Kings New York Jury Instruction — Fraud In Connection With Counterfeit Credit Cards Or Other Access Devices is a legal guideline provided to juries in Kings County, New York, to understand and determine cases related to fraud involving counterfeit credit cards or other unauthorized access devices. This instruction aims to guide jurors in comprehending the elements of the crime, evaluating evidence, and ultimately reaching a fair and just verdict. Fraud cases concerning counterfeit credit cards or unauthorized access devices are prevalent in today's technologically advanced world. Criminals exploit these devices to obtain financial gains or personal information illegally. Therefore, it is crucial for juries to be well-informed about the types of frauds associated with such counterfeit cards or access devices. The following are some types of frauds covered under this instruction: 1. Credit Card Fraud: This type of fraud involves the unauthorized use of a counterfeit credit card or a valid credit card without the owner's knowledge or consent. Criminals clone or counterfeit credit cards to make unauthorized transactions, often causing financial loss to individuals or institutions. 2. Identity Theft: Identity theft occurs when criminals use counterfeit credit cards or access devices to steal personal information, such as social security numbers or passwords. They may then use this stolen information to commit fraudulent activities, such as applying for loans or making purchases under the victim's name. 3. Skimming: Skimming is a fraudulent technique where criminals use devices to steal credit card information. These devices are often discreetly installed on legitimate card readers found at ATMs, gas stations, or retail stores. When individuals swipe their cards, the skimming device captures the card data, allowing criminals to create counterfeit cards with the stolen information. 4. Card Not Present Fraud: This type of fraud involves using stolen credit card information for online purchases or over the phone where the physical card is not required for the transaction. Criminals may obtain credit card data through phishing scams or data breaches and then use it to make unauthorized transactions. In cases alleging fraud in connection with counterfeit credit cards or other access devices, jurors should carefully evaluate the evidence and consider factors such as the defendant's intent, the presence or absence of valid authorization, and the financial harm caused to victims. The jury instruction provides a comprehensive framework to guide jurors through the complex nature of these cases, ensuring a fair trial and justice for all parties involved.

Kings New York Jury Instruction - Fraud In Connection With Counterfeit Credit Cards Or Other Access Devices

Description

How to fill out Kings New York Jury Instruction - Fraud In Connection With Counterfeit Credit Cards Or Other Access Devices?

Preparing papers for the business or personal needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to draft Kings Jury Instruction - Fraud In Connection With Counterfeit Credit Cards Or Other Access Devices without expert assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Kings Jury Instruction - Fraud In Connection With Counterfeit Credit Cards Or Other Access Devices on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Kings Jury Instruction - Fraud In Connection With Counterfeit Credit Cards Or Other Access Devices:

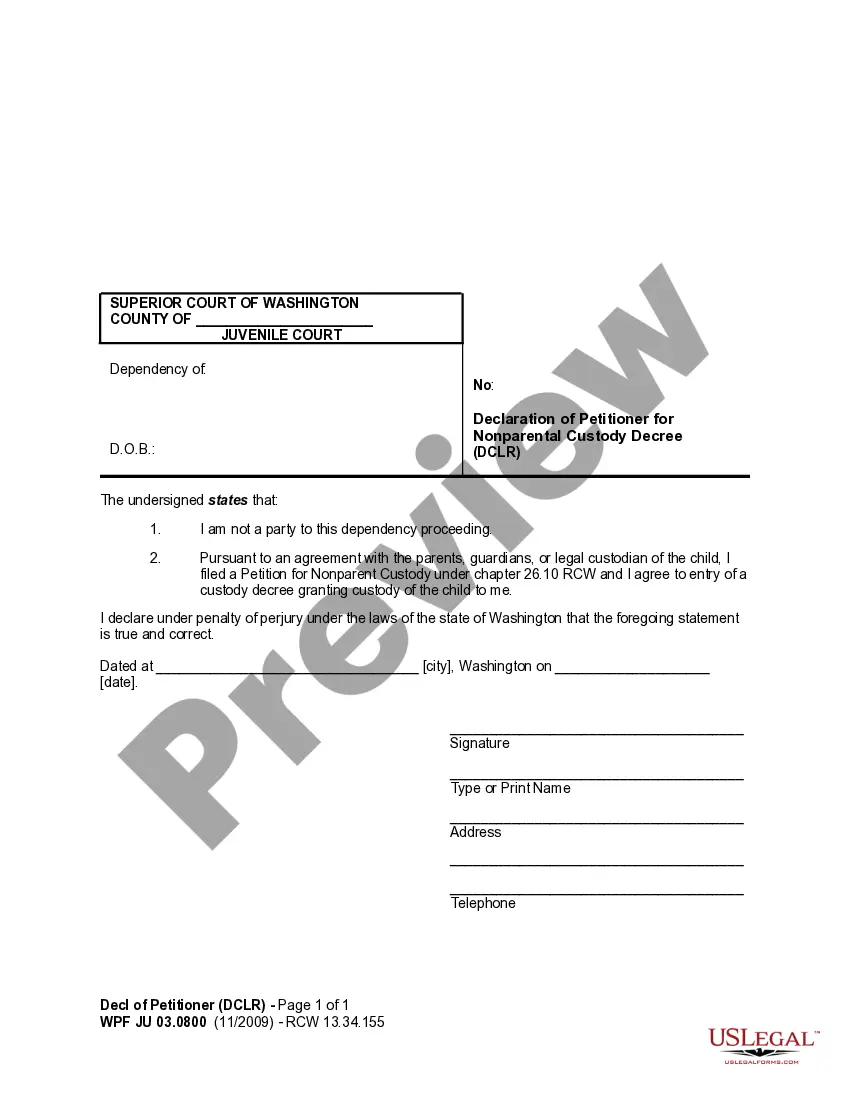

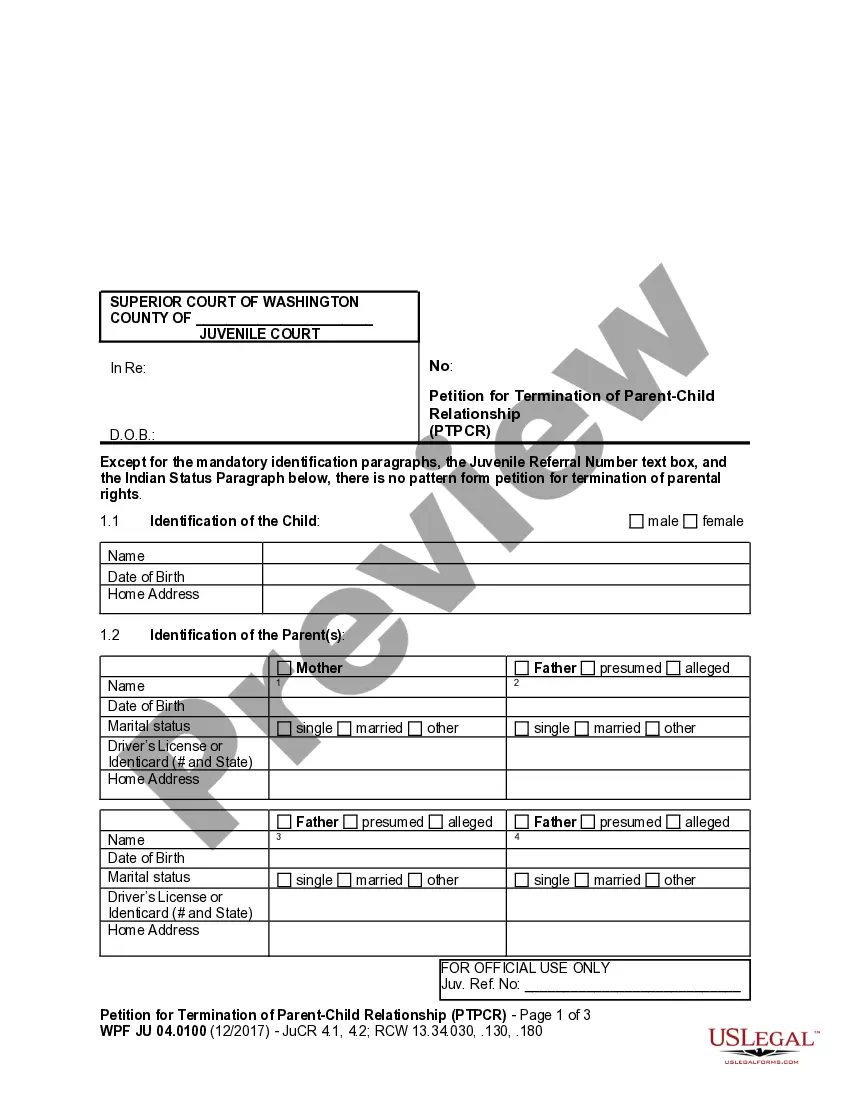

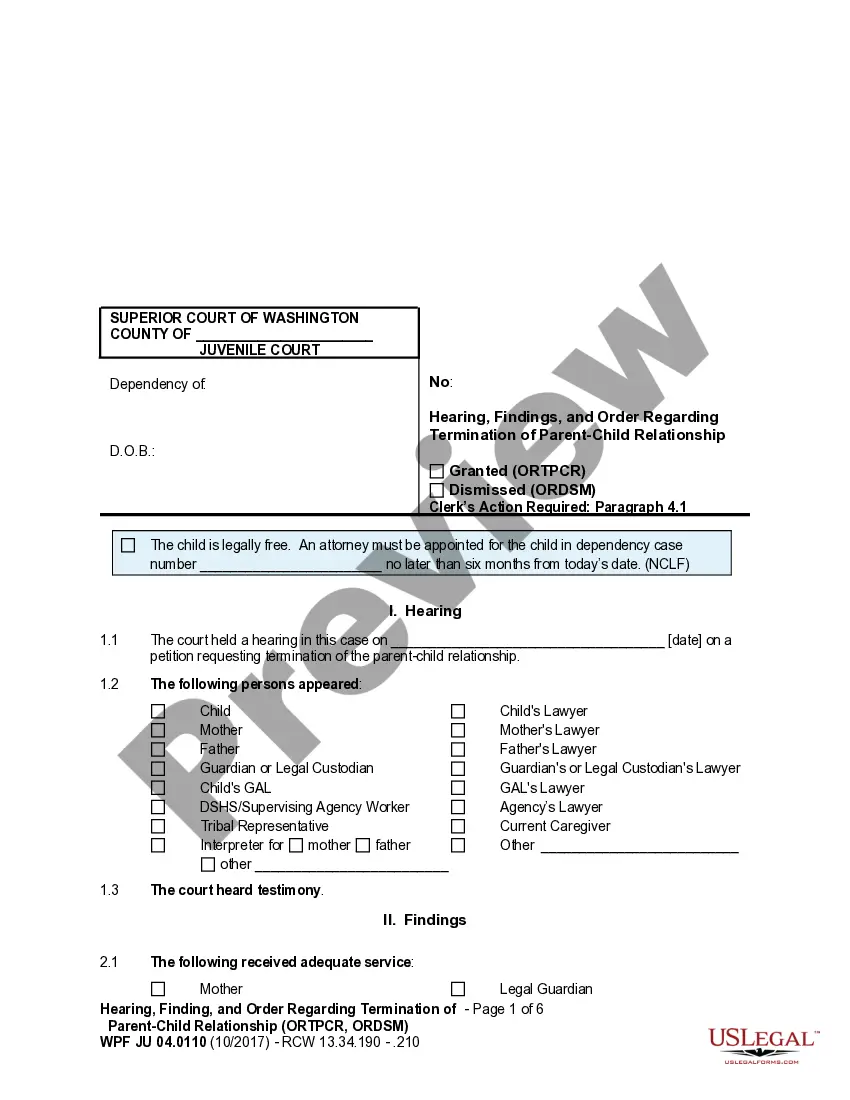

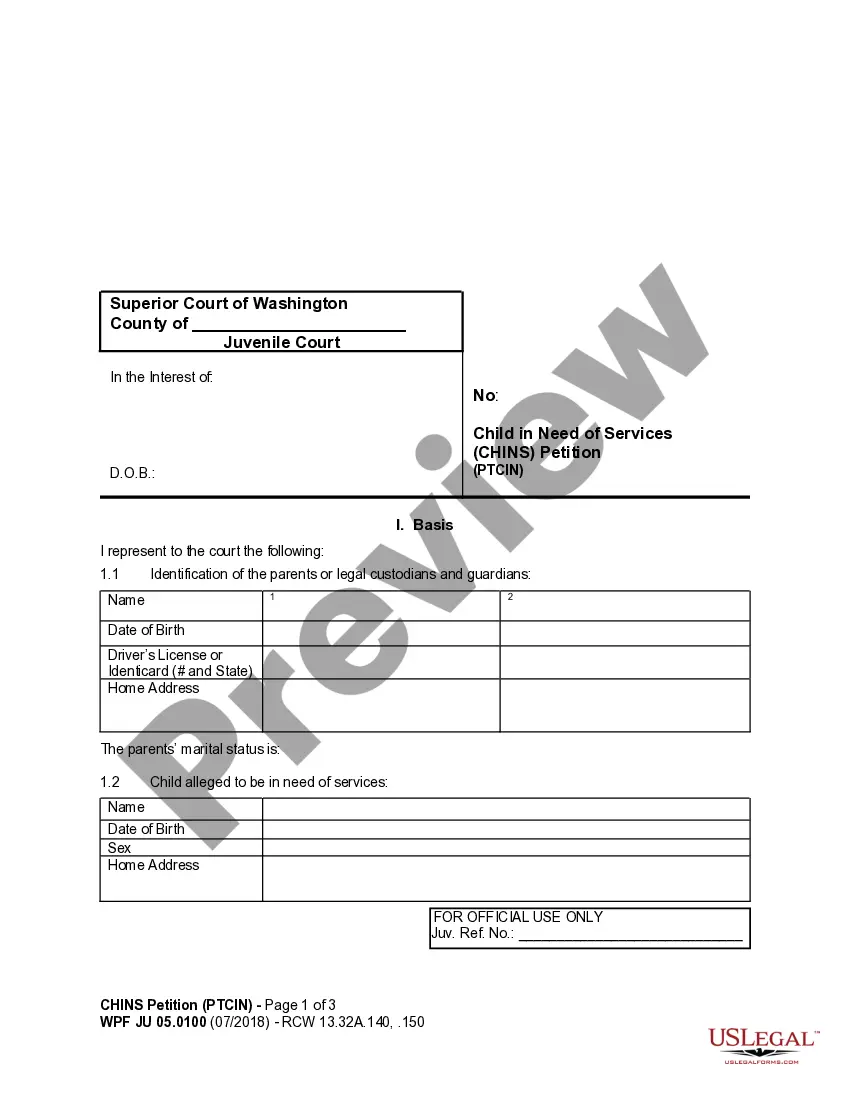

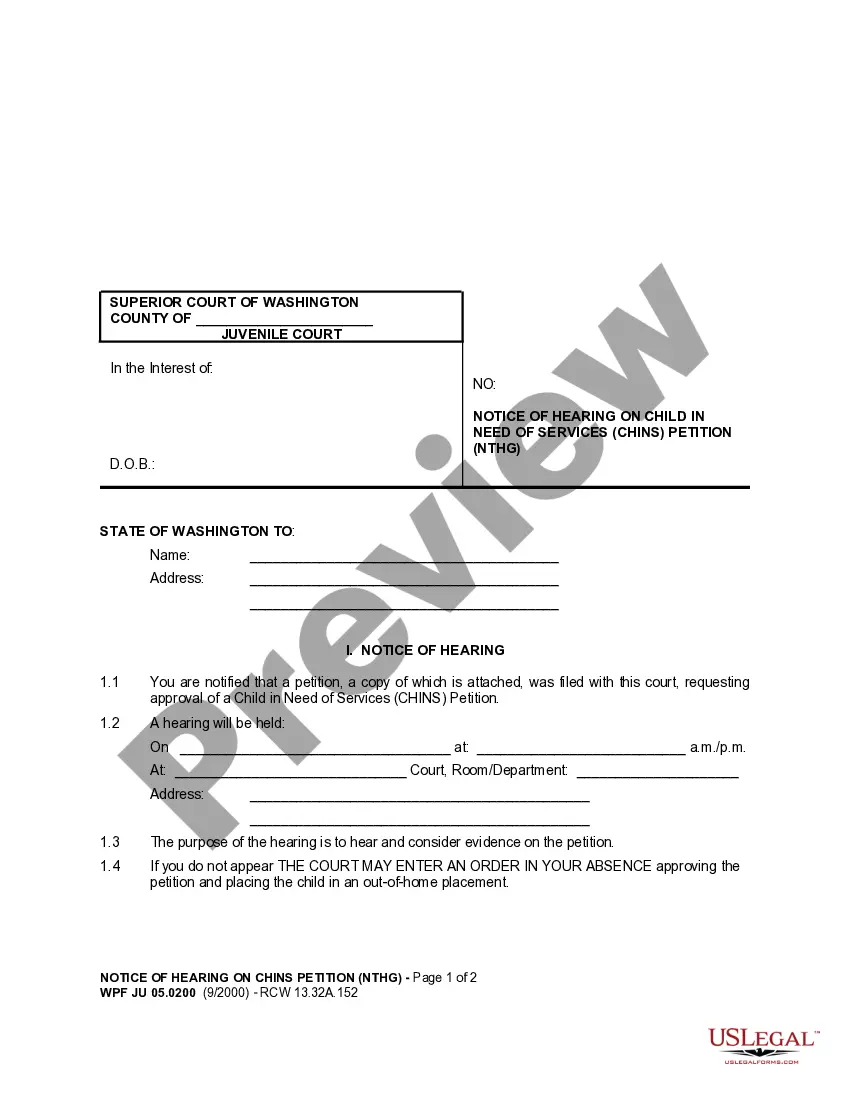

- Look through the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that suits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a couple of clicks!