San Antonio Texas Jury Instruction — Cash Expenditures Method refers to a legal instruction provided to jurors during a trial in San Antonio, Texas. This instruction specifically relates to the Cash Expenditures Method, which is a method used in financial analysis to determine income or profits by examining cash inflows and outflows of an individual or entity. This method is commonly employed in cases involving alleged financial fraud, tax evasion, or illegal financial activities. The San Antonio Texas Jury Instruction — Cash Expenditures Method educates jurors on how to evaluate evidence, financial records, and testimony in order to calculate income or profits using this method. Jurors are provided with specific guidelines and criteria to consider when assessing cash expenditures and determining if they are in line with reported income or profits. Furthermore, there are no different types of San Antonio Texas Jury Instruction — Cash Expenditures Method. However, there may be variations or modifications based on the specific case, the court's instructions, and any additional legal precedents or statutes that may apply. Relevant keywords: San Antonio, Texas, jury instruction, cash expenditures' method, financial analysis, income determination, profit calculation, financial fraud, tax evasion, illegal financial activities, evidence evaluation, financial records, testimony, reported income, reported profits, guidelines, criteria, legal precedents, statutes. Please note that the content above is purely fictional and should not be used as actual legal advice or guidance.

San Antonio Texas Jury Instruction - Cash Expenditures Method

Description

How to fill out San Antonio Texas Jury Instruction - Cash Expenditures Method?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the San Antonio Jury Instruction - Cash Expenditures Method, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the San Antonio Jury Instruction - Cash Expenditures Method from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the San Antonio Jury Instruction - Cash Expenditures Method:

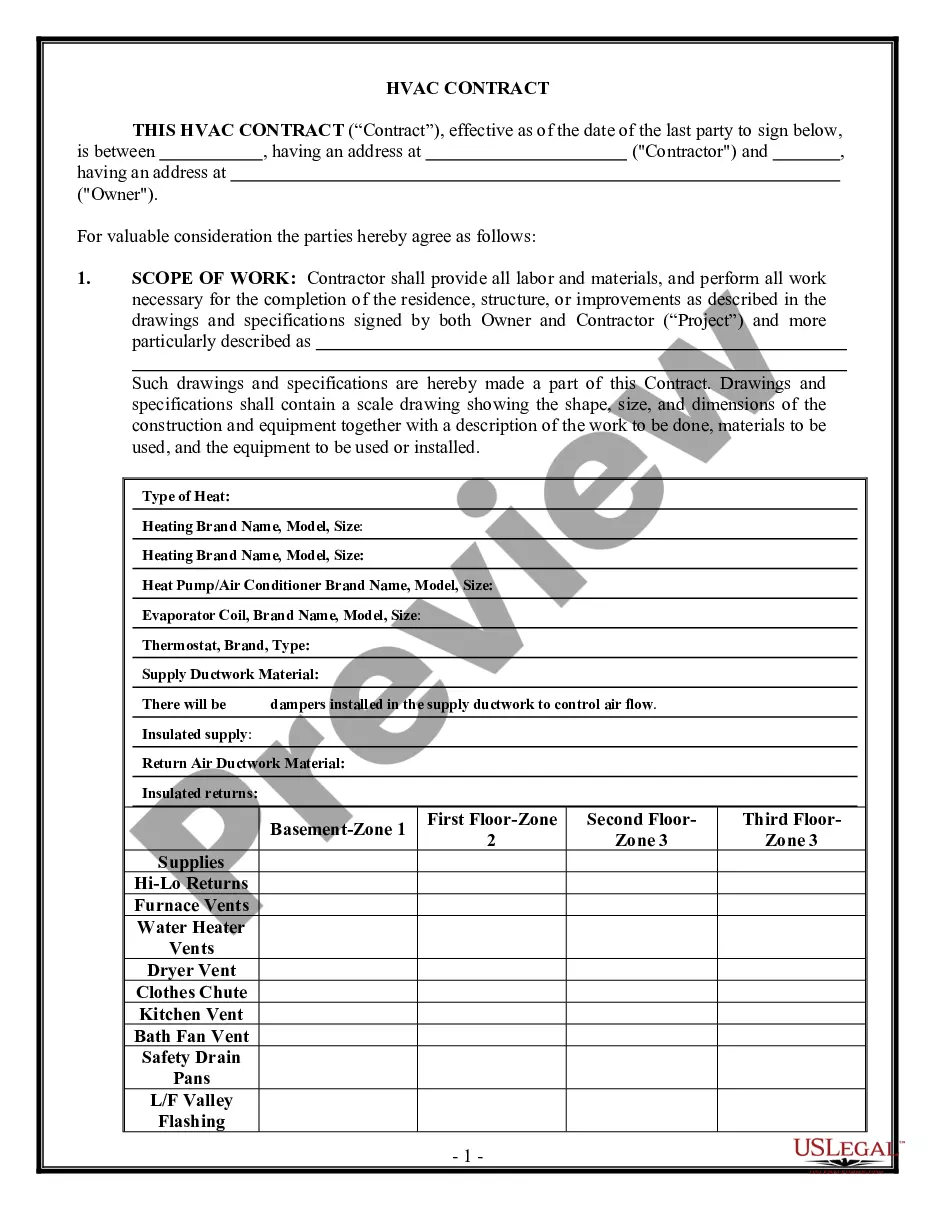

- Take a look at the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!