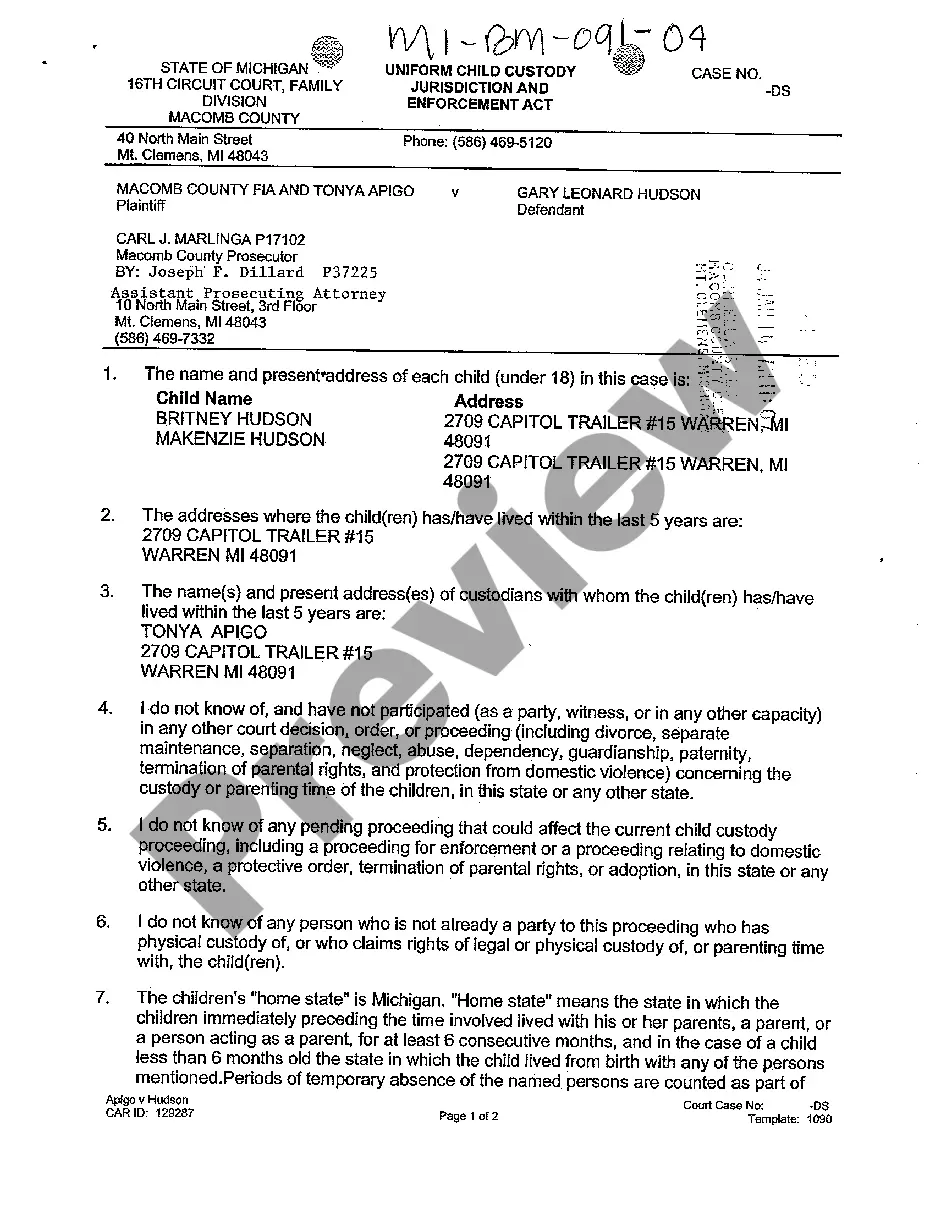

Los Angeles California Jury Instruction — 10.10.6 Section 6672 Penalty is a legal instruction specific to the jurisdiction of Los Angeles, California. It pertains to penalties associated with Section 6672 of the Internal Revenue Code (IRC). This instruction dictates the potential consequences for individuals who willfully fail to pay or withhold taxes that are to be withheld under the IRC Section 6672. Under this section, two types of penalties may apply: 1. Civil Penalty: The first type of penalty is a civil penalty. This penalty can be imposed if an individual, who is responsible for paying or withholding taxes, fails to do so willfully. The amount of the penalty can be up to the total amount of taxes that were not paid or withheld. However, it is important to note that this penalty only applies if the responsible individual had funds or assets available to pay the taxes but intentionally chose not to do so. 2. Criminal Penalty: The second type of penalty is a criminal penalty. This penalty can be imposed if an individual willfully fails to pay or withhold taxes and does so with the intent to evade or defeat taxes owed. The criminal penalty for violating Section 6672 can include fines and potential imprisonment. Los Angeles California Jury Instruction — 10.10.6 Section 6672 Penalty serves as a guide for the jury when deciding on the appropriate penalty for individuals involved in tax evasion or willful failure to pay or withhold taxes. By providing clear instructions regarding the penalties associated with Section 6672, this instruction ensures fair and consistent decision-making in Los Angeles courtrooms. It is crucial to consult with legal professionals and thoroughly review the specific language and requirements of Los Angeles California Jury Instruction — 10.10.6 Section 6672 Penalty when dealing with tax-related matters in Los Angeles, California courts to ensure accurate understanding and compliance with the law.

Los Angeles California Jury Instruction - 10.10.6 Section 6672 Penalty

Description

How to fill out Los Angeles California Jury Instruction - 10.10.6 Section 6672 Penalty?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life scenario, locating a Los Angeles Jury Instruction - 10.10.6 Section 6672 Penalty suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Aside from the Los Angeles Jury Instruction - 10.10.6 Section 6672 Penalty, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Los Angeles Jury Instruction - 10.10.6 Section 6672 Penalty:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Los Angeles Jury Instruction - 10.10.6 Section 6672 Penalty.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!