Riverside California Jury Instruction — 10.10.6 Section 6672 Penalty is a legal instruction provided to jurors in Riverside, California, regarding penalties under Section 6672 of the Internal Revenue Code. This instruction relates to cases involving tax liabilities and potential penalties for individuals who are deemed responsible for the non-payment of certain federal taxes, specifically those related to employment taxes. Section 6672 Penalty is a crucial part of tax law as it aims to hold accountable those individuals in positions of responsibility within a business who willfully fail to pay employment taxes withheld from employees' wages to the Internal Revenue Service (IRS). This instruction outlines the penalties individuals may face if convicted under Section 6672. Keywords: Riverside California, jury instruction, Section 6672, penalty, tax liabilities, Internal Revenue Code, employment taxes, responsible individuals, non-payment, federal taxes, willful failure, consequences. Different types of Riverside California Jury Instruction — 10.10.6 Section 6672 Penalties can be classified based on the severity of the offense. Some potential variations of penalties under Section 6672 include: 1. Civil Penalties: This type of penalty typically involves monetary fines imposed by the IRS as a result of the responsible individual's failure to pay employment taxes. The individual may be required to pay the outstanding tax amount, along with interest and additional penalties, as determined by the IRS. 2. Criminal Penalties: In more severe cases, when an individual's actions are considered willful and intentional, criminal charges may be filed. If convicted, the penalties can range from fines and restitution to probation, community service, or even imprisonment, depending on the extent of the offense. It's important to note that while the specifics of Riverside California Jury Instruction — 10.10.6 Section 6672 Penalty may vary based on the unique circumstances of each case, the instruction serves as a guide for jurors to understand the potential consequences faced by individuals responsible for non-payment of employment taxes.

Riverside California Jury Instruction - 10.10.6 Section 6672 Penalty

Description

How to fill out Riverside California Jury Instruction - 10.10.6 Section 6672 Penalty?

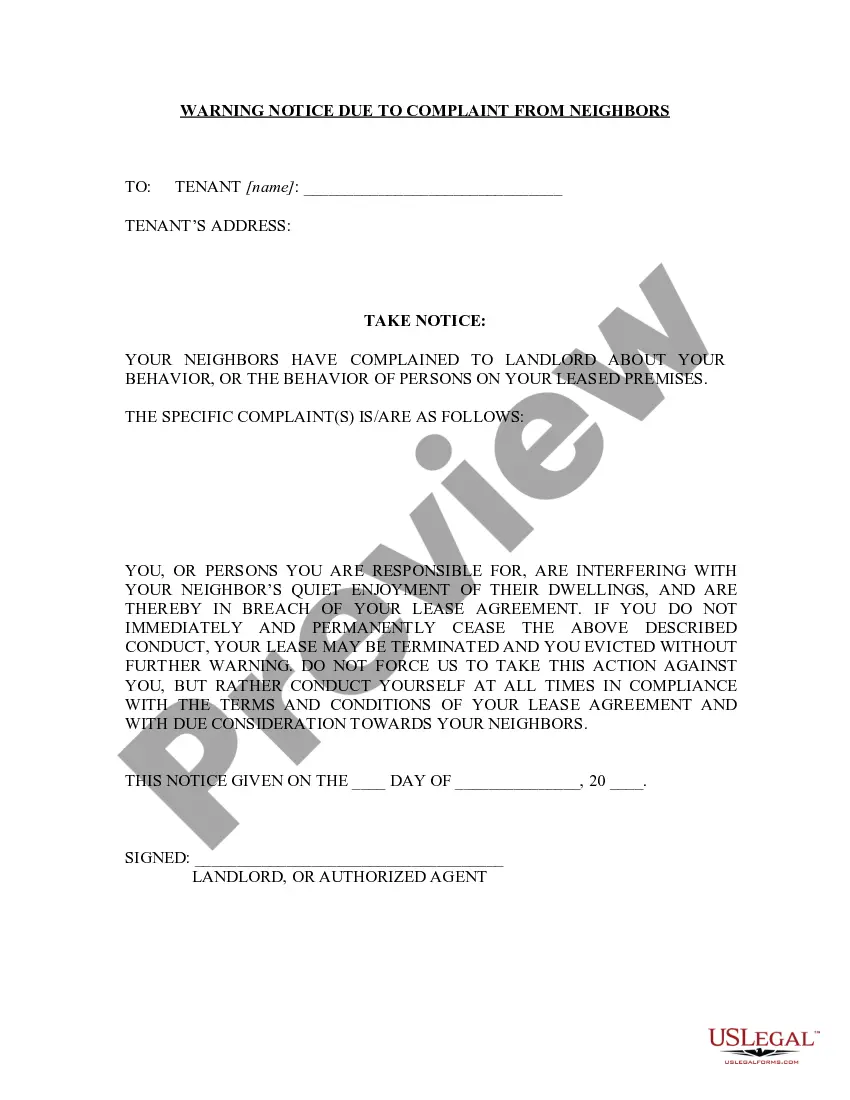

Preparing paperwork for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to generate Riverside Jury Instruction - 10.10.6 Section 6672 Penalty without expert assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Riverside Jury Instruction - 10.10.6 Section 6672 Penalty on your own, using the US Legal Forms online library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step guide below to get the Riverside Jury Instruction - 10.10.6 Section 6672 Penalty:

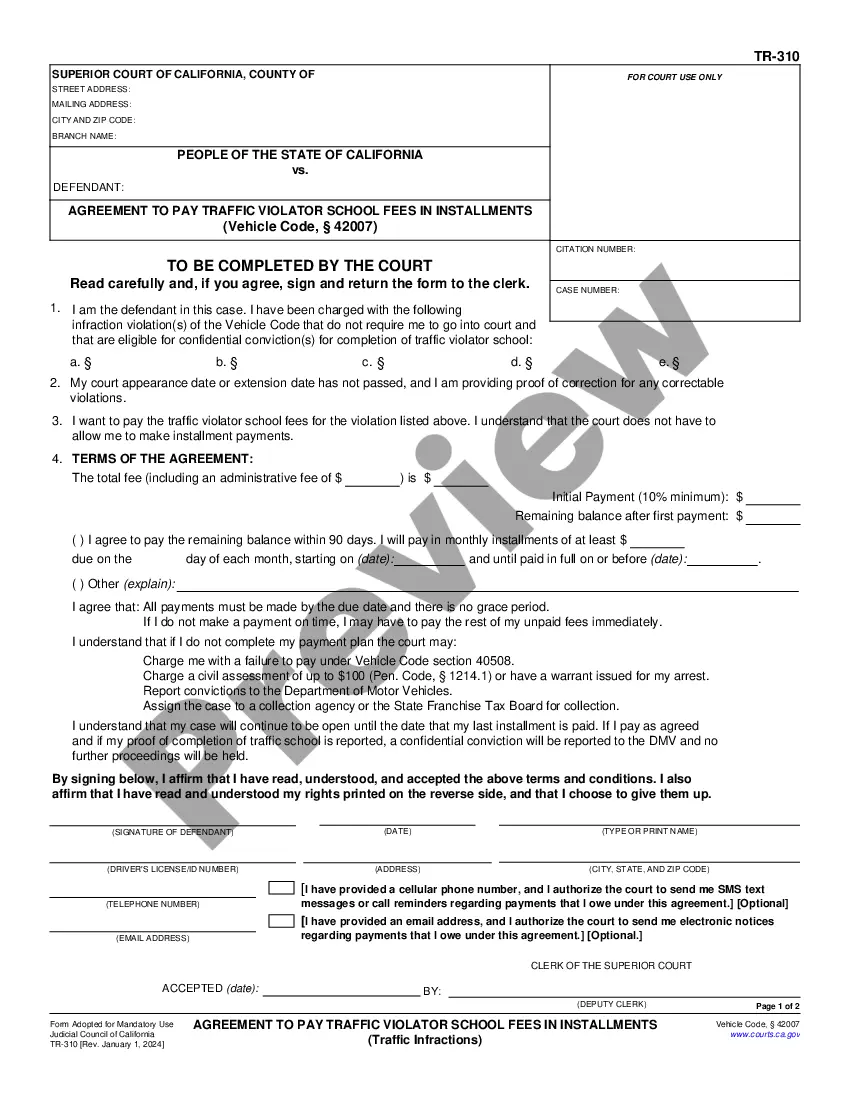

- Examine the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To find the one that suits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any use case with just a few clicks!

Form popularity

FAQ

We are able to provide a one-time 60-day extension or two 30-day extensions on infraction citations.

Common Effective Jury Duty Excuses Extreme Financial Hardship.Full-Time Student Status.Surgery/Medical Reasons.Being Elderly.Being Too Opinionated.Mental/Emotional Instability.Relation to the Case/Conflict of Interest.Line of Work.

You may pay by cash, credit card (Visa, MasterCard, American Express or Discover), debit card with a Visa or MC logo, cashier's check, money order, personal check, or by Western Union Quick Collect. Note: Fees may apply. Payments can be made in person, online, by mail, or by phone.

A juror may also request to be excused from service if they are 70 years of age and older requesting an excuse due to a physical/mental disability or impairment; or as a result of caring for another, as listed in the Request to be Excused section of the summons.

Riverside County is located within the Fourth District Court of Appeal. The people of Riverside County are served by a Superior Court. The United States District Court for the Central District of California has jurisdiction in Riverside County.

When you do not appear for jury duty, you will be sent a postcard stating you failed to appear. You need to follow the instructions on the postcard. You will automatically be assigned a new date for jury duty if you do not respond. Further failure to appear could result in punishment by fine, incarceration or both.

You may postpone your jury service two times within one year from your initial report date. You may request postponement of your jury service online after submitting your online questionnaire. If you have already postponed your jury service two times, you may not request an additional postponement.

Payment is accepted by cash, check (payable to "Clerk/Superior Court"), or credit card. Checks accepted include: personal check, cashier's check, certified check, traveler's check, or money order. Counter credit card payment can be made via NCourt, which accesses a 3.5% convenience fee per transaction.

You must appear on the designated date and time given on the Order to Show Cause notice. This date cannot be changed and will require your personal appearance. Failure to appear on this day can result in a fine, imprisonment or both pursuant to C.C.P. 209.

Select one of the following options: Online. By telephone: 951.222.0384. In person at any Traffic Court location. By mail: Please make your check or money order payable to 'Riverside Superior Court' and note your citation number on the check.