Riverside California Jury Instruction — Cash Expenditures Method is a crucial component in the legal process of evaluating cash expenditures and determining their credibility during a trial. These jury instructions provide guidance to jurors in understanding the methodology for assessing the reliability and accuracy of financial transactions involving cash. One type of Riverside California Jury Instruction — Cash Expenditures Method focuses on the concept of cash expenditures. It instructs the jury on how to evaluate evidence concerning cash transactions and expenses incurred by the parties involved in the case. The significance of this instruction lies in its ability to ensure fair verdicts based on thorough examination of financial records and expenditures. Another type of Riverside California Jury Instruction — Cash Expenditures Method may address the burden of proof regarding cash expenditures. It outlines the specific obligations of the party presenting financial evidence to sufficiently prove or refute the legitimacy of cash transactions. This instruction emphasizes the importance of providing credible evidence in order to support claims and counterclaims related to cash expenditures. Furthermore, Riverside California Jury Instruction — Cash Expenditures Method also encompasses instructions on determining the weight, credibility, and believability of cash expenditure evidence during jury deliberations. It helps jurors assess the reliability of financial records submitted as evidence and encourages them to consider factors such as consistency, quality of documentation, corroborating witnesses, or any discrepancies that may arise. Keywords: Riverside California, jury instruction, cash expenditures' method, legal process, credibility, financial transactions, trial, guidance, methodology, reliability, accuracy, cash transactions, expenses, evidence, verdicts, financial records, burden of proof, legitimacy, claims, counterclaims, weight, credibility, believability, jury deliberations, reliability, documentation, witnesses, discrepancies.

Riverside California Jury Instruction - Cash Expenditures Method

Description

How to fill out Riverside California Jury Instruction - Cash Expenditures Method?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business purpose utilized in your county, including the Riverside Jury Instruction - Cash Expenditures Method.

Locating samples on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Riverside Jury Instruction - Cash Expenditures Method will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the Riverside Jury Instruction - Cash Expenditures Method:

- Ensure you have opened the proper page with your localised form.

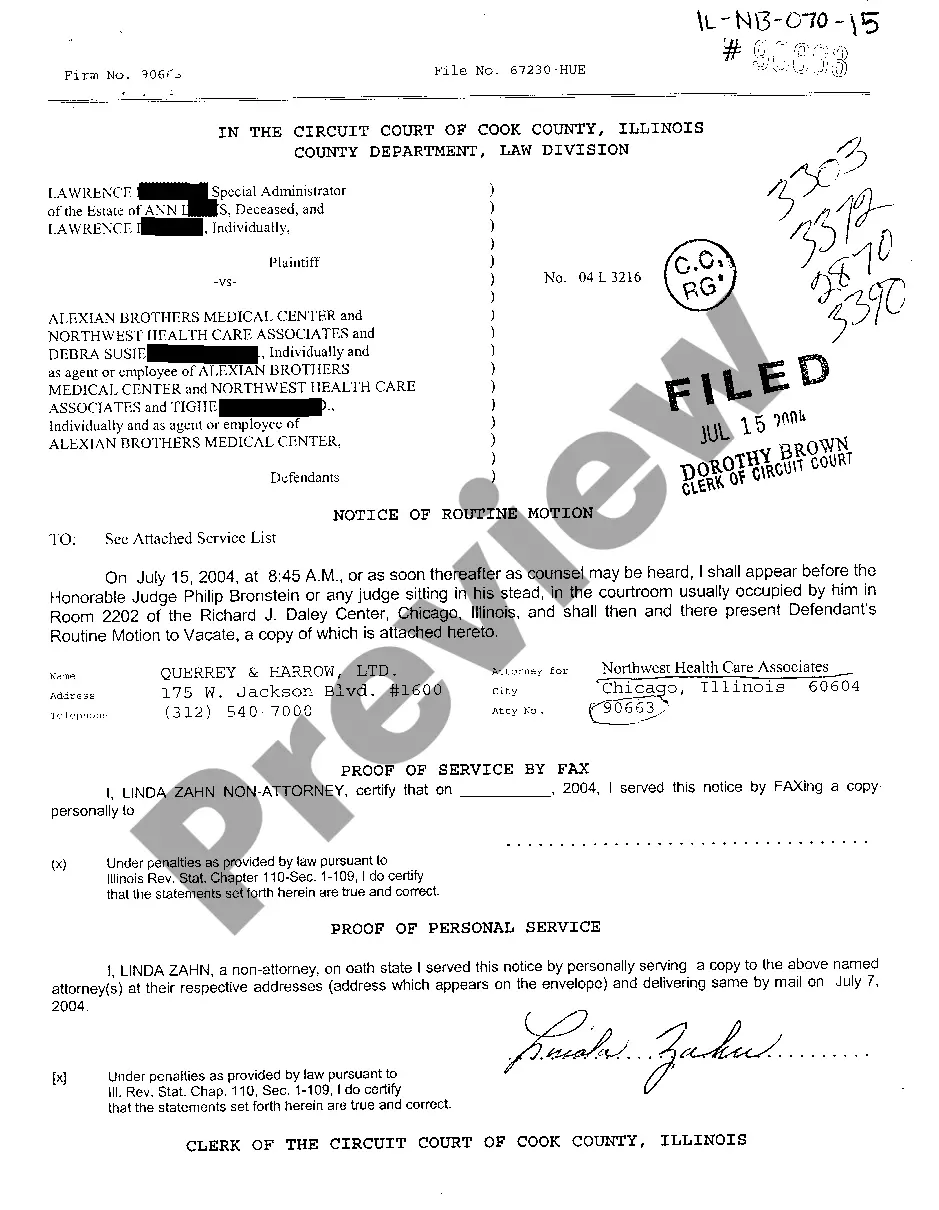

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Riverside Jury Instruction - Cash Expenditures Method on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!