Phoenix Arizona Jury Instruction — 4.4.1 Rule 10(b— - 5(a) Device, Scheme, or Artifice to Defraud Insider Trading In the legal context of Phoenix, Arizona, the Jury Instruction 4.4.1 addresses the crucial rule 10(b) under the Securities Exchange Act of 1934, which prohibits the use of any device, scheme, or artifice to defraud in relation to insider trading. This instruction aims to guide the jury through the complexities of the case and ensure a fair trial. Let's delve into the details of this instruction and explore its significance. Insider trading refers to the illegal practice of trading stocks or securities based on non-public information obtained by an individual with privileged access within a company or organization. Such individuals, referred to as "insiders," may include corporate officers, directors, employees, or any individuals who have access to material, non-public information about the company's affairs. Rule 10(b) of the Securities Exchange Act of 1934 exists to maintain the integrity of the financial markets and protect investors from fraudulent activities. It deems it unlawful for any person to employ any deceptive or manipulative device, scheme, or artifice to defraud in connection with the purchase or sale of securities. Under Phoenix Arizona Jury Instruction — 4.4.1, the prosecution must prove the following elements to establish a violation of Rule 10(b) — 5(a) regarding a device, scheme, or artifice to defraud insider trading: 1. Material Non-Public Information: The defendant possessed information that was not publicly available and had the potential to impact the value of a security. 2. Breach of a Duty: The defendant owed a duty to the source of the information, the shareholders, or the entity involved, and this duty was breached by trading on the information. 3. Deception or Manipulation: The defendant employed a device, scheme, or artifice to deceive or manipulate others in connection with the trading of securities. 4. Materiality: The information on which the defendant traded was material, meaning it would have been significant to a reasonable investor in making an informed decision. 5. Interstate Commerce: The trading activities took place in interstate commerce, which falls under federal jurisdiction. It's important to note that Phoenix Arizona Jury Instruction — 4.4.1 refers specifically to the violation of Rule 10(b) — 5(a) related to a device, scheme, or artifice to defraud in insider trading cases. However, there may be other provisions or rules, both at the federal and state levels, that address different aspects or variations of insider trading offenses, such as tipper/tipped liability, misappropriation theory, or trading based on material non-public information. In conclusion, Phoenix Arizona Jury Instruction — 4.4.1 Rule 10(b— - 5(a) serves as a guiding framework for judges, attorneys, and jurors in understanding the elements of the offense related to device, scheme, or artifice to defraud insider trading. This instruction ensures that a fair and comprehensive analysis of the case is conducted, considering the complexities involved in prosecuting and adjudicating matters related to insider trading within the jurisdiction of Phoenix, Arizona.

Phoenix Arizona Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading

Description

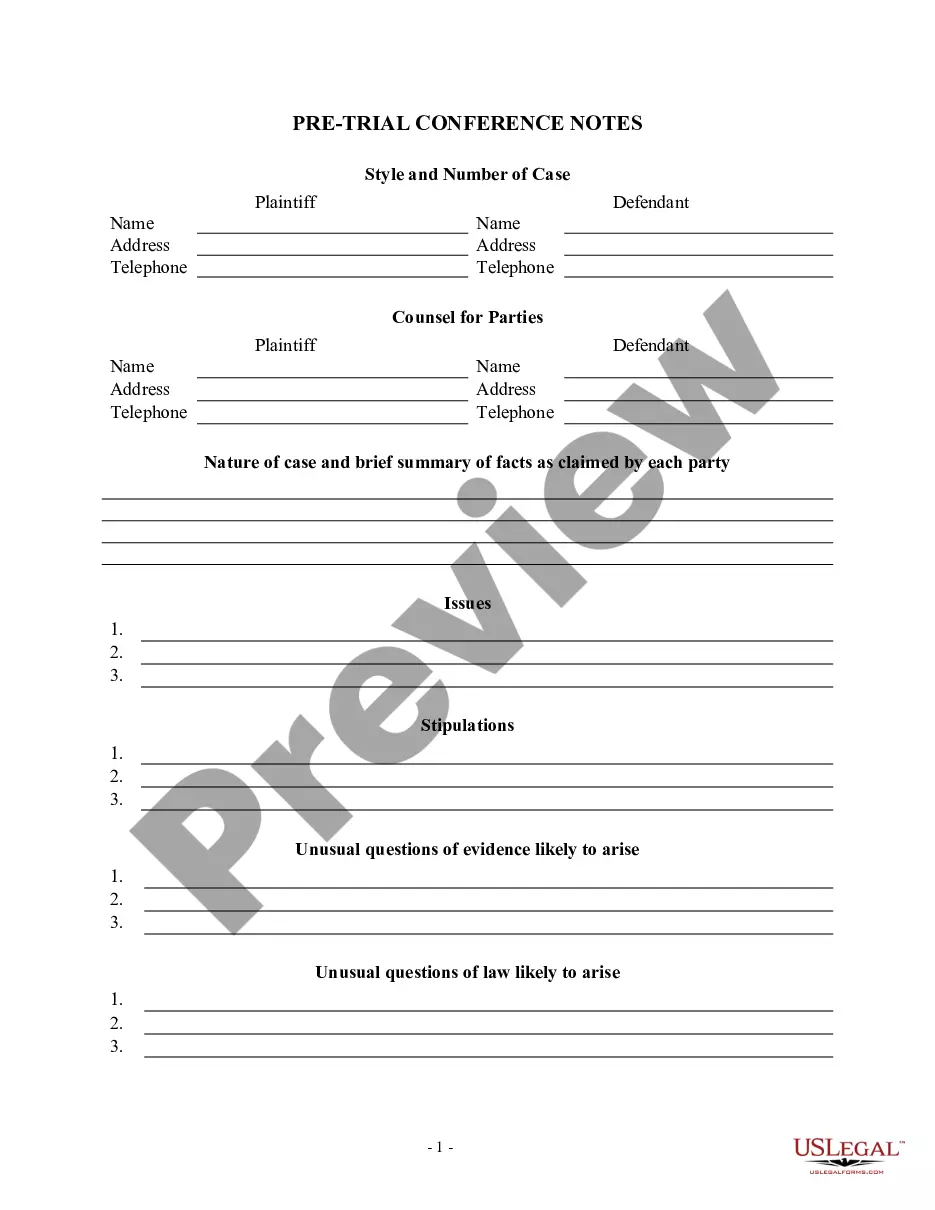

How to fill out Phoenix Arizona Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Phoenix Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Phoenix Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Phoenix Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading:

- Analyze the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!