Suffolk New York Jury Instruction — 10.10.6 Section 6672 Penalty is a legal instruction that provides guidance to jurors in Suffolk County, New York, regarding the penalties associated with Section 6672 of the Internal Revenue Code. This instruction relates specifically to cases involving potential violations of the tax code and is applicable in the context of a jury trial. Section 6672 of the Internal Revenue Code pertains to the penalty imposed on individuals who are deemed responsible for the withholding and payment of federal employment taxes, such as social security and Medicare taxes, but willfully fail to do so. The penalty is known as the Trust Fund Recovery Penalty (TARP). TARP is intended to hold individuals personally liable for the unpaid taxes on behalf of their employer or the business entity they represent. The Suffolk New York Jury Instruction — 10.10.6 is aimed at helping jurors understand the elements that need to be proven for the imposition of Section 6672 penalties. It is crucial for jurors to grasp the legal requirements and implications involved in these cases. The instruction may contain different types of penalties that can be associated with Section 6672 depending on the specific circumstances and evidence presented during the trial. These penalties can include civil penalties, interest, and potentially even criminal charges, depending on the severity of the violation. Jurors will be instructed on the importance of carefully evaluating the evidence, witness testimony, and legal arguments presented by both the prosecution and the defense. They will be educated on the burden of proof and their role in determining whether the defendant is liable for the section 6672 penalty. Keywords: Suffolk New York, jury instruction, Section 6672 penalty, Internal Revenue Code, Trust Fund Recovery Penalty, TARP, Suffolk County, tax code, employment taxes, social security, Medicare taxes, willful failure, personal liability, withholding, unpaid taxes, civil penalties, interest, criminal charges, evidence, witness testimony, burden of proof, liability.

Suffolk New York Jury Instruction - 10.10.6 Section 6672 Penalty

Description

How to fill out Suffolk New York Jury Instruction - 10.10.6 Section 6672 Penalty?

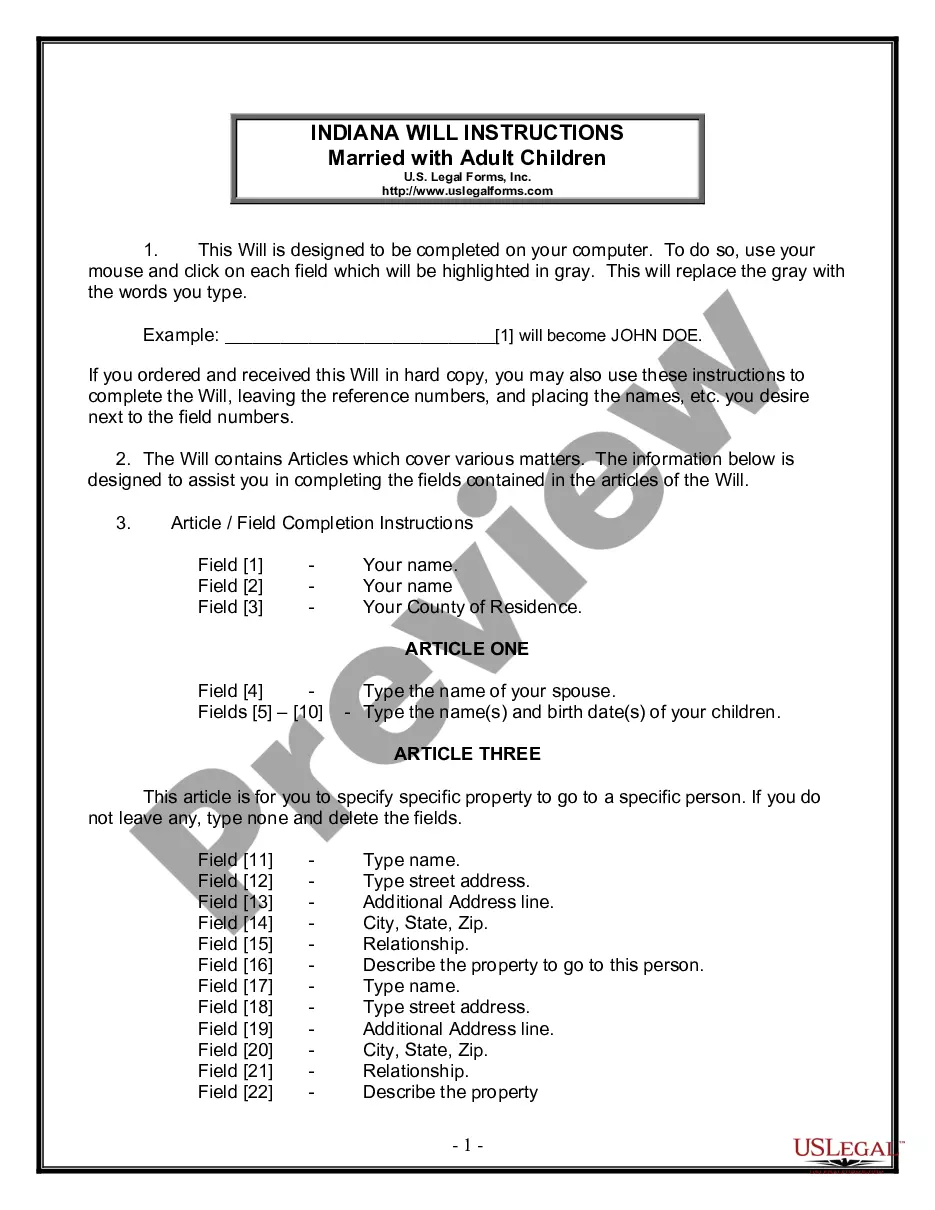

Preparing legal paperwork can be difficult. In addition, if you decide to ask a legal professional to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Suffolk Jury Instruction - 10.10.6 Section 6672 Penalty, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Therefore, if you need the current version of the Suffolk Jury Instruction - 10.10.6 Section 6672 Penalty, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Suffolk Jury Instruction - 10.10.6 Section 6672 Penalty:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Suffolk Jury Instruction - 10.10.6 Section 6672 Penalty and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!