Dallas Texas Jury Instruction — 4.4.3 Rule 10(b— - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning — Violation of Blue Sky Law and Breach of Fiduciary Duty: In Dallas, Texas, the jury instruction 4.4.3 related to Rule 10(b) — 5(c) pertains to a fraudulent practice or course of dealing in the context of stockbroker churning. This instruction addresses cases where a stockbroker engages in excessive trading or turnover of securities in a client's account without their authorization or with the intent to defraud, in violation of the Blue Sky Law and the broker's fiduciary duty. 1. Fraudulent Practice or Course of Dealing: This type of case involves a stockbroker's deceptive or fraudulent actions in handling a client's investments. It includes instances where the broker engages in excessive trading, known as churning, with the intention of generating excessive commissions at the expense of the client's investment returns. The instruction highlights the importance of establishing that the broker's actions were deceitful, manipulative, or fraudulent. 2. Violation of Blue Sky Law: The Blue Sky Law refers to state securities laws enacted to protect investors from fraudulent securities practices. This type of violation in the context of stockbroker churning involves the broker's non-compliance with the specific regulations and requirements set by the state's securities authorities. The instruction emphasizes the need to establish the broker's failure to adhere to the Blue Sky Law related to securities trading and investment. 3. Breach of Fiduciary Duty: Stockbrokers owe their clients a fiduciary duty, which requires acting in the best interests of the client and maintaining a high standard of care. This type of violation occurs when the stockbroker fails to act in the client's best interest, places their own financial interests above the client's, or engages in any activity that breaches their fiduciary duty. The instruction focuses on proving that the stockbroker breached their fiduciary duty to the client in the context of stockbroker churning. In summary, the Dallas Texas jury instruction 4.4.3 Rule 10(b) — 5(c) addresses cases involving fraudulent practices or courses of dealing in stockbroker churning, violations of the Blue Sky Law, and breaches of the stockbroker's fiduciary duty. These violations can significantly harm investors and undermine the integrity of the financial markets, making it essential to establish the elements of these offenses in order to seek appropriate legal remedies.

Dallas Texas Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty

Description

How to fill out Dallas Texas Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice Or Course Of Dealing Stockbroker Churning - Violation Of Blue Sky Law And Breach Of Fiduciary Duty?

Drafting documents for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft Dallas Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty without professional assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Dallas Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step instruction below to get the Dallas Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty:

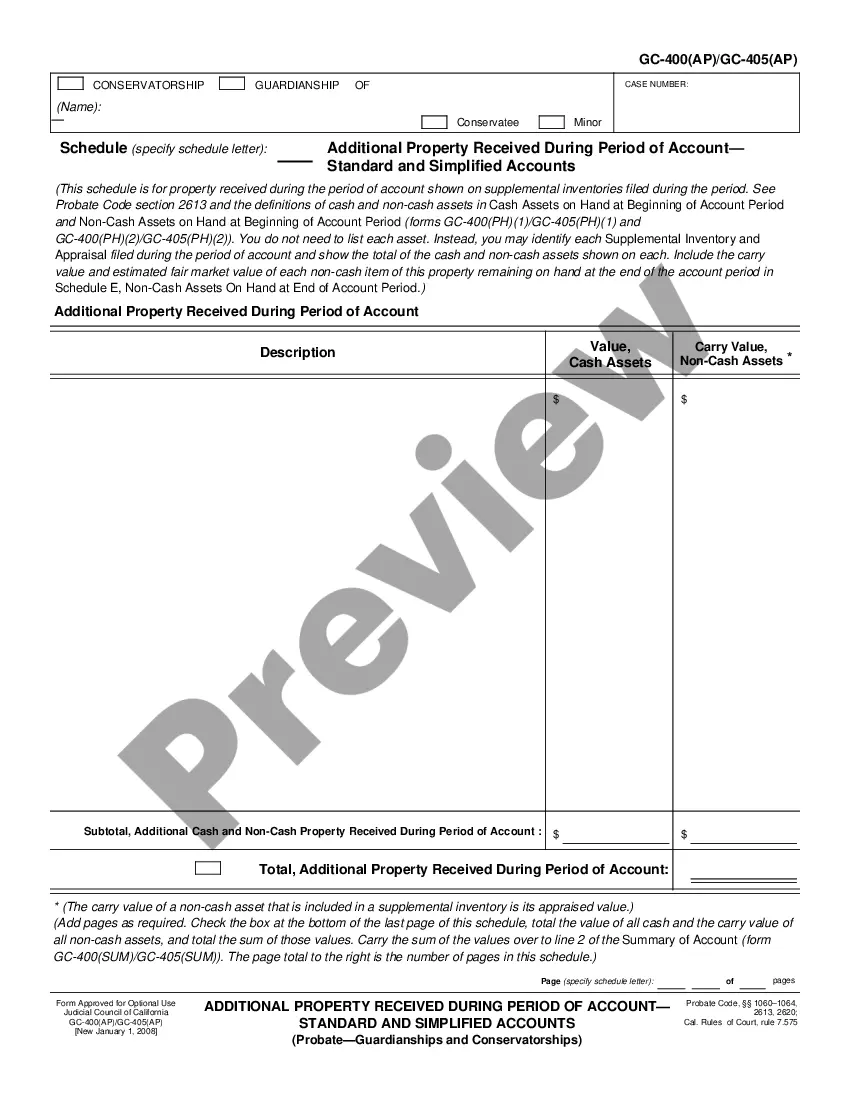

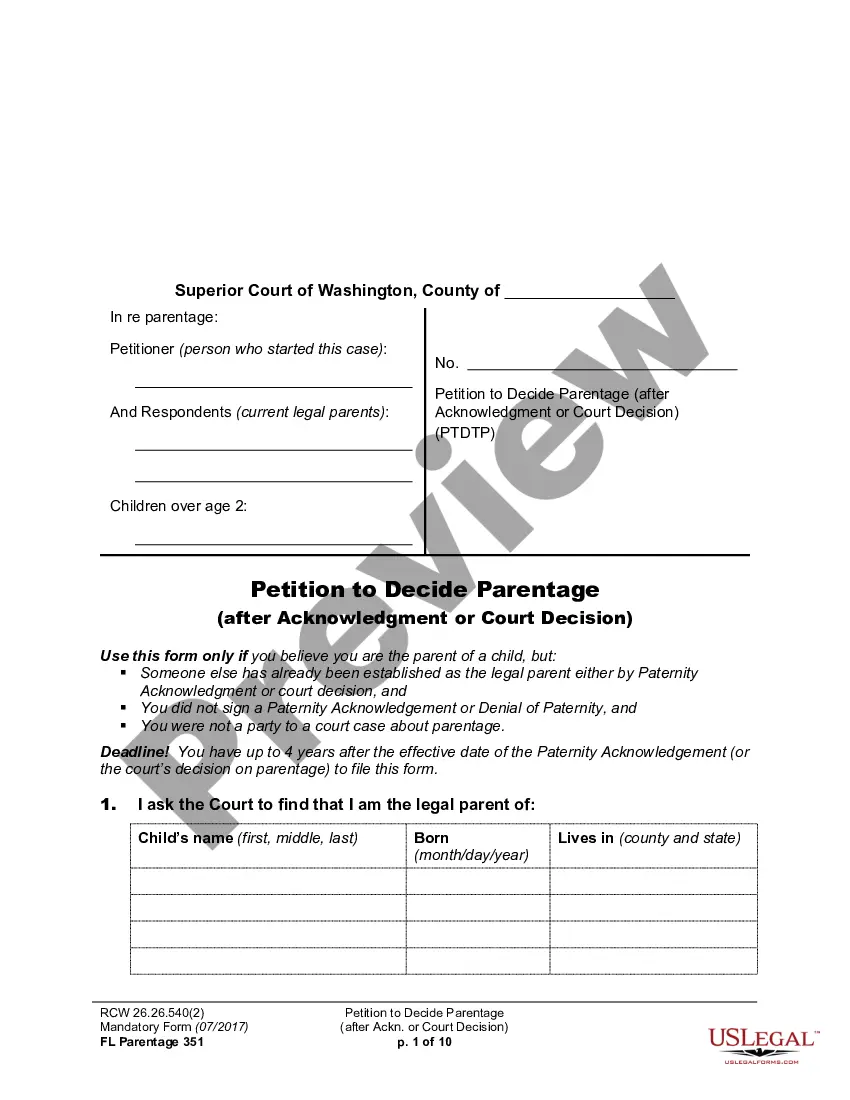

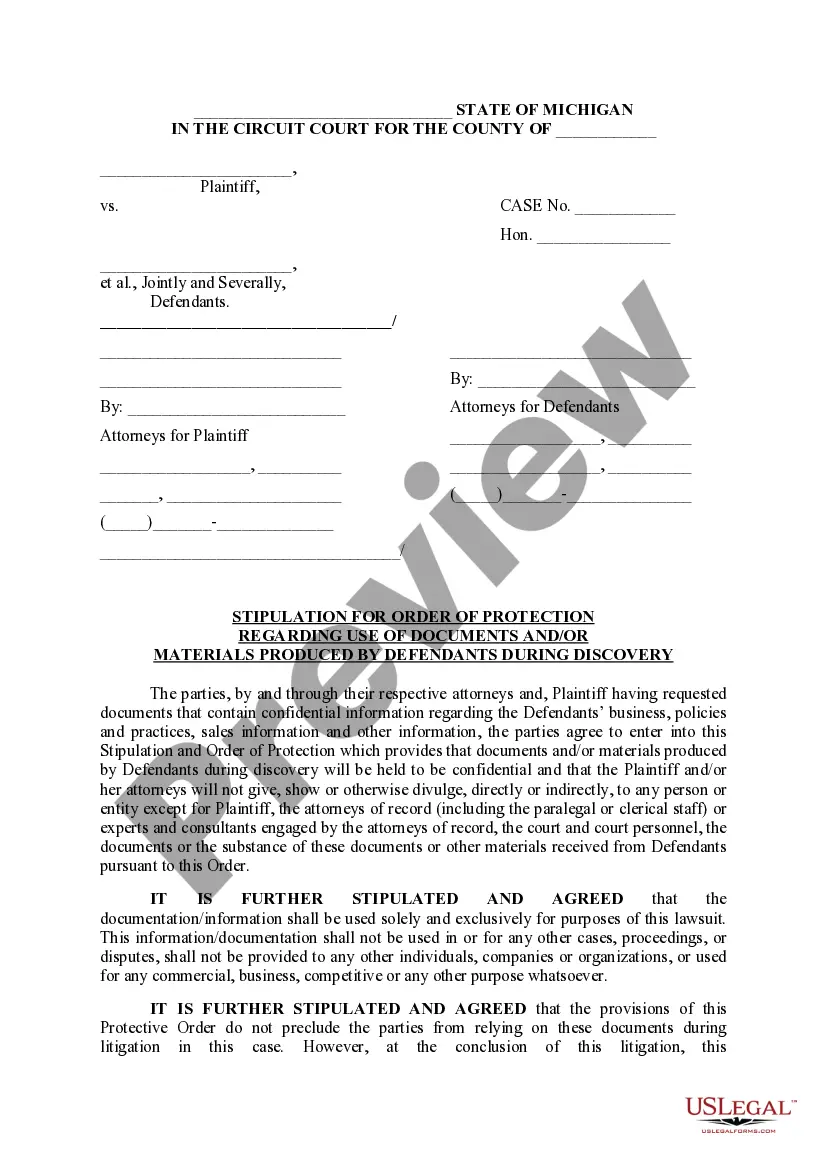

- Look through the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that suits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!

Form popularity

FAQ

Fiduciary duty is the requirement that certain professionals, like lawyers or financial advisors, work in the best financial interest of their clients. U.S. law dictates that members of certain professions who are doing business for certain clients be bound by fiduciary duty.

These exemptions include securities listed on national stock exchanges (part of an effort by federal regulators to streamline the oversight process where possible). Offerings that fall under Rule 506 of Regulation D of the Securities Act of 1933, for example, qualify as ?covered securities? and are also exempt.

Blue sky laws typically require the registration of any securities sold in a state, regulate broker-dealer and investment advisers, impose liability for false and misleading information relating to securities, and establish administrative agencies to enforce the laws.

Blue sky laws are federal securities regulations that are designed to protect investors from highly risky investments and nefarious practices by people who sell investments.

More specifically, fiduciary financial advisors must: Put their client's best interests before their own, seeking the best prices and terms. Act in good faith and provide all relevant facts to clients. Avoid conflicts of interest and disclose any potential conflicts of interest to clients.

Non-Fiduciary Advisor. Your best bet for finding a fiduciary is to look for a fee-only advisor. These advisors receive compensation solely from their clients through a flat or hourly rate, or an assets under management fee (a percentage based on the amount of assets they manage for you).

RIAs are registered with either the U.S. Securities and Exchange Commission (SEC) or state securities administrators. RIAs have fiduciary obligations to their clients, meaning that they have a fundamental duty to always and only provide investment advice that is in their client's best interests.

A fiduciary is any professional who is upheld to a fiduciary standard ? meaning the person must act in your best interest ? and can include financial advisors, attorneys, guardians and other professionals. Fiduciary duty entails always acting in your beneficiary's best interest, even if doing so is contrary to yours.

RIAs have a fiduciary duty to their clients. This means they're obligated to always act in your best financial interest and to offer the lowest-cost products that fit your needs. Non-RIA financial advisors, such as broker-dealers, may only have to offer advice that is suitable to clients.

Blue Sky Law Exemptions: Rule 504 and Rule 506 There are exceptions to the Blue Sky laws which may apply to your business. While the legal intricacies of security registration are complex, private companies and startups often fall under the ?covered securities? category, which is exempt from Blue Sky laws.