Travis Texas Jury Instruction — 10.10.6 Section 6672 Penalty: Detailed Description and Types In Travis County, Texas, the jury instruction 10.10.6 Section 6672 Penalty is a crucial guideline used in cases involving the assessment of penalties under Section 6672 of the Internal Revenue Code. This instruction helps jurors understand the implications and legal responsibilities associated with this particular section. By providing clear guidance on the penalties, it ensures a fair and informed decision-making process for the jury. Section 6672 of the Internal Revenue Code primarily deals with the penalty imposed on individuals who willfully fail to collect, account for, and deposit taxes withheld from employee wages. It aims to hold responsible the persons or entities handling employment taxes, such as employers or responsible officers of corporations, who intentionally evade or disregard their obligations. The penalties under this section can be significant and may result in severe financial consequences for the erring parties. The Travis Texas Jury Instruction — 10.10.6 Section 6672 Penalty comes in several types, including: 1. Willful failure to collect and pay taxes: This type of penalty is applicable when an employer or responsible officer intentionally fails to collect taxes from wages paid to employees and subsequently fails to pay them to the Internal Revenue Service (IRS). The instruction details the legal consequences associated with this violation. 2. Willful failure to account for and deposit taxes: This type of penalty is levied when an employer or responsible officer purposefully fails to account for and deposit withheld taxes into the designated IRS accounts. The instruction clarifies the various elements required for establishing willful intent and guides the jury in assessing the appropriate penalty. 3. Responsible officer liability: This type of penalty focuses on holding responsible officers of corporations accountable for willful failure to remit employee taxes. The instruction outlines the criteria for identifying a responsible officer and the extent of their liability, ensuring fair determinations during the legal proceedings. 4. Severe financial repercussions: The 10.10.6 Section 6672 Penalty can lead to severe monetary consequences, including substantial fines, interest on unpaid taxes, and even potential imprisonment. The instruction emphasizes the significance of the penalties and their potential impact on the defendant's financial well-being. 5. Burden of proof: The instruction also clarifies the burden of proof the government must fulfill to establish a violation of Section 6672. It guides the jury in evaluating the evidence presented by both sides and determining whether the government has met its burden. Overall, the Travis Texas Jury Instruction — 10.10.6 Section 6672 Penalty serves as a comprehensive guideline for jurors, enabling them to understand the legal implications and assist in rendering an impartial decision. By providing clarity on different types of penalties, it ensures that jurors have a well-rounded understanding of the complexities involved in Section 6672 cases.

Travis Texas Jury Instruction - 10.10.6 Section 6672 Penalty

Description

How to fill out Travis Texas Jury Instruction - 10.10.6 Section 6672 Penalty?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so beneficial.

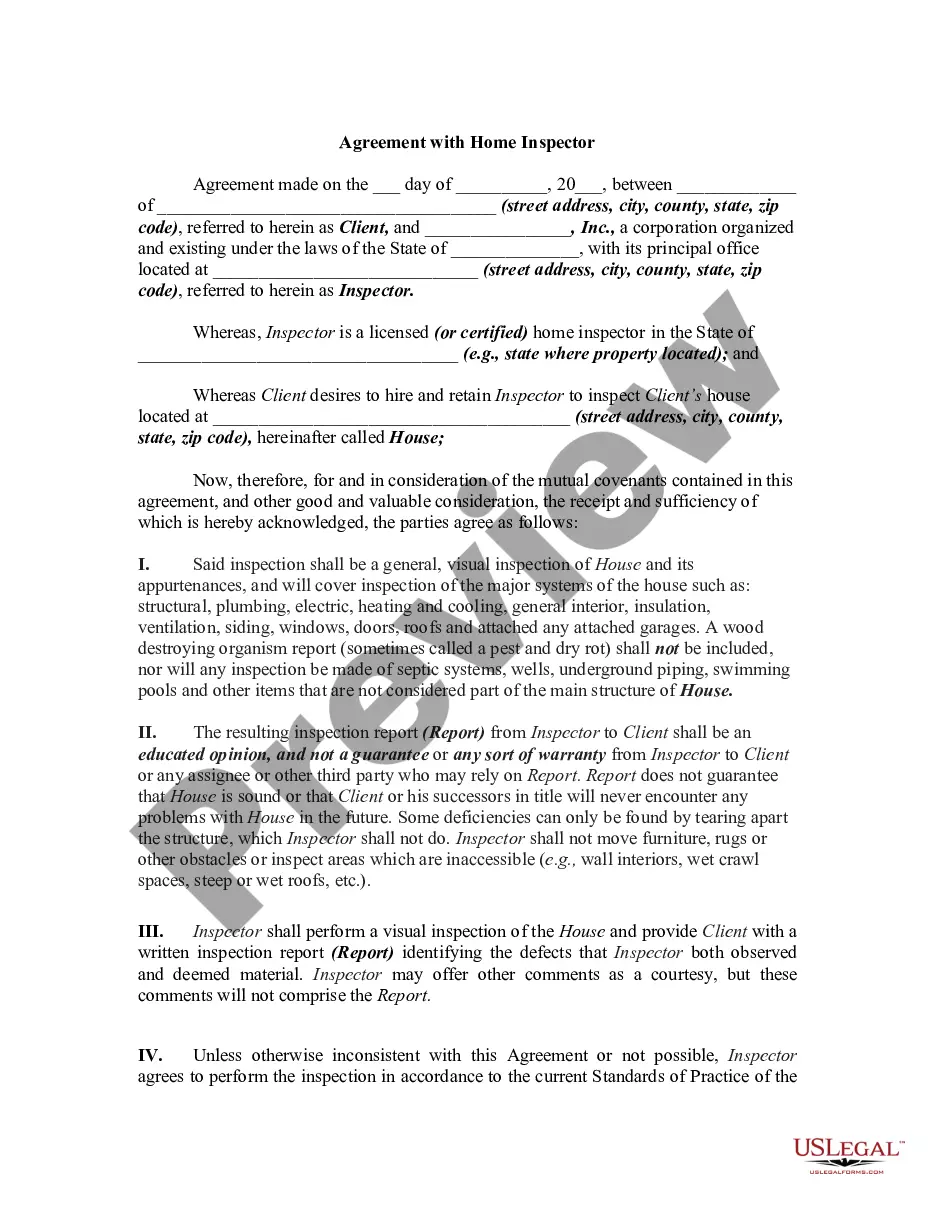

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business objective utilized in your region, including the Travis Jury Instruction - 10.10.6 Section 6672 Penalty.

Locating templates on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Travis Jury Instruction - 10.10.6 Section 6672 Penalty will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to get the Travis Jury Instruction - 10.10.6 Section 6672 Penalty:

- Ensure you have opened the proper page with your local form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Travis Jury Instruction - 10.10.6 Section 6672 Penalty on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!