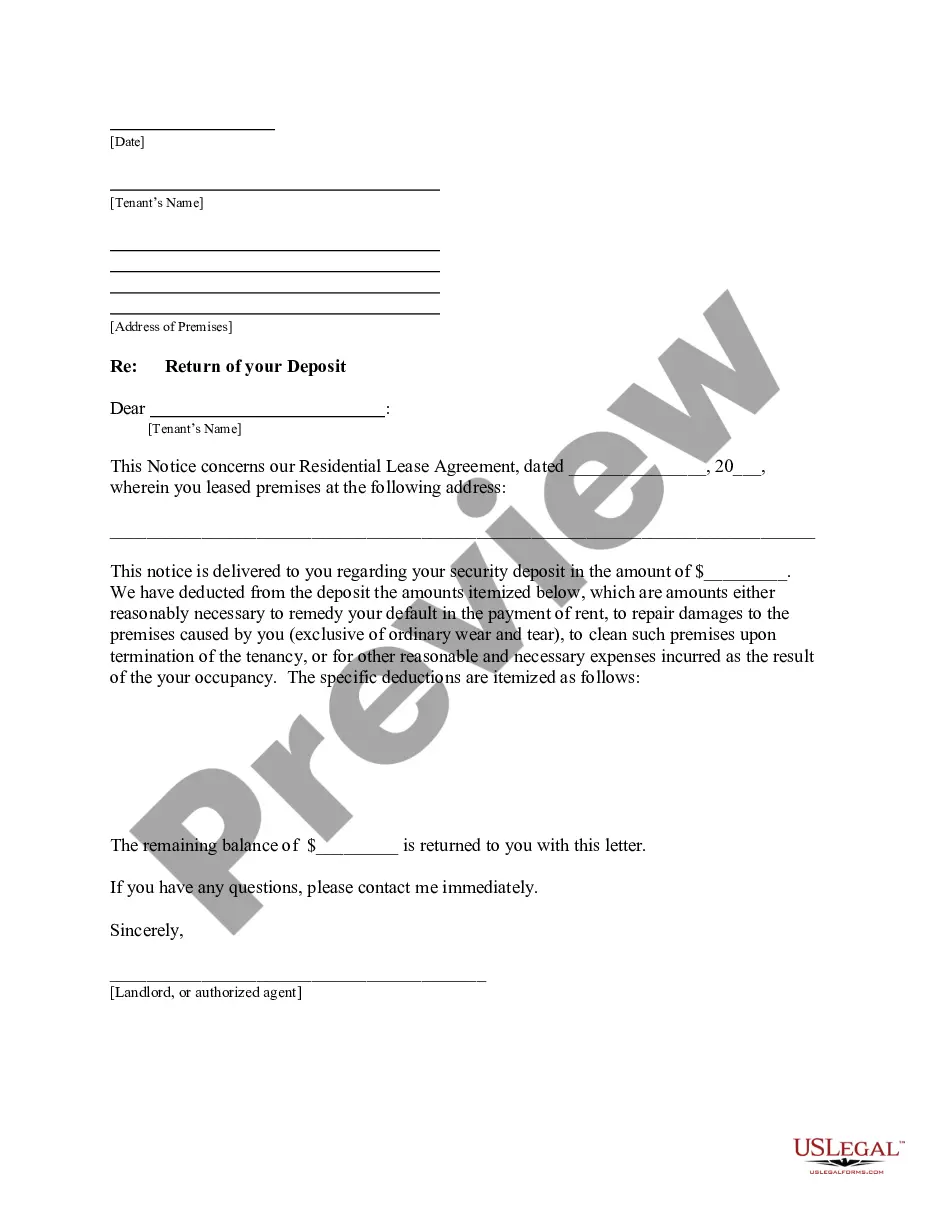

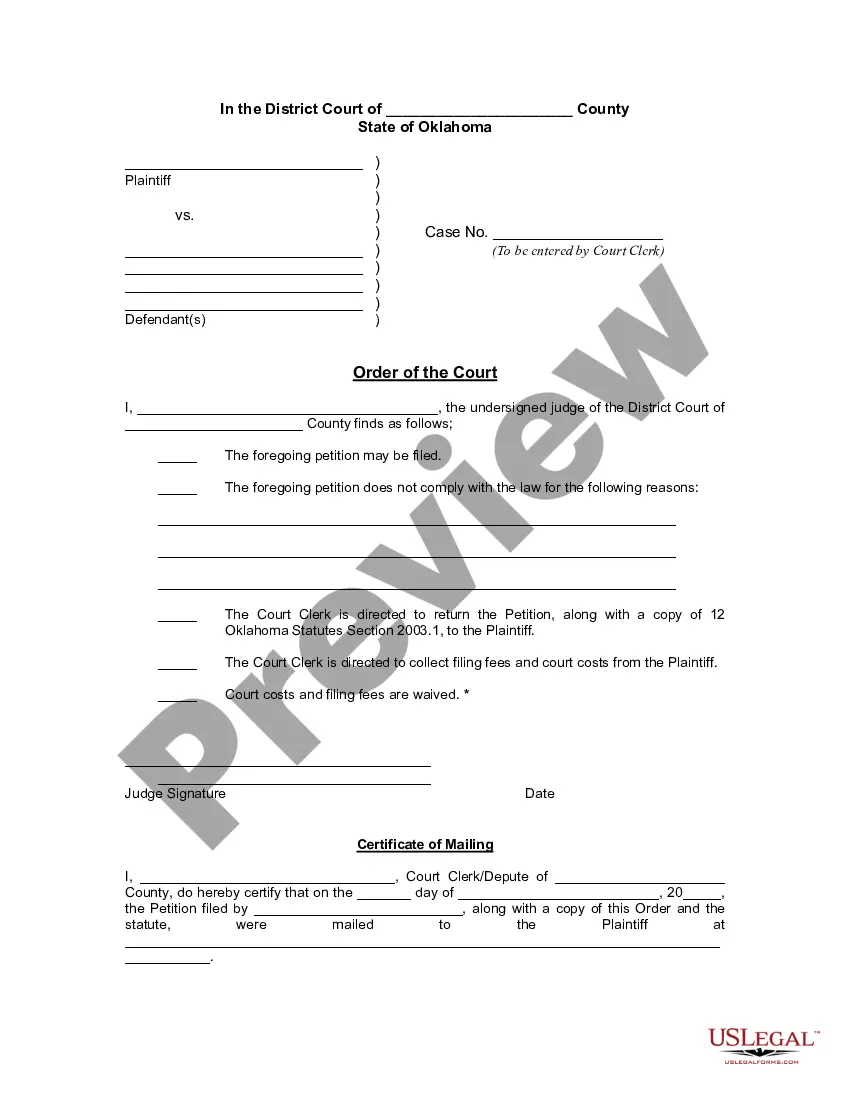

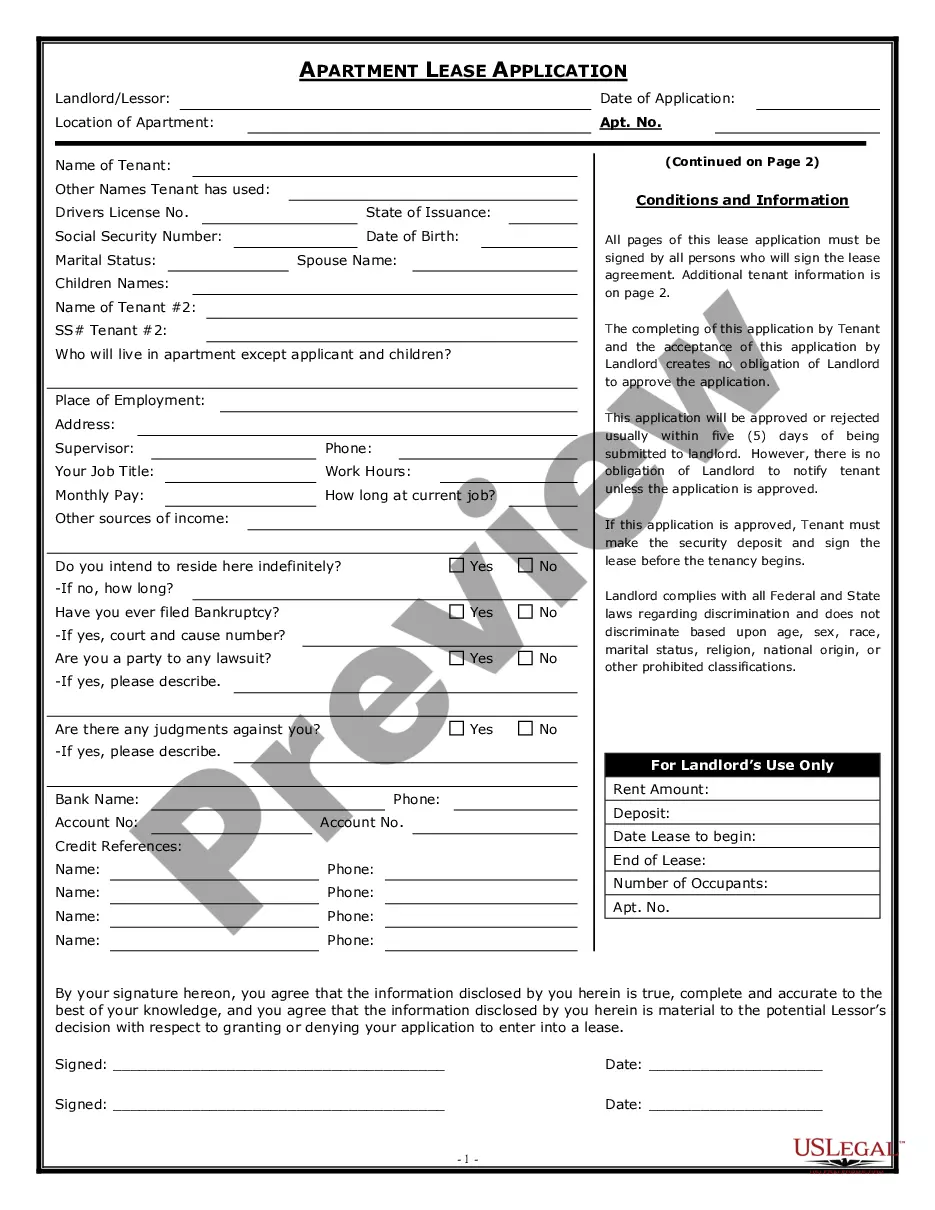

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Bronx Jury Instruction - 10.10.6 Section 6672 Penalty, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Bronx Jury Instruction - 10.10.6 Section 6672 Penalty from the My Forms tab.

For new users, it's necessary to make some more steps to get the Bronx Jury Instruction - 10.10.6 Section 6672 Penalty:

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Under Internal Revenue Code (IRC) section 6672(a), an individual can be held personally liable for a penalty for the willful failure to collect, account for, and pay to the IRS the employment taxes of a business. This is known as the trust fund recovery penalty (TFRP).

Section 6672 of the Internal Revenue Code imposes personal liability in the amount of the unpaid trust fund taxes upon any person who is required to collect, account for, and pay over such taxes and who willfully fails to do so. I.R.C.

Civil penalty assessments for Title 31 violations are assessed by the Secretary of the Treasury. The statute of limitations for such assessments expires six years from the date of the transaction that is the basis for the civil penalty.

An IRS civil penalty is the fine imposed by the Internal Revenue Service on taxpayers who fail to abide by their legal regulations. This is in contrast to a criminal penalty such as jail tim20262026. e. Although the IRS has established more than 140 civil penalties, a few are much more common than others.

IRC 6672 Civil Penalty Prior to being assessed to the Responsible Individual(s) of the delinquent business, this tax is often referred to simply as the Trust Fund. Once the TFRP is assessed to the individual(s), it is called a Civil Penalty. It is often abbreviated on IRS notices as CivPen.

Background. . 01 Section 6672(a) imposes a penalty against any person required to collect, truthfully account for, and pay over any tax imposed by the Code who willfully fails to collect, or truthfully account for and pay over the tax, or who willfully attempts in any manner to evade or defeat the tax.

The statute of limitation for the IRS to assess trust fund recovery penalty is three years from the "filing date". This three year mark begins when your company files the employment tax returns, Form 941.

During the call, we'll tell you if your penalty relief is approved. If we cannot approve your relief over the phone, you may request relief in writing with Form 843, Claim for Refund and Request for Abatement. To reduce or remove an estimated tax penalty, see: Underpayment of Estimated Tax by Individuals Penalty.

Under Internal Revenue Code (IRC) section 6672(a), an individual can be held personally liable for a penalty for the willful failure to collect, account for, and pay to the IRS the employment taxes of a business. This is known as the trust fund recovery penalty (TFRP).

Civil penalty assessments for Title 31 violations are assessed by the Secretary of the Treasury. The statute of limitations for such assessments expires six years from the date of the transaction that is the basis for the civil penalty.