Nassau New York Jury Instruction 4.4.3 Rule 10(b)-5© Fraudulent Practice or Course of Dealing Stockbroker Churning — Violation of Blue Sky Law and Breach of Fiduciary Duty In Nassau, New York, the jury instruction 4.4.3 Rule 10(b)-5(c) addresses the deceptive actions taken by stockbrokers known as churning. This fraudulent practice involves excessive trading of a client's account, driven by the broker's desire to generate commissions rather than acting in the client's best interest. Churning violates both federal securities laws and the state's Blue Sky Law, as well as breaching the fiduciary duty that stockbrokers owe to their clients. Churning occurs when a stockbroker makes unauthorized trades in a client's account or excessively buys and sells securities, not for the purpose of achieving the client's financial goals, but rather to generate excessive commissions or fees for themselves. The broker manipulates the client's account through aggressive trading strategies, such as purchasing and selling securities frequently within a short period, with little regard for the potential negative impact on the client's portfolio. By engaging in churning, the stockbroker not only violates the federal securities' law, specifically Rule 10(b)-5(c) of the Securities Exchange Act of 1934, but also breaches their fiduciary duty to act in the best interests of the client. This breach of fiduciary duty is further compounded by the violation of the Blue Sky Law, a state-level statute that aims to protect investors from fraudulent practices in the sale of securities. The Nassau New York Jury Instruction 4.4.3 Rule 10(b)-5(c) provides guidance to the jury on how to evaluate a case involving stockbroker churning and violation of Blue Sky Law. It outlines the elements necessary to establish a claim of fraudulent practice or course of dealing, including: 1. Excessive trading: The plaintiff must demonstrate that the stockbroker engaged in excessive trading, as evidenced by the volume of trades made within a specific timeframe. 2. Intent: The plaintiff should prove the stockbroker's intent to deceive or defraud the client, typically by demonstrating the disproportionality between the generated commissions and the actual benefit to the client's account. 3. Material misrepresentations or omissions: The plaintiff must show that the stockbroker made false statements or failed to disclose material information regarding the risks, costs, or potential returns associated with the recommended trades. 4. Breach of fiduciary duty: The plaintiff needs to establish that the stockbroker breached their fiduciary duty by not acting in the client's best interests and prioritizing their own gains instead. If proven, stockbroker churning and violation of Blue Sky Law can lead to significant financial losses for the investor. Therefore, it is crucial for investors in Nassau, New York, to remain vigilant and seek legal recourse if they suspect they have been victims of churning or fraudulent practices.

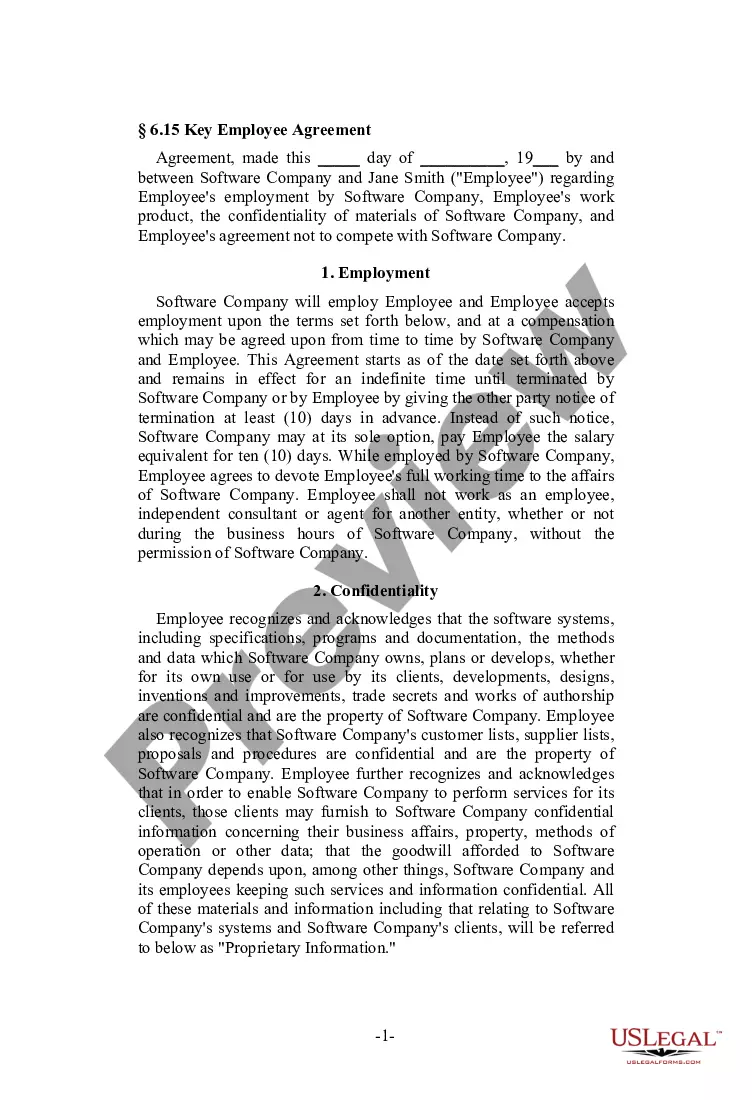

Nassau New York Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty

Description

How to fill out Nassau New York Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice Or Course Of Dealing Stockbroker Churning - Violation Of Blue Sky Law And Breach Of Fiduciary Duty?

If you need to find a trustworthy legal paperwork supplier to find the Nassau Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty, consider US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting resources, and dedicated support make it simple to locate and complete various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply type to search or browse Nassau Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty, either by a keyword or by the state/county the form is created for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Nassau Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and select a subscription option. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less expensive and more reasonably priced. Set up your first business, arrange your advance care planning, draft a real estate agreement, or execute the Nassau Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty - all from the comfort of your home.

Sign up for US Legal Forms now!