Franklin Ohio Jury Instruction — 10.10.6 Section 6672 Penalty is a legal instruction that deals with the consequences of violating Section 6672 of the Ohio Revised Code, which pertains to the penalty imposed for the willful failure to collect, truthfully account for, or pay over certain withheld taxes (such as income and employment taxes). Under this instruction, the jury is informed about the specific penalty that can be imposed on individuals who are found guilty of violating Section 6672. The jury is provided with a detailed overview of the penalty and its potential impact on the defendant. Keywords: Franklin Ohio, jury instruction, 10.10.6, Section 6672 penalty, legal instruction, consequences, willful failure, withheld taxes, Ohio Revised Code, income taxes, employment taxes, guilty, penalty, defendant. Different types or variations of Franklin Ohio Jury Instruction — 10.10.6 Section 6672 Penalty may include: 1. Standard Jury Instruction: This type of instruction provides a general overview of the penalty imposed for violating Section 6672 of the Ohio Revised Code. It includes a comprehensive explanation of the penalty and its implications. 2. Modified Jury Instruction: In certain cases, the jury instruction may be modified to fit specific circumstances or to address unique aspects of the case. This modification may involve additional explanations or clarifications to ensure the jury fully understands the penalty and its application. 3. Revised Jury Instruction: Over time, the Franklin Ohio Jury Instruction — 10.10.6 Section 6672 Penalty may undergo revisions to address changes in legislation, court rulings, or legal precedents. These revisions aim to provide the most accurate and up-to-date information to the jury. 4. Simplified Jury Instruction: In some instances, the complexity of Section 6672 and its penalty may necessitate the creation of a simplified instruction. This instruction is designed to make the legal concept more accessible for the jury, ensuring they can understand and apply it correctly during deliberations. 5. Extended Jury Instruction: In cases where the violation of Section 6672 involves particularly complex circumstances or multiple defendants, the jury instruction may be extended to provide a more detailed explanation. This extension can aid the jury in comprehending the nuances and potential ramifications of the penalty. Overall, Franklin Ohio Jury Instruction — 10.10.6 Section 6672 Penalty is an essential legal instruction that provides guidance to the jury regarding the penalty for failing to fulfill tax obligations. It helps ensure that the jury has a clear understanding of the consequences faced by individuals who violate Section 6672 of the Ohio Revised Code.

Franklin Ohio Jury Instruction - 10.10.6 Section 6672 Penalty

Description

How to fill out Franklin Ohio Jury Instruction - 10.10.6 Section 6672 Penalty?

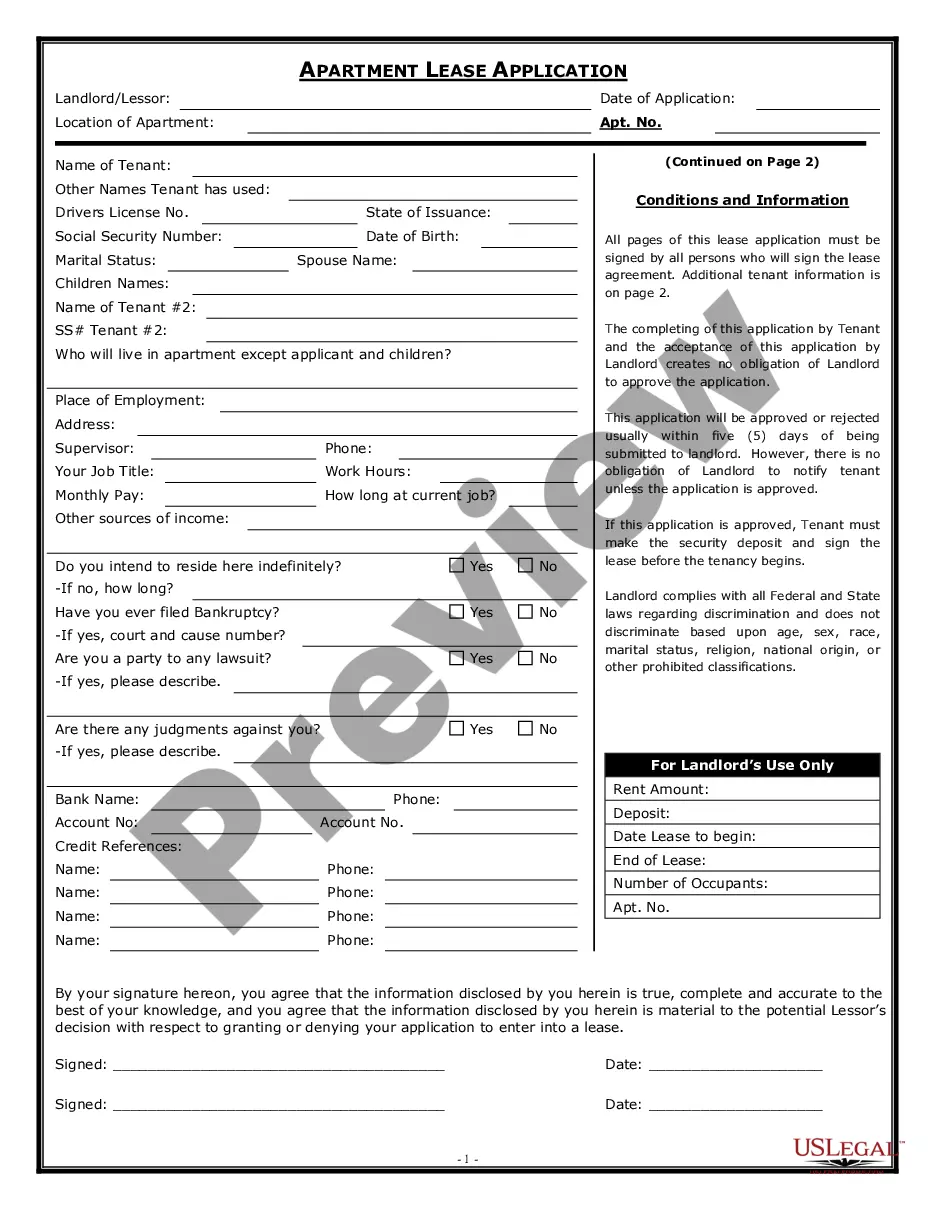

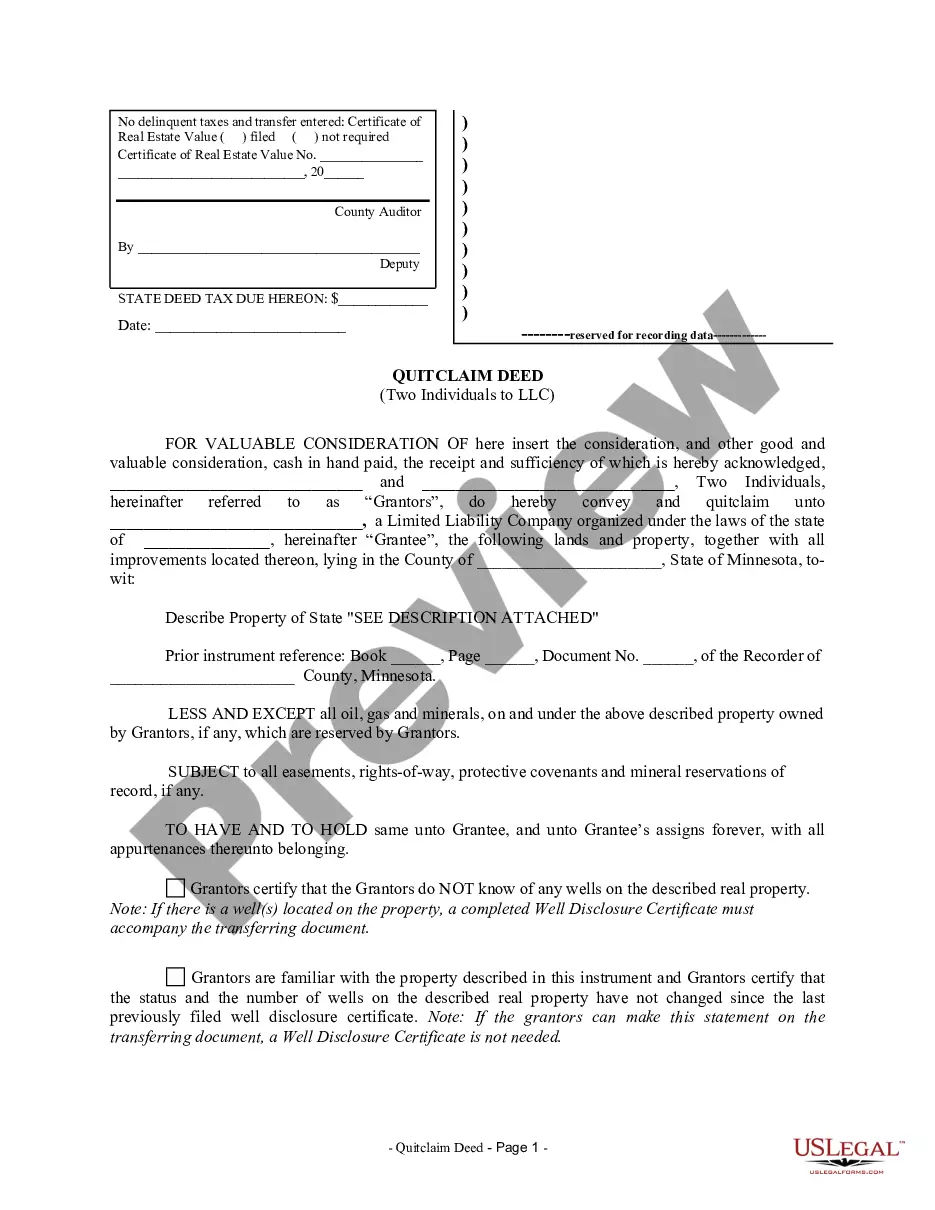

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Franklin Jury Instruction - 10.10.6 Section 6672 Penalty, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Consequently, if you need the recent version of the Franklin Jury Instruction - 10.10.6 Section 6672 Penalty, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Franklin Jury Instruction - 10.10.6 Section 6672 Penalty:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Franklin Jury Instruction - 10.10.6 Section 6672 Penalty and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

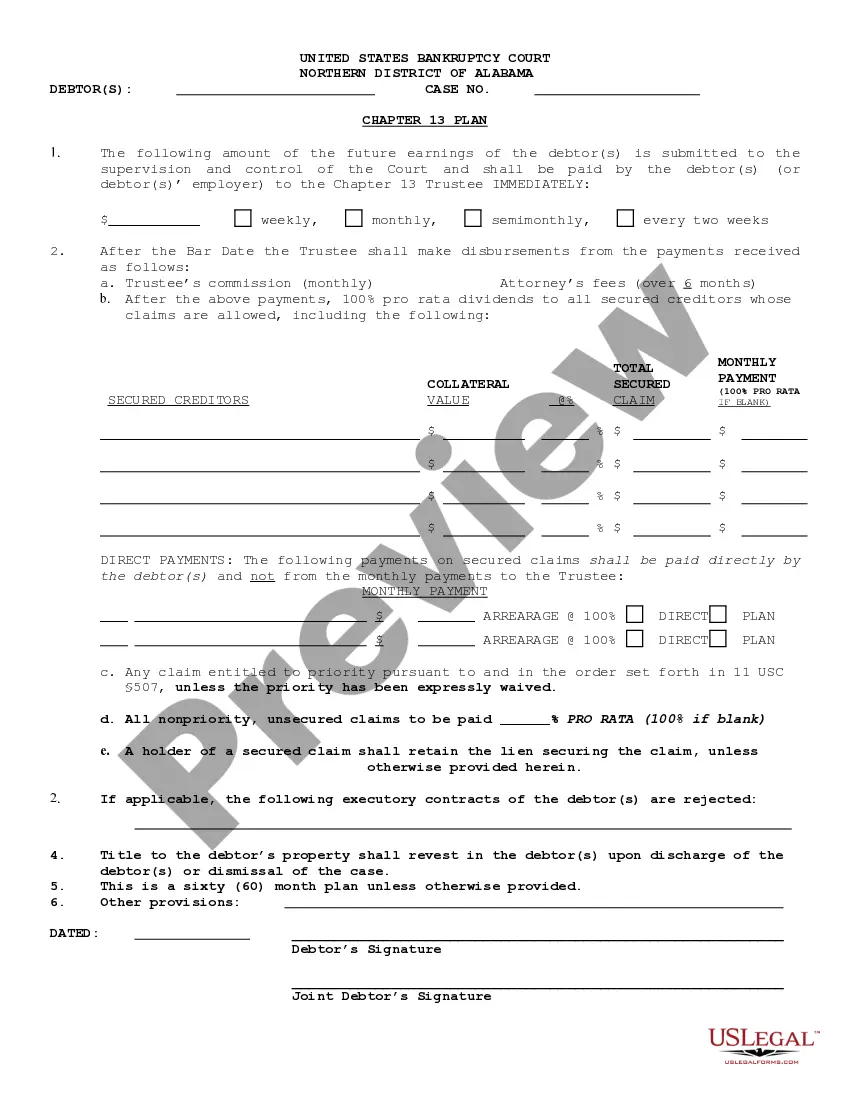

(2) to any reckless or intentional disregard of rules or regulations by any such person, such person shall pay a penalty of $1,000 with respect to such return or claim.

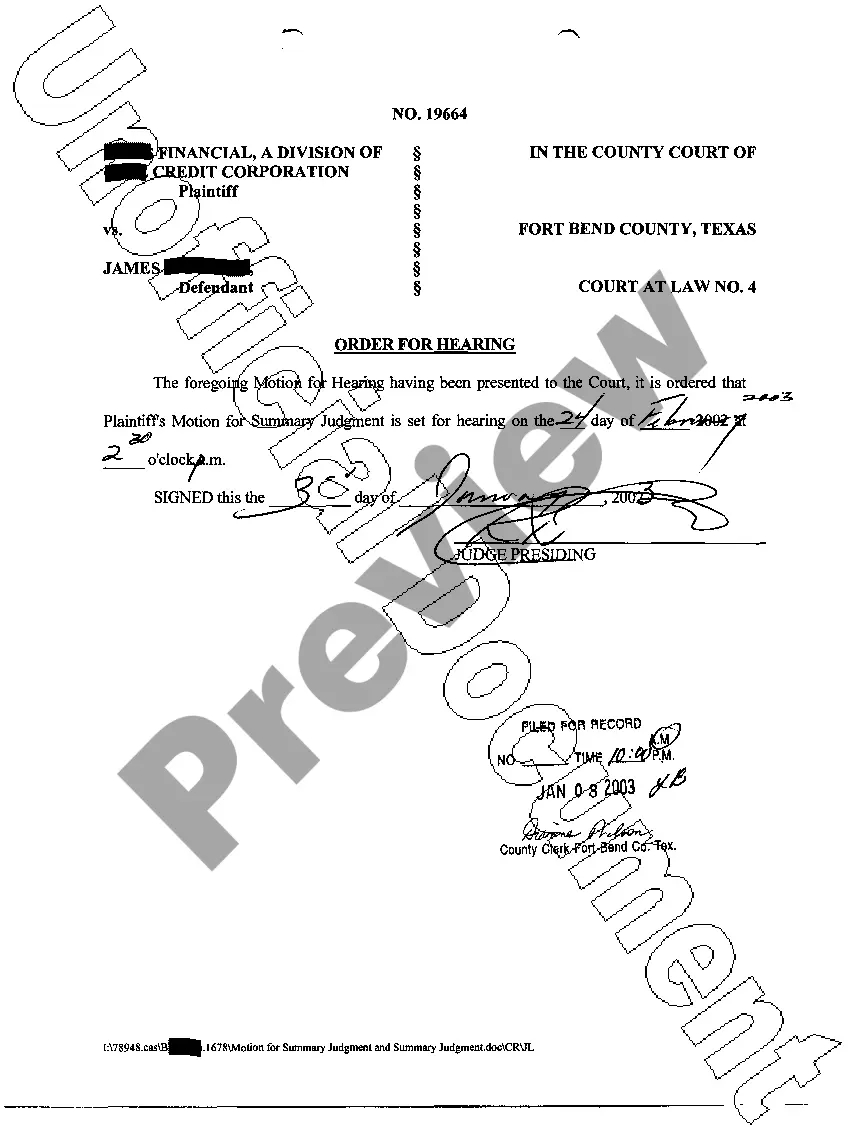

Background. . 01 Section 6672(a) imposes a penalty against any person required to collect, truthfully account for, and pay over any tax imposed by the Code who willfully fails to collect, or truthfully account for and pay over the tax, or who willfully attempts in any manner to evade or defeat the tax.

An IRS civil penalty is the fine imposed by the Internal Revenue Service on taxpayers who fail to abide by their legal regulations. This is in contrast to a criminal penalty such as jail tim20262026. e. Although the IRS has established more than 140 civil penalties, a few are much more common than others.

The penalty is $250 for each unauthorized disclosure or use of information given to a tax preparer to prepare a tax return. The maximum penalty assessed cannot be greater than $10,000 in a calendar year.

Section 6695(f) of the Code provides that an income tax return preparer who endorses or otherwise negotiates (directly or through an agent) any refund check issued to s taxpayer shall pay a penalty of $500 for each such check.

The section 6694(b) penalty is imposed in an amount equal to the greater of $5,000 or 50 percent of the income derived (or to be derived) by the tax return preparer for an understatement of liability with respect to tax that is due to a willful attempt to understate tax liability or that is due to reckless or

Civil penalty assessments for Title 31 violations are assessed by the Secretary of the Treasury. The statute of limitations for such assessments expires six years from the date of the transaction that is the basis for the civil penalty.

Under Internal Revenue Code (IRC) section 6672(a), an individual can be held personally liable for a penalty for the willful failure to collect, account for, and pay to the IRS the employment taxes of a business. This is known as the trust fund recovery penalty (TFRP).

IRC § 6694 Understatement of taxpayer's liability by tax return preparer. IRC § 6694(a) Understatement due to unreasonable positions. The penalty is the greater of $1,000 or 50% of the income derived by the tax return preparer with respect to the return or claim for refund.

Under Internal Revenue Code (IRC) section 6672(a), an individual can be held personally liable for a penalty for the willful failure to collect, account for, and pay to the IRS the employment taxes of a business. This is known as the trust fund recovery penalty (TFRP).