Contra Costa California Jury Instruction — TaEvasionio— - General Charge provides guidance to jurors regarding the elements and considerations involved in a tax evasion case. This instruction helps the jury understand the legal framework and evidence required to establish the guilt of a defendant accused of tax evasion in Contra Costa County, California. Keywords: Contra Costa California, jury instruction, tax evasion, general charge, elements, evidence, guilt, defendant, Contra Costa County. Various types of Contra Costa California Jury Instruction — TaEvasionio— - General Charge include: 1. Standard Elements Instruction: This instruction outlines the essential elements that must be proven beyond a reasonable doubt in a tax evasion case. It typically includes elements such as willful attempt to evade or defeat tax, underreporting income, filing false returns, and affirmative acts indicating an intent to deceive the IRS. 2. Burden of Proof Instruction: This instruction explains to the jury that the burden of proof rests with the prosecution to prove the defendant's guilt beyond a reasonable doubt. It emphasizes that the defendant is presumed innocent until proven guilty, and that the jury must be convinced of the defendant's guilt based on the evidence presented. 3. Evidence Instructions: These instructions provide guidance on the types of evidence that can be considered by the jury in determining the guilt of the defendant. It may cover the admissibility of documents, witness testimonies, expert opinions, and other relevant evidence. The instruction may also address the credibility of witnesses and the weight given to particular evidence. 4. Jury Deliberation Instruction: This instruction guides the jury on their duty to deliberate upon the evidence presented during the trial. It reminds jurors to consider only the evidence presented in court and to set aside any personal biases or prejudices during their deliberations. It may also instruct jurors on the process of reaching a unanimous verdict. 5. Lesser Included Offenses Instruction: In some cases, the jury may be provided with instructions regarding lesser offenses related to tax evasion. These instructions inform the jury of alternatives to the main charge, such as misdemeanor failure to file a tax return or negligence in reporting income. Contra Costa California Jury Instruction — TaEvasionio— - General Charge plays a crucial role in ensuring a fair trial and the defendant's right to a jury of their peers. It provides the framework for jurors to evaluate the evidence and determine whether the prosecution has met its burden of proving the defendant's guilt beyond a reasonable doubt.

Contra Costa California Jury Instruction - Tax Evasion - General Charge

Description

How to fill out Contra Costa California Jury Instruction - Tax Evasion - General Charge?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a lawyer to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Contra Costa Jury Instruction - Tax Evasion - General Charge, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Therefore, if you need the latest version of the Contra Costa Jury Instruction - Tax Evasion - General Charge, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Contra Costa Jury Instruction - Tax Evasion - General Charge:

- Look through the page and verify there is a sample for your area.

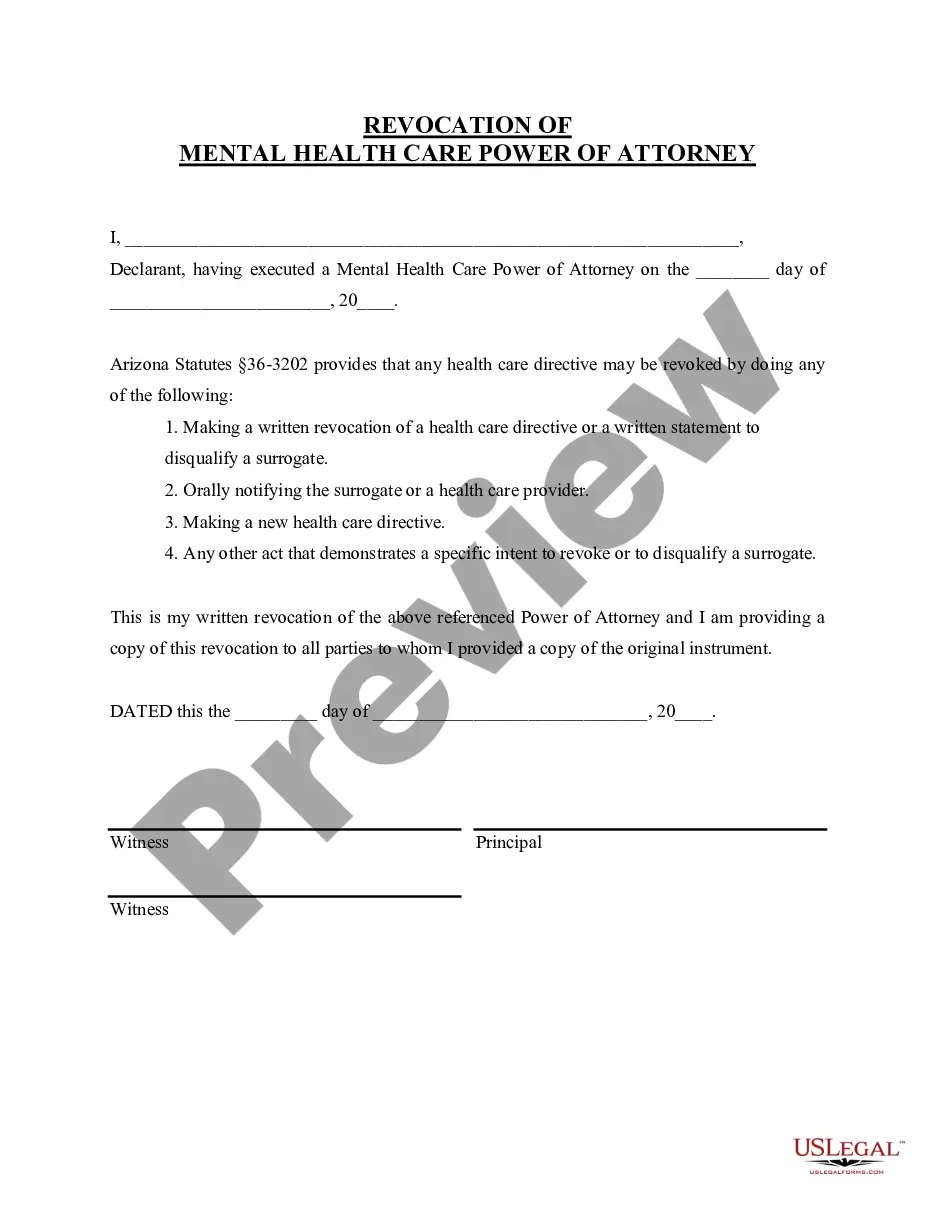

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Contra Costa Jury Instruction - Tax Evasion - General Charge and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!