Title: Harris Texas Jury Instruction — Concealment of Property Belonging to Bankruptcy Estate of Debtor: A Detailed Overview Keywords: Harris Texas, jury instruction, concealment of property, bankruptcy estate, debtor. Introduction: In the legal proceedings of bankruptcy cases, Harris Texas provides specific jury instructions to guide the deliberations and decision-making process. One such instruction is related to the "Concealment of Property Belonging to Bankruptcy Estate of Debtor." This instruction is crucial for ensuring fair and just outcomes by addressing instances where debtors may try to hide assets to evade their obligations. In this article, we will explore the intricacies of this particular jury instruction while highlighting its significance in bankruptcy litigation. Types of Harris Texas Jury Instruction — Concealment of Property Belonging to Bankruptcy Estate of Debtor: 1. General Concealment Instruction: The general concealment instruction aims to inform the jury about the essential aspects of property concealment within a bankruptcy estate. It details the specific elements required to establish concealment, such as deliberate actions to hide assets, intent to defraud creditors, and the impact on the bankruptcy estate as a whole. 2. Elements of Concealment: This type of instruction breaks down the essential elements the jury must consider when assessing a concealment claim. It typically includes factors like the debtor's knowledge regarding property ownership, the existence of transfer or sale of property, misrepresentations made about assets, and any other relevant evidence that may indicate a deliberate attempt to conceal property from the bankruptcy estate. 3. Burden of Proof and Reasonable Doubt: These instructions clarifies the burden of proof placed on the party accusing the debtor of concealing property belonging to the bankruptcy estate. It emphasizes the importance of establishing each element of concealment beyond a reasonable doubt, which is the standard required for conviction in a criminal case. 4. Defenses to Concealment Claims: This instruction educates the jury about potential defenses the debtor may present for concealing property. Common defenses include lack of intent to defraud creditors, innocent mistakes or misunderstandings, or an absence of evidence proving concealment. The jury must carefully assess these defenses and weigh them against the prosecution's evidence. 5. Consequences of Concealment: This instruction explains the legal implications of finding the debtor guilty of concealing property. It may address the consequences of such actions, including penalties, fines, potential criminal charges, and the impact on the debtor's bankruptcy case, such as the denial of discharge or the rejection of the proposed repayment plan. Conclusion: The Harris Texas Jury Instruction — Concealment of Property Belonging to Bankruptcy Estate of Debtor plays a vital role in guiding the jury's decision-making process in bankruptcy cases. By outlining the required elements and potential defenses, this instruction ensures fair proceedings and helps protect the rights of creditors and the integrity of the bankruptcy process. Understanding the nuances of these instructions is crucial for legal professionals involved in bankruptcy litigation in Harris Texas.

Harris Texas Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor

Description

How to fill out Harris Texas Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor?

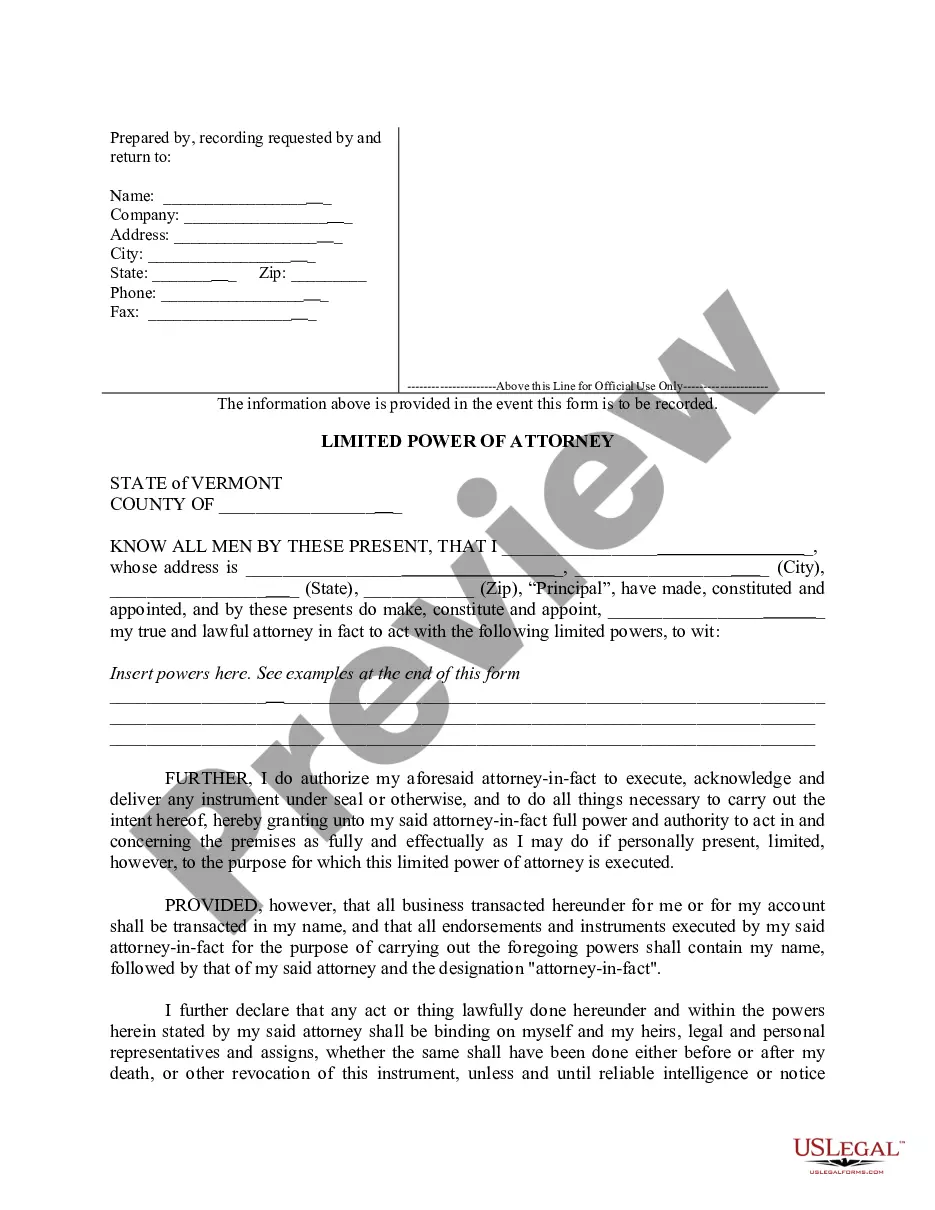

Preparing legal documentation can be burdensome. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Harris Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the Harris Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Harris Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Harris Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Definition of concealed asset : a tangible or intangible asset that is not reflected on the balance sheet in accounting or finance or that is carried at nominal value (as stock of a subsidiary or a valuable patent)

Prior studies have not consistently distinguished between various disclosure-related constructs such as nondisclosure or concealment; the former describes a global lack of openness around a given identity, while the latter involves deliberate efforts to suppress, hide, or otherwise prevent discovery of this information

In a bankruptcy setting, ?concealment of property? refers to the act of a debtor dishonestly representing their assets to a creditor. A debtor's actions that hinder or delay creditors' efforts may constitute the concealment of property.

Concealment is the act of intentionally or unintentionally not revealing information that should be disclosed and would otherwise affect the terms or creation of a contract. A concealment can occur through either purposeful misrepresentation or withholding of material facts.

Understanding Concealment Concealment technically consists of neglecting to provide information that, if presented, would change the terms of the policy. Misrepresentation involves actively providing incorrect information to an insurance agent when purchasing a policy.

Concealment is the act of intentionally or unintentionally not revealing information that should be disclosed and would otherwise affect the terms or creation of a contract. A concealment can occur through either purposeful misrepresentation or withholding of material facts.

Penal Code 152 PC is the California statute that makes it a crime for a person to conceal, or attempt to conceal, an accidental death. To conceal includes such acts as. hiding a body, destroying evidence, or. hiding the objects or instruments that caused the accidental death.

Concealment is the process of disguising something or the condition of keeping something private. Secret agents need to focus on concealment all the time, of their identities and sometimes their hair color, citizenship, and activities.