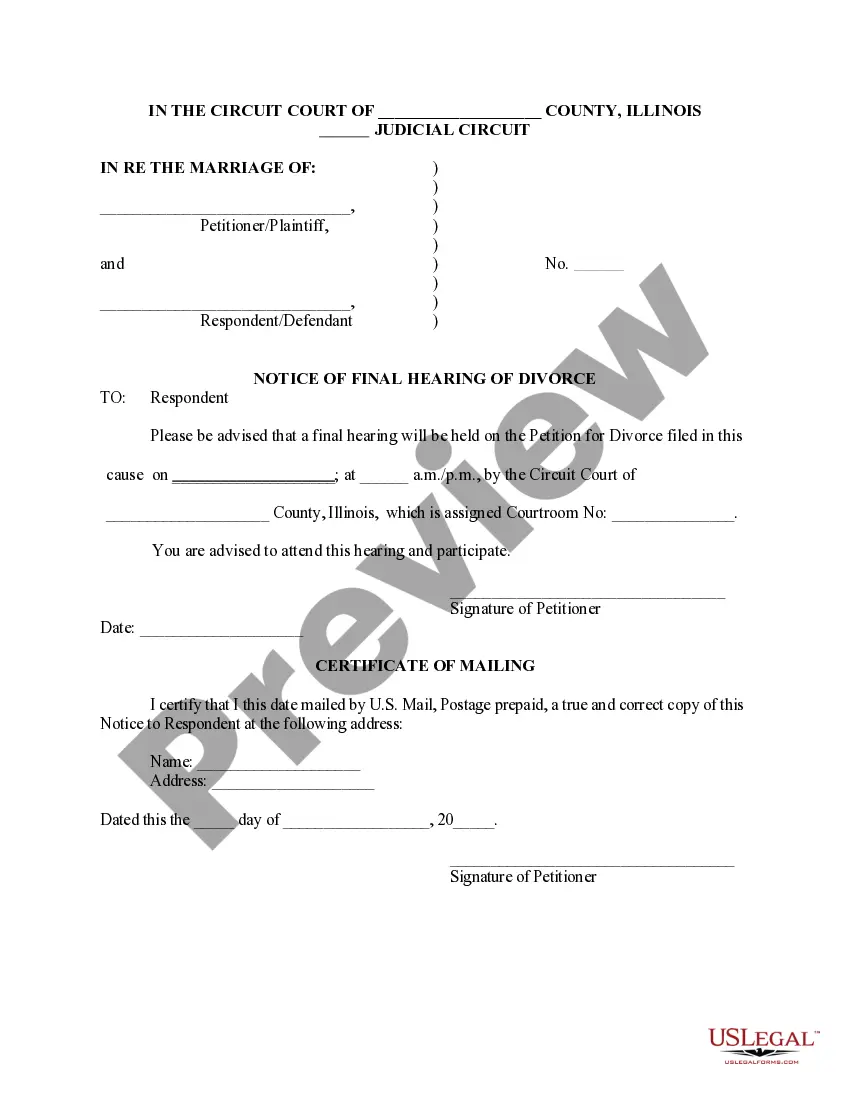

Franklin Ohio Jury Instruction — False Statement to Federal Agency is a legal instruction provided to a jury during a trial in Franklin, Ohio, regarding the offense of making false statements to a federal agency. This instruction highlights the specific elements, rules, and principles that the jury must consider while deliberating on such cases. In Franklin, Ohio, making false statements to a federal agency is considered a serious offense under federal law. This instruction helps educate the jury about the legal framework surrounding this offense and guides them in determining the guilt or innocence of the accused individual. The instruction covers various aspects of the offense, including the types of false statements, the federal agency involved, and the potential consequences. There are different types of Franklin Ohio Jury Instruction — False Statement to Federal Agency that may be applicable depending on the specific circumstances of the case. These instructions can be categorized based on the nature of the false statements or the federal agency involved: 1. Generic False Statement Instruction: This instruction provides a general overview of the offense, outlining the elements that the prosecution must prove beyond a reasonable doubt. It covers the federal law applicable to false statements made to any federal agency and the potential penalties associated with the crime. 2. IRS False Statement Instruction: This instruction specifically addresses false statements made to the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement. It explains the specific laws and regulations related to false statements made to the IRS and the potential legal consequences. 3. FBI False Statement Instruction: When false statements are made to the Federal Bureau of Investigation (FBI), this instruction focuses on the laws and principles relevant to the offense. It educates the jury about the significance of honest and accurate information provided to the FBI and the potential impact of false statements on national security and criminal investigations. 4. SEC False Statement Instruction: If false statements are related to securities or financial matters and made to the Securities and Exchange Commission (SEC), this instruction pertains to securities fraud, insider trading, or other financial crimes. It outlines the specific laws and regulations associated with false statements made to the SEC and emphasizes the importance of honesty in the financial sector. These are just a few examples of the types of Franklin Ohio Jury Instruction — False Statement to Federal Agency that may be encountered in relevant cases. It is important to note that specific instructions can vary based on the federal agency involved and the particular elements of the crime alleged. Each instruction aims to provide clarity and guidance to the jury in understanding the legal aspects of the offense and ensuring a fair and just trial.

Franklin Ohio Jury Instruction - False Statement To Federal Agency

Description

How to fill out Franklin Ohio Jury Instruction - False Statement To Federal Agency?

Creating paperwork, like Franklin Jury Instruction - False Statement To Federal Agency, to manage your legal matters is a tough and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can acquire your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms created for different scenarios and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Franklin Jury Instruction - False Statement To Federal Agency template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before downloading Franklin Jury Instruction - False Statement To Federal Agency:

- Make sure that your document is compliant with your state/county since the rules for writing legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Franklin Jury Instruction - False Statement To Federal Agency isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to begin utilizing our website and get the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!