Alameda California Jury Instruction — TaEvasionio— - General Charge is a set of instructions provided to the jury in a tax evasion case in Alameda, California. It encompasses all the essential elements and guidelines that the jury needs to consider while determining the guilt or innocence of the defendant. Keywords: Alameda, California, jury instruction, tax evasion, general charge. Types of Alameda California Jury Instruction — TaEvasionio— - General Charge: 1. Basic Elements of Tax Evasion: This instruction outlines the basic elements necessary to prove tax evasion, including willfulness, attempt to evade or defeat taxes, and the existence of a tax due and owing. 2. Concealment of Income Instruction: This instruction focuses on the concealment of income as a key component of tax evasion. It explains that deliberate acts of concealing or failing to report income can be considered evidence of intent to evade taxes. 3. False Statements and Fraudulent Documents Instruction: This instruction highlights the use of false statements and fraudulent documents as evidence of tax evasion. It explains that the creation, use, or submission of false documents or statements can be indicative of a willful attempt to evade taxes. 4. Tax Evasion and Tax Protester Instruction: This instruction clarifies the distinction between legitimate tax protest activities and illegal tax evasion. It guides the jury on differentiating between lawful dissent and the intentional violation of tax laws. 5. Conscious Avoidance of Knowledge Instruction: This instruction addresses the concept of conscious avoidance and its relevance to tax evasion cases. It explains that if a defendant deliberately avoids learning about their tax obligations to evade taxes, it can still be considered willful conduct. 6. Burden of Proof Instruction: This instruction informs the jury about the burden of proof in a tax evasion case. It explains that the government has the burden of proving the defendant's guilt beyond a reasonable doubt. 7. Reasonable Doubt Instruction: This instruction emphasizes the importance of reasonable doubt in reaching a verdict. It explains that if the jury has a reasonable doubt about the defendant's guilt, they must find the defendant not guilty. These instructions play a vital role in guiding the jury's decision-making process and ensuring a fair trial in tax evasion cases in Alameda, California.

Alameda California Jury Instruction - Tax Evasion - General Charge

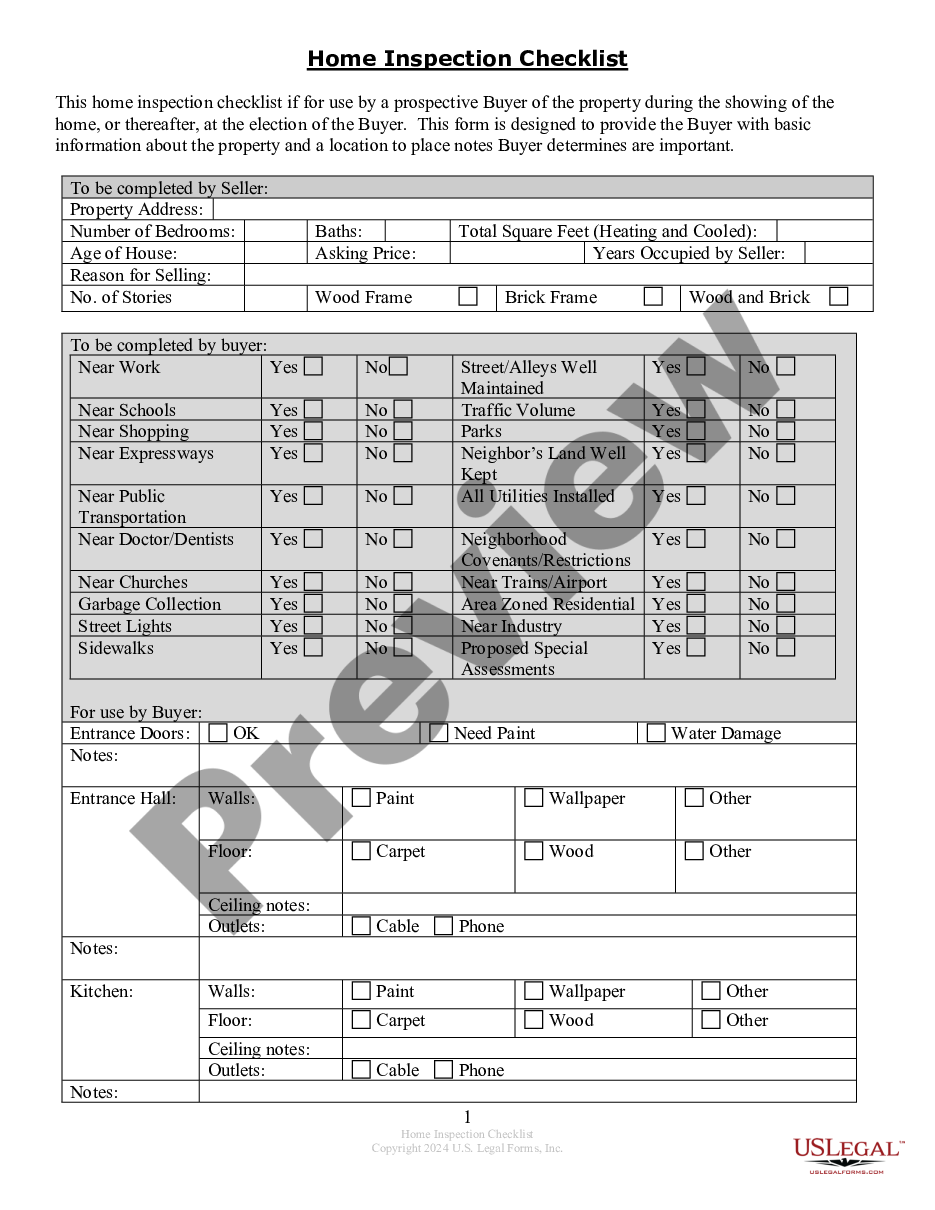

Description

How to fill out Alameda California Jury Instruction - Tax Evasion - General Charge?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life sphere, locating a Alameda Jury Instruction - Tax Evasion - General Charge meeting all local requirements can be stressful, and ordering it from a professional attorney is often costly. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Aside from the Alameda Jury Instruction - Tax Evasion - General Charge, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Alameda Jury Instruction - Tax Evasion - General Charge:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Alameda Jury Instruction - Tax Evasion - General Charge.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!