San Diego California Jury Instruction — Possession Or Transfer Of Non-Tax-Paid Distilled Spirits Keywords: San Diego, California, jury instruction, possession, transfer, non-tax-paid distilled spirits Description: San Diego, located in Southern California, has specific jury instructions regarding the possession or transfer of non-tax-paid distilled spirits. These instructions are provided to juries during trials related to cases involving the illegal possession or transfer of untamed alcoholic beverages within the jurisdiction of San Diego County. The possession or transfer of non-tax-paid distilled spirits is a serious offense in San Diego, as it violates state and federal laws governing the taxation and regulation of alcoholic beverages. These jury instructions help ensure that juries understand the legal implications and requirements associated with such cases. Types of San Diego California Jury Instruction — Possession Or Transfer Of Non-Tax-Paid Distilled Spirits: 1. Instruction on Possession of Non-Tax-Paid Distilled Spirits: This instruction explains the legal definition of possession and the necessary elements that must be proven to establish possession of untamed alcoholic spirits. It outlines the burden of proof for the prosecution and provides guidance for jurors to consider when evaluating whether a defendant had possession of non-tax-paid distilled spirits in their control. 2. Instruction on Transfer of Non-Tax-Paid Distilled Spirits: This instruction focuses on the illegal transfer or sale of non-tax-paid distilled spirits. It highlights the key elements required to prove a transfer, including evidence of the intent to sell or distribute untamed alcoholic beverages. Jurors are instructed to carefully analyze the evidence presented, assess witness credibility, and determine if there is sufficient proof of the accused's involvement in the transfer or sale of these spirits. 3. Instruction on Intent in Possession or Transfer Cases: In cases involving possession or transfer of non-tax-paid distilled spirits, the issue of intent is crucial. This jury instruction provides guidance on how jurors should evaluate evidence related to the defendant's mental state and intentions. It explains the concept of specific intent and its relevance in determining guilt or innocence. Jurors are instructed to assess whether the defendant's actions were willful, deliberate, and carried out with the intent to evade taxes or regulations on distilled spirits. These San Diego California jury instructions aim to educate juries about the specific legal elements and nuances of possessing or transferring non-tax-paid distilled spirits. By providing clear instructions, the court ensures a fair trial process and enables jurors to make informed decisions based on the presented evidence and applicable laws.

San Diego California Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits

Description

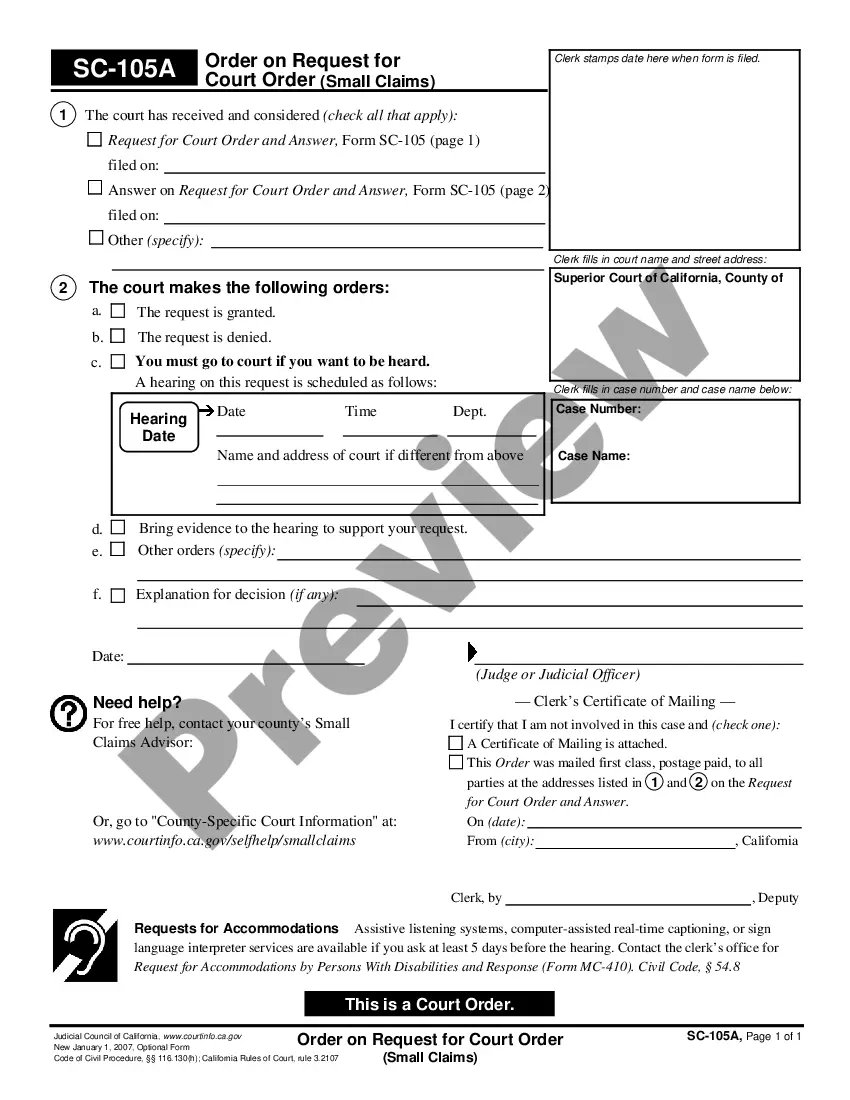

How to fill out San Diego California Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits?

Whether you intend to open your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like San Diego Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the San Diego Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits. Follow the guidelines below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!