Travis Texas Jury Instruction — TaEvasionio— - General Charge is a set of instructions given to the jury in a tax evasion case in Travis County, Texas. These instructions aim to guide the jury in understanding the elements, burden of proof, and legal principles surrounding tax evasion charges. Tax evasion refers to the deliberate act of evading taxes by individuals or entities through illegal means, such as underreporting income, inflating deductions, or hiding assets. It is considered a serious offense and can lead to criminal penalties, including fines and imprisonment. The Travis Texas Jury Instruction — TaEvasionio— - General Charge provides an overview of the legal framework and essential elements that the prosecution must prove beyond a reasonable doubt to establish guilt for tax evasion. Some relevant keywords associated with these instructions may include: 1. Tax evasion: The deliberate act of evading taxes through illegal means, such as fraudulent reporting or concealing income. 2. Burden of proof: The responsibility of the prosecution to prove the defendant's guilt beyond a reasonable doubt. 3. Willfulness: The element requiring the prosecution to establish that the defendant acted willfully in evading taxes. Willfulness implies a voluntary and intentional violation of the tax laws. 4. Materiality: The requirement that the defendant's actions were material, meaning that they had the potential to affect the accuracy of their tax liability. 5. Concealment: Actions taken by the defendant to hide or disguise income or assets to avoid detection by tax authorities. 6. Fraudulent intent: The intent to deceive or defraud the government through false or misleading representations on tax returns. 7. Income reporting: The accurate reporting of income earned, including wages, self-employment earnings, investment income, etc. 8. Deductions and credits: The proper reporting and use of deductions and credits allowed by the tax laws. 9. Accountant/client privilege: The potential privilege that may exist in conversations and communications between an accountant and their client, which may restrict certain evidence from being used in the trial. Depending on the specific circumstances and complexities of the tax evasion case, there might be variations or additional instructions provided by the court. These could include instructions specific to particular defenses raised by the defendant, evidentiary rules, expert witness testimony, or other relevant legal considerations. It is important to consult the official Travis Texas court resources or legal professionals for the most up-to-date and accurate information regarding the Travis Texas Jury Instruction — TaEvasionio— - General Charge and any associated variations.

Travis Texas Jury Instruction - Tax Evasion - General Charge

Description

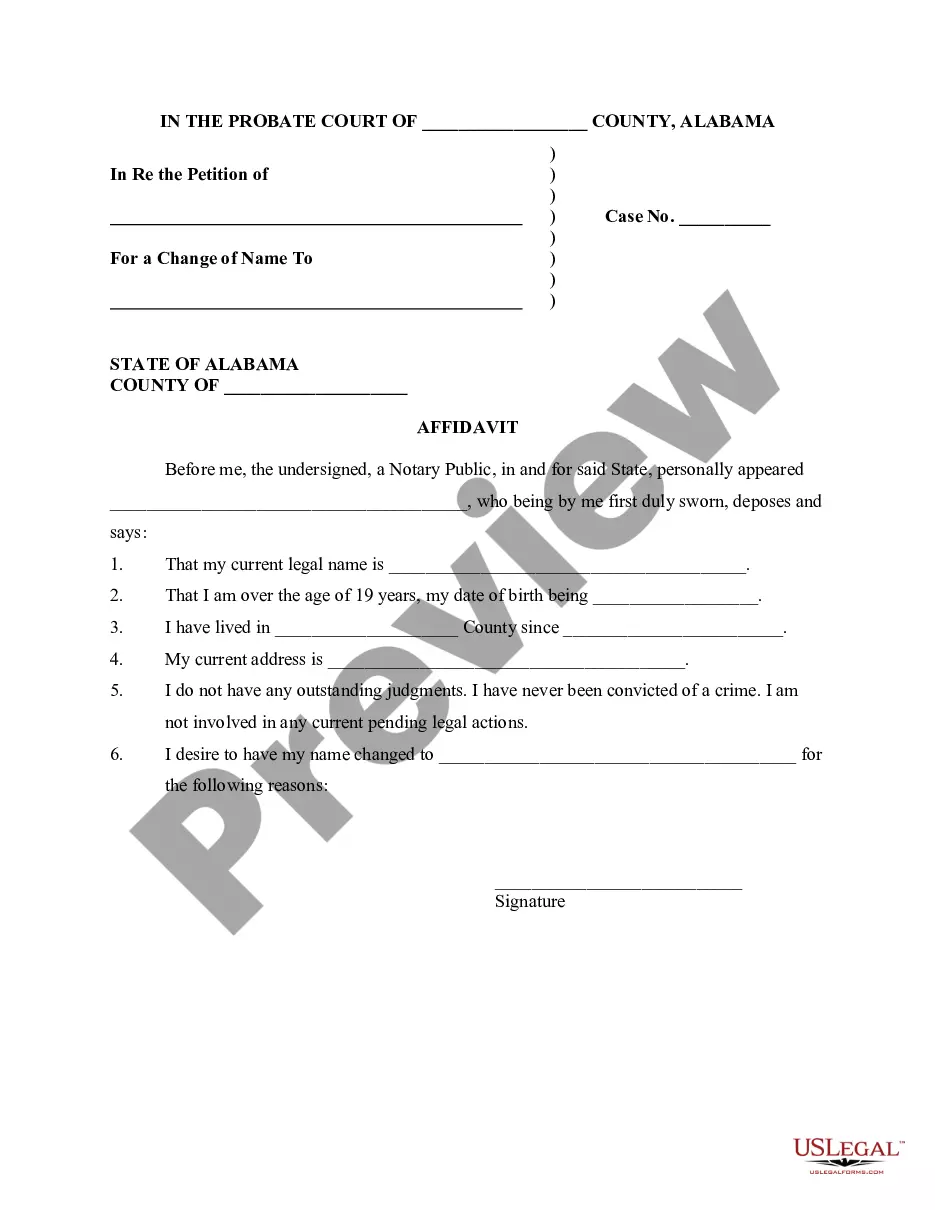

How to fill out Travis Texas Jury Instruction - Tax Evasion - General Charge?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from the ground up, including Travis Jury Instruction - Tax Evasion - General Charge, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find detailed materials and guides on the website to make any activities associated with paperwork completion simple.

Here's how you can find and download Travis Jury Instruction - Tax Evasion - General Charge.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Check the similar document templates or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and buy Travis Jury Instruction - Tax Evasion - General Charge.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Travis Jury Instruction - Tax Evasion - General Charge, log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you need to deal with an extremely challenging case, we recommend using the services of an attorney to review your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-specific paperwork with ease!