Maricopa Arizona Jury Instruction — 10.10.6 Section 6672 Penalty is a legal instruction utilized in jury trials in Maricopa County, Arizona. This instruction specifically pertains to the penalties enforced under Section 6672 of the Internal Revenue Code, which focuses on the civil penalties for individuals who are responsible for collecting, accounting for, or paying over withheld income and employment taxes. The purpose of Maricopa Arizona Jury Instruction — 10.10.6 Section 6672 Penalty is to provide guidance to the jury in understanding the legal consequences and potential penalties that individuals may face if they are found liable of violating Section 6672. It emphasizes the gravity and importance of fulfilling one's responsibilities when it comes to handling withheld taxes. It is crucial to note that each jurisdiction may have its specific version of this jury instruction, tailored to conform to local laws and regulations. However, there might not be different types of Maricopa Arizona Jury Instruction — 10.10.6 Section 6672 Penalty, as it primarily refers to a standard instruction used in trials within Maricopa County. Keywords: Maricopa Arizona, Jury Instruction, 10.10.6, Section 6672 Penalty, legal, jury trials, Maricopa County, Arizona, penalties, Internal Revenue Code, civil penalties, withheld income taxes, employment taxes, responsible, liable, violating, gravity, importance, withheld taxes, jurisdiction, local laws, regulations.

Maricopa Arizona Jury Instruction - 10.10.6 Section 6672 Penalty

Description

How to fill out Maricopa Arizona Jury Instruction - 10.10.6 Section 6672 Penalty?

How much time does it usually take you to draw up a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Maricopa Jury Instruction - 10.10.6 Section 6672 Penalty meeting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Apart from the Maricopa Jury Instruction - 10.10.6 Section 6672 Penalty, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Maricopa Jury Instruction - 10.10.6 Section 6672 Penalty:

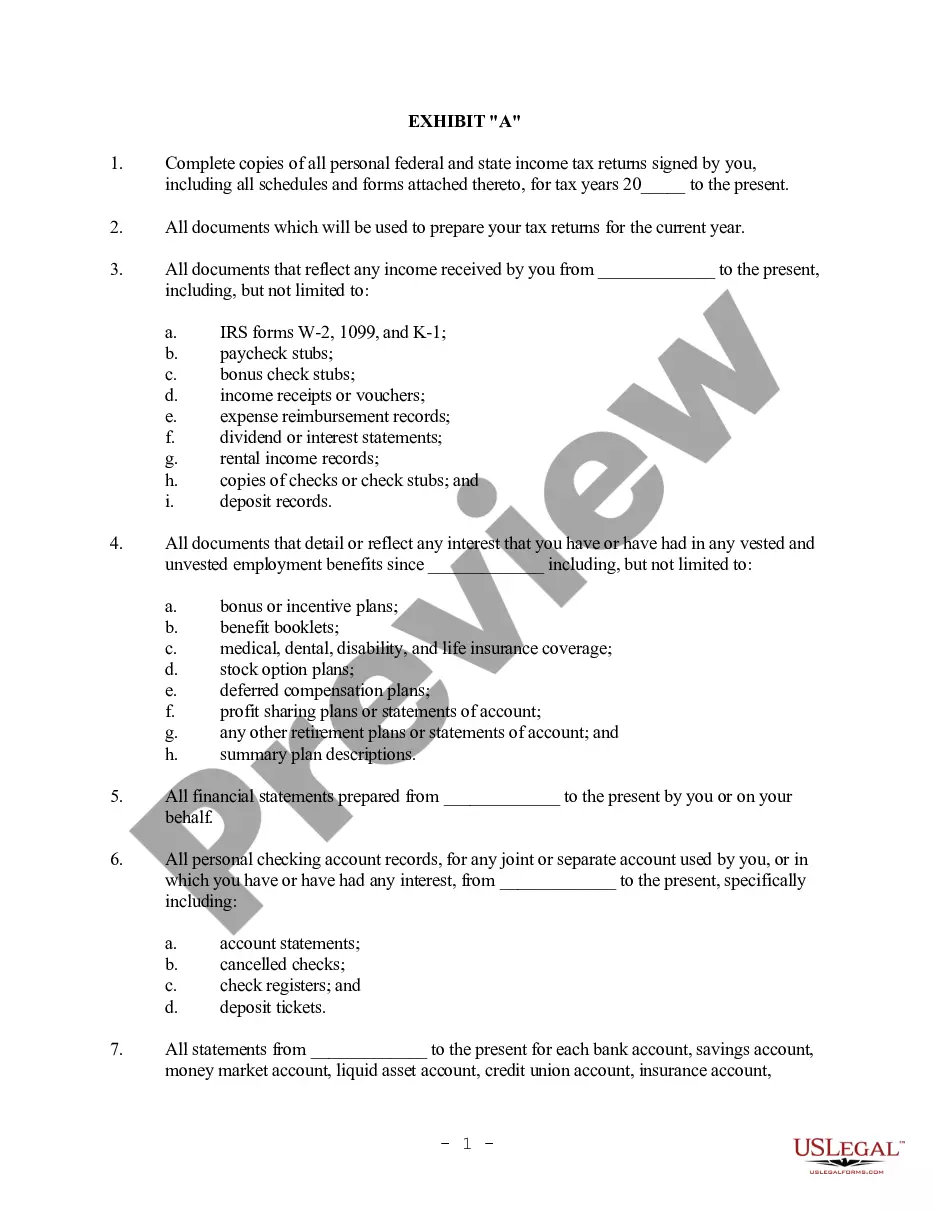

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Maricopa Jury Instruction - 10.10.6 Section 6672 Penalty.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!