Fairfax Virginia Jury Instruction — Possession Or Transfer Of Non-Tax-Paid Distilled Spirits is a legal guideline provided to the jury in Fairfax, Virginia, when dealing with cases related to the possession or transfer of non-tax-paid distilled spirits. This instruction outlines the legal requirements, elements, and relevant considerations for the jury to consider during the trial. Understanding this specific jury instruction is crucial to correctly applying the law in cases involving non-tax-paid distilled spirits. Here are some relevant details worth considering: 1. Possession of Non-Tax-Paid Distilled Spirits: This section of the jury instruction focuses on cases where individuals are found to be in possession of non-tax-paid distilled spirits. It outlines the legal elements necessary to establish possession and highlights potential defenses or mitigating factors. 2. Transfer of Non-Tax-Paid Distilled Spirits: Another type of Fairfax Virginia jury instruction may address cases involving the transfer or sale of non-tax-paid distilled spirits. This instruction typically covers the legal requirements for establishing the act of transfer and the corresponding penalties or liabilities associated with such actions. 3. Legal Elements: The jury instruction will emphasize the key elements that the prosecution must prove beyond a reasonable doubt in order to secure a conviction. This could include proving the defendant’s knowledge of the non-tax-paid status of the distilled spirits, intent to possess or transfer, and the specific quantity or volume involved. 4. Defenses and Mitigating Factors: The instruction may also discuss potential defenses available to the accused. For instance, if the defendant can prove they were unaware of the non-tax-paid status, lacked intent to possess or transfer, or were not aware of the nature of the alcoholic beverage, it could potentially influence the jury's decision. 5. Penalties and Consequences: This instruction is likely to mention the potential penalties and consequences that individuals may face if found guilty. This could include fines, probation, community service, or even imprisonment depending on the severity of the offense and any prior convictions. Legal proceedings involving non-tax-paid distilled spirits can be complex, and these jury instructions provided by Fairfax County, Virginia, are designed to ensure a fair and accurate trial. Jurors are instructed to carefully review all the evidence and consider the specific elements outlined in the instructions before arriving at a verdict. Please note that the specific content and structure of these jury instructions may vary depending on the particular case, local legal requirements, and any additional relevant considerations. It is essential to consult with legal professionals or refer to the official Fairfax jurisdiction resources for the most up-to-date and accurate information.

Fairfax Virginia Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits

Description

How to fill out Fairfax Virginia Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits?

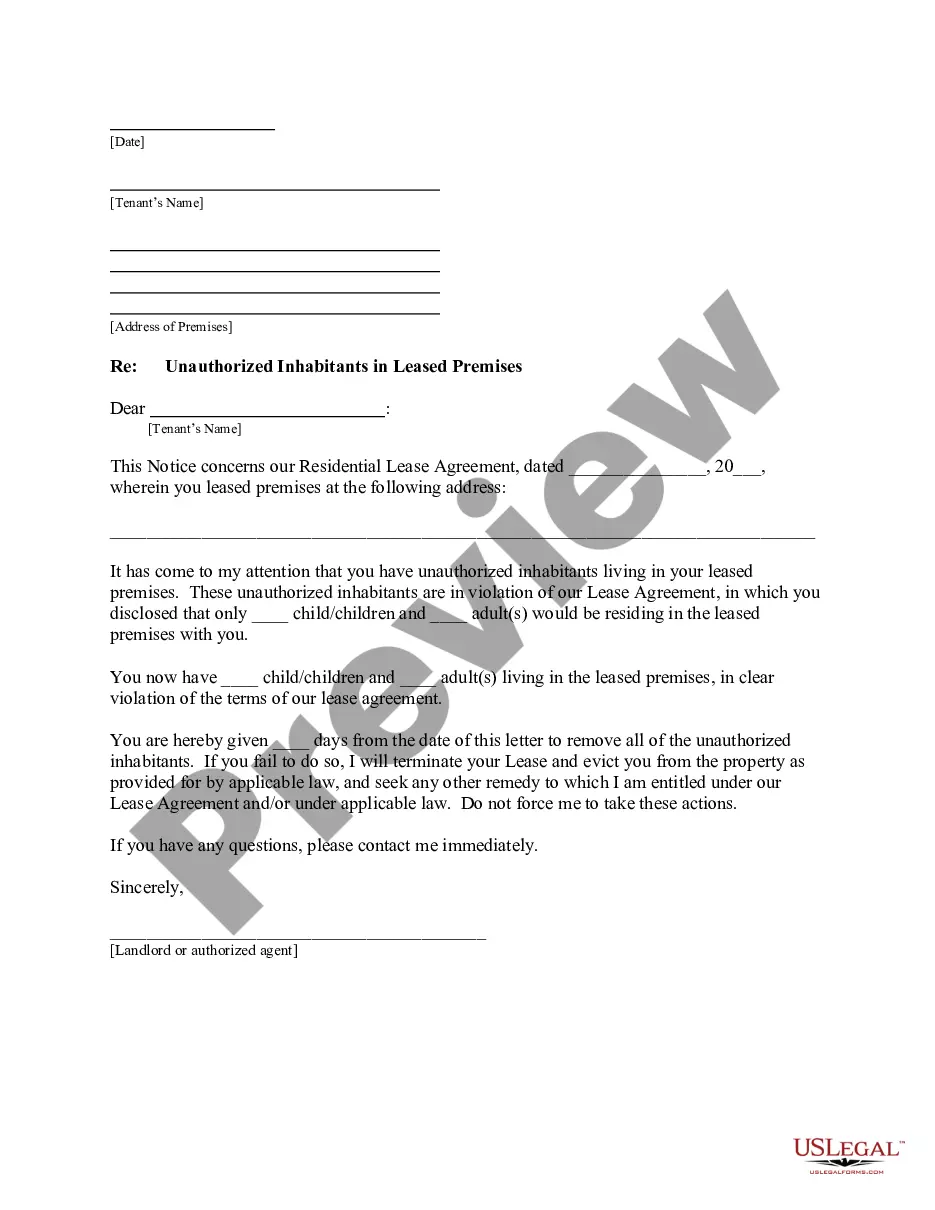

Whether you plan to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Fairfax Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Fairfax Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits. Follow the guidelines below:

- Make certain the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Fairfax Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!