The Suffolk New York Jury Instruction — Bank Deposits Method is a crucial aspect of the judicial process in Suffolk County, New York. This method involves instructing jurors on how to evaluate evidence related to bank deposits in order to gather relevant information and make informed decisions in a trial. These instructions provide jurors with a standardized framework for understanding and analyzing bank deposit evidence presented in court. The Bank Deposits Method allows jurors to assess the credibility and accuracy of financial records and transactional information provided by banks or individuals involved in a case. It assists them in determining whether the evidence supports or contradicts the arguments and allegations presented by the parties involved. Apart from the general Suffolk New York Jury Instruction — Bank Deposits Method, there are several specific types that jurors may encounter, depending on the nature of the case. These may include: 1. Suffolk New York Jury Instruction — Bank Deposits Method for Embezzlement Cases: This instruction specifically focuses on bank deposit evidence related to embezzlement charges. Jurors are provided with guidance on identifying suspicious transactions, discrepancies in financial records, and patterns that may indicate fraudulent activities. 2. Suffolk New York Jury Instruction — Bank Deposits Method for Bankruptcy Cases: This instruction guides jurors on analyzing bank deposit evidence in bankruptcy proceedings. It educates them on deciphering financial data to determine if the debtor attempted to conceal assets, redirect funds, or engage in other forms of financial wrongdoing. 3. Suffolk New York Jury Instruction — Bank Deposits Method for Fraud Cases: In fraud cases, jurors are given specific instructions tailored to analyze bank deposit evidence related to fraudulent activities. This instruction empowers jurors to identify irregularities, forged documents, false representations, or suspicious transactions that indicate fraudulent behavior. 4. Suffolk New York Jury Instruction — Bank Deposits Method for Tax Evasion Cases: Jurors in tax evasion cases receive instructions specifically designed to evaluate bank deposit evidence for potential discrepancies, hidden income, or unreported funds. These instructions emphasize identifying patterns indicating attempts to evade taxes, underreport income, or engage in other forms of tax fraud. It is important to note that the instructions provided to jurors may vary depending on the specific circumstances and legal nuances of each case. The Suffolk New York Jury Instruction — Bank Deposits Method equips jurors with the necessary tools to effectively assess bank deposit evidence, aiding them in rendering fair and informed verdicts.

Suffolk New York Jury Instruction - Bank Deposits Method

Description

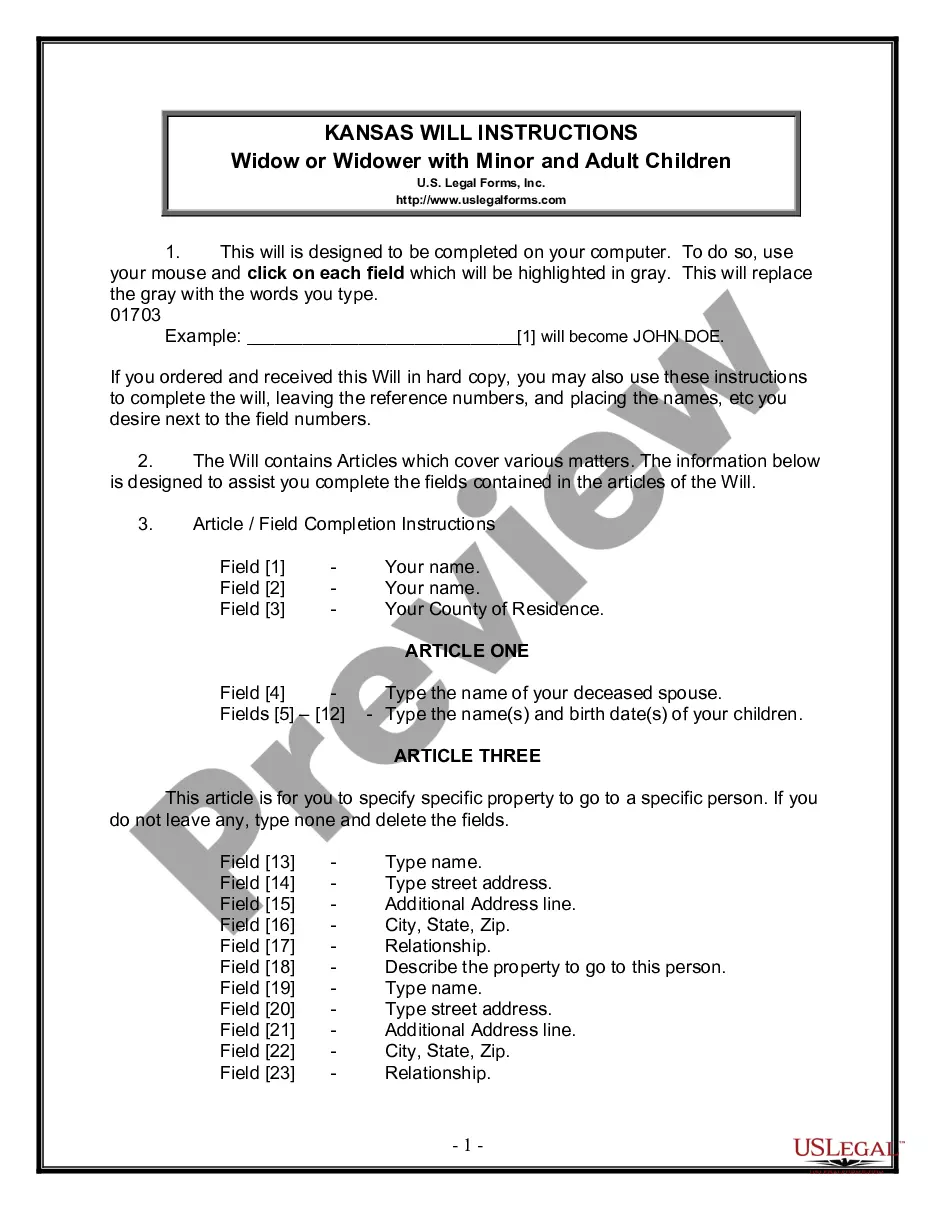

How to fill out Suffolk New York Jury Instruction - Bank Deposits Method?

Creating forms, like Suffolk Jury Instruction - Bank Deposits Method, to take care of your legal matters is a difficult and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for different cases and life circumstances. We ensure each form is compliant with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Suffolk Jury Instruction - Bank Deposits Method form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Suffolk Jury Instruction - Bank Deposits Method:

- Make sure that your form is specific to your state/county since the rules for writing legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Suffolk Jury Instruction - Bank Deposits Method isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin using our website and download the form.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment details.

- Your form is all set. You can go ahead and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!