Maricopa Arizona Jury Instruction — TaEvasionio— - General Charge provides guidance to the jury on the applicable laws and elements of tax evasion cases within Maricopa County, Arizona. These instructions are provided to ensure a fair and proper understanding of the charges and to assist the jury in reaching a just verdict. Keywords: Maricopa Arizona, jury instruction, tax evasion, general charge, laws, elements, charges, verdict, guidance, fair, just. There are no specific types mentioned in the prompt; however, additional keywords may include specific elements of tax evasion, penalties, intent, willful, fraudulent, income tax, tax returns, evasion schemes, assets, offshore accounts, willful blindness, and evidence. Some potential sub-sections or variations of Maricopa Arizona Jury Instruction — TaEvasionio— - General Charge could include: 1. Maricopa Arizona Jury Instruction — TaEvasionio— - Willful Attempt to Evade or Defeat Tax Assessment — Elements Charge: This instruction may outline the specific elements required to establish a willful attempt to evade or defeat a tax assessment, such as intentional underreporting of income or fraudulent deductions. 2. Maricopa Arizona Jury Instruction — TaEvasionio— - Fraudulent Statements or Concealment — Elements Charge: This instruction might focus on establishing the elements of tax evasion related to making false statements or concealing income or assets with fraudulent intent. 3. Maricopa Arizona Jury Instruction — TaEvasionio— - Offshore Account Reporting — Elements Charge: This instruction could pertain to tax evasion cases involving offshore accounts, providing guidance on the elements necessary to prove intentional failure to report income from such accounts. 4. Maricopa Arizona Jury Instruction — TaEvasionio— - Money Laundering Connection — Elements Charge: This instruction might address cases in which money laundering is connected to tax evasion, explaining the elements required to prove a link between illegal proceeds and an attempt to evade taxes. It is important to note that the specific types of jury instructions may vary based on the laws and regulations of Maricopa Arizona, and it is always advised to consult the most up-to-date and relevant resources when researching or dealing with legal matters.

Maricopa Arizona Jury Instruction - Tax Evasion - General Charge

Description

How to fill out Maricopa Arizona Jury Instruction - Tax Evasion - General Charge?

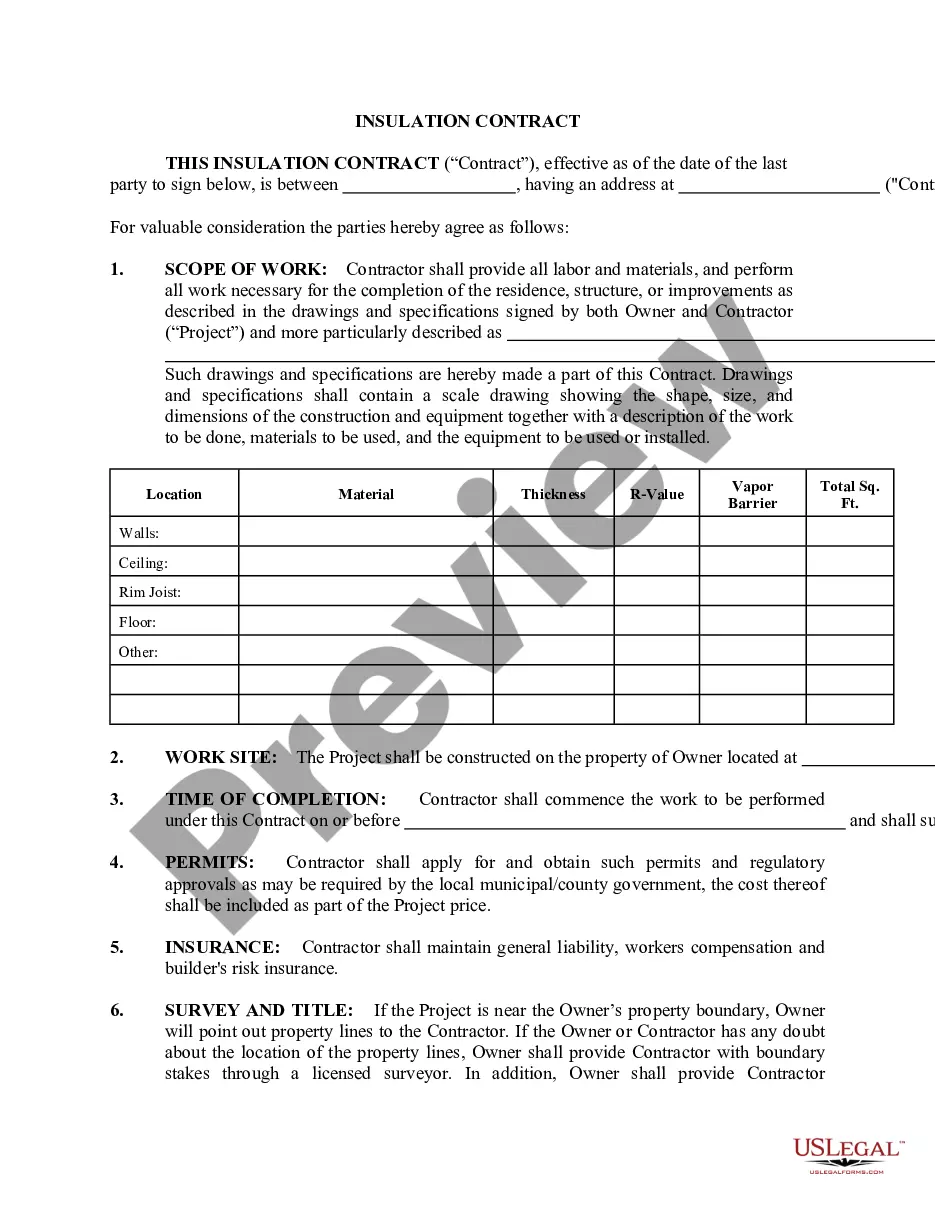

If you need to get a reliable legal paperwork provider to get the Maricopa Jury Instruction - Tax Evasion - General Charge, consider US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support make it simple to get and complete various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply select to search or browse Maricopa Jury Instruction - Tax Evasion - General Charge, either by a keyword or by the state/county the document is created for. After finding the needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Maricopa Jury Instruction - Tax Evasion - General Charge template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is completed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less pricey and more reasonably priced. Set up your first company, arrange your advance care planning, draft a real estate contract, or execute the Maricopa Jury Instruction - Tax Evasion - General Charge - all from the comfort of your home.

Join US Legal Forms now!