Chicago Illinois Jury Instruction — 10.10.6 Section 6672 Penalty aims to provide guidance to juries in cases involving Section 6672 of the Internal Revenue Code. This instruction pertains specifically to penalties related to the failure to pay withheld income and employment taxes. Section 6672 Penalty: In Chicago, Illinois, the jury is instructed on the severity and implications of Section 6672 of the Internal Revenue Code, which deals with penalties associated with the non-payment of withheld income and employment taxes. This instruction details the following key points: 1. Definition of Section 6672: The instruction outlines the precise language and meaning of Section 6672, emphasizing that it imposes penalties on responsible individuals who willfully fail to collect, account for, or pay the required taxes. 2. Elements required for a Section 6672 penalty: The instruction specifies the essential elements that must be proven by the government in order to impose a Section 6672 penalty. These elements typically include establishing that the defendant had significant control within the company and the authority to pay the taxes but intentionally chose not to do so. 3. Willful Failure to Pay: The instruction explains that in order to levy a Section 6672 penalty, it must be proven beyond reasonable doubt that the individual's failure to pay was willful, meaning it was intentional, voluntary, and with knowledge of the legal responsibility to pay the withheld taxes. 4. Responsible Persons: The instruction identifies who can be considered a "responsible person" under Section 6672. This typically encompasses officers, directors, and individuals with significant control over the company's finances. 5. Defense and Exception: The instruction may also cover any potential defenses or exceptions that can be raised by the accused, such as demonstrating that they were not a responsible person or that their failure to pay was not willful. Different types of Chicago Illinois Jury Instruction — 10.10.6 Section 6672 Penalty may differ based on the specific circumstances of the case and the unique instructions provided by the judge. The judge might modify or tailor the instruction according to the evidence presented and the relevant legal precedents.

Chicago Illinois Jury Instruction - 10.10.6 Section 6672 Penalty

Description

How to fill out Chicago Illinois Jury Instruction - 10.10.6 Section 6672 Penalty?

Preparing documents for the business or personal needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Chicago Jury Instruction - 10.10.6 Section 6672 Penalty without professional assistance.

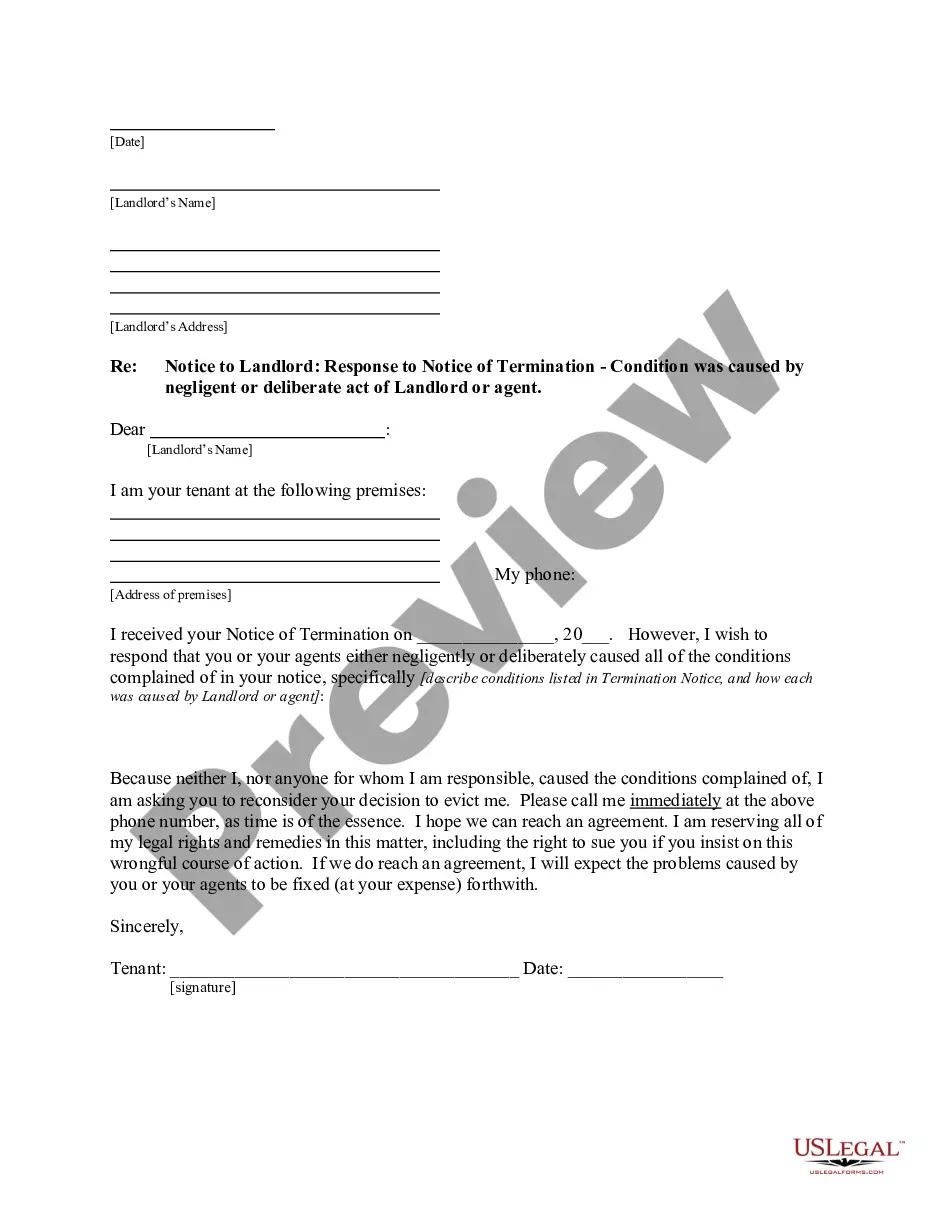

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Chicago Jury Instruction - 10.10.6 Section 6672 Penalty by yourself, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Chicago Jury Instruction - 10.10.6 Section 6672 Penalty:

- Look through the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that suits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!